Capital market analysts expect sustained positive sentiments on the stock market to continue this week as more companies released their fourth quarter (Q4) 2024 results on the Nigerian Exchange (NGX) Limited.

The Nigerian Exchange witnessed a remarkable turnaround last week as the benchmark index recorded significant appreciation. This upward trajectory was buoyed by strong investor sentiment, underpinned by anticipation of fourth-quarter earnings releases, and the ongoing adjustments in portfolio rebalancing. These factors have begun to shape investor expectations for the end-of-year financial performance of listed companies.

Analysts Optimism

Looking ahead, analysts at Cowry Assets Management Limited said, “the current positive market sentiment is expected to persist into the coming week, supported by the release of corporate earnings and anticipated corporate actions.

“The results published so far have been encouraging, providing a foundation for sustained price support and attracting fresh capital inflows into the market.”

Cowry added that, “Moreover, the prevailing low valuation of many stocks continues to create opportunities for investors to buy into value and strategically reposition their portfolios.

“However, the market may experience bouts of volatility as the earnings season progresses. Mixed macroeconomic data and upcoming economic events are likely to influence market sentiment, particularly for companies with December year-end financials.”

Afrinvest Limited stated that, “while the Debt Management Office’s planned bond auction is expected to headline early trading days this week, we project that the bourse will sustain the positive momentum riding on the back of impressive early Q4 earnings releases thus far.”

Last Week’s Trading Activities

The local bourse ended last week on a bullish note, reversing prior week’s bearish trend. This recovery was driven by renewed investor confidence in key sectors, particularly Telecommunications, following Nigerian Communications Commission’s approval of a 50.0 per cent tariff hike (first adjustment since 2013).

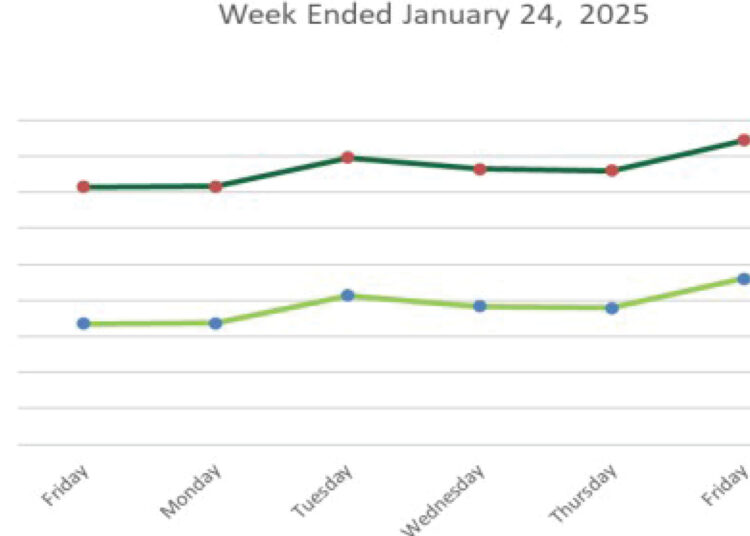

The positive sentiment spilled over to the broader market, with the All-Share Index advanced by 1.22 per cent week-on-week (W-o-W) to close at 103,598.30 points. Similarly, the market capitalisation increased by N794 billion to the week at N63.645 trillion.

Sectoral performance during the week was mixed. The NGX Banking index emerged as the best-performing sector, with a 4.09 per cent WoW increase. The newly introduced NGX Commodity index posted a 1.03 per cent WoW gain, while the NGX Industrial index edged higher by 0.12 per cent.

Conversely, the NGX Insurance index led the decliners with a 1.30 per cent drop, followed by the NGX Consumer Goods and NGX Oil & Gas indices, which fell by 1.20 per cent and 0.75 per cent, respectively for the week.

The market breadth for the week closed with 44 equities gainer and loser, while 64 equities remained unchanged. SCOA Nigeria led the gainers table by 59.68 per cent to close at N3.96, per share. UPDC followed with a gain of 19.05 per cent to close at N2.00, while Coronation Insurance went up by 15.32 per cent to close to N2.56, per share.

On the other side, SUNU Assurances led the decliners table by 25.11 per cent to close at N5.01, per share. Eunisell Interlinked followed with a loss of 18.95 per cent to close at N12.66, while John Holt declined by 18.47 per cent to close at N8.30, per share.

Overall, a total turnover of 3.132 billion shares worth N76.552 billion in 61,456 deals was traded last week by investors on the floor of the Exchange, in contrast to a total of 2.252 billion shares valued at N58.831 billion that exchanged hands prior week in 63,657 deals.

The Financial Services Industry (measured by volume) led the activity chart with 2.336 billion shares valued at N33.014 billion traded in 27,100 deals; contributing 74.59 per cent and 43.13 per cent to the total equity turnover volume and value respectively.

The Services industry followed with 284.988 million shares worth N807.646 million in 4,638 deals, while the Consumer Goods Industry traded a turnover of 139.010 million shares worth N5.704 billion in 6,469 deals.

Trading in the top three equities; Wema Bank, Secure Electronic Technology and Access Holdings (measured by volume) accounted for 1.437 billion shares worth N15.406 billion in 5,292 deals, contributing 45.89 per cent and 20.13 per cent to the total equity turnover volume and value respectively.