Industry experts are set to move the payment industry forward by showcasing disruptors in the industry and setting agenda on contactless payments, new technologies, the future of payment, cybersecurity and financial inclusion, among others.

All payments industries, including global and domestic payment networks, financial institutions, retailers, processors, mobile wallets providers, FinTech, and other payments industry technology and service providers, will convene at the DigitalPayExpo 2023 to brainstorm on ways to boost the payment industry in Nigeria.

The managing director, Intermarc Consulting, Yinka Adeyemi, in a press statement made available to LEADERSHIP, averred that technology evolves rapidly, and the payments space is no exception, adding that, “If we focus on what is happening now, we are already falling behind.”

Speaking at this year’s event, Adeyemi said: “this year’s DigitalPayExpo is moving the industry forward by showcasing the innovations and disruptors that are changing the way we transact. We are giving professionals, from merchants to payments networks and everyone in between, a chance to explore strategies for quick and efficient adoption of new payment technologies.”

The managing director added that contactless payment is one of the most exciting new applications to be launched in the payment world.

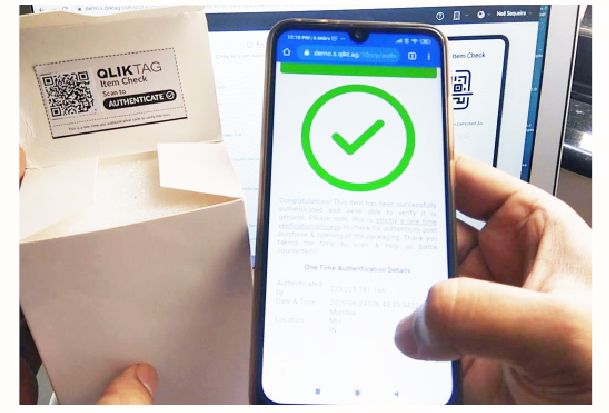

Explaining further, he said: “Contactless payment is a unique advancement that has completely changed how people transact goods and services on the go. With the popularity of mobile payments, contactless credit cards, and other payment systems taking off in recent years, it is clear that this trend will not be slowing down anytime soon.

“There is no doubt that some of the biggest innovations regarding merchant products and services being utilised in the industry have been around contactless payment solutions. DigitalPayExpo 2023 is therefore designed to explore the future of contactless, which is already here.”

Adeyemi posited that the conference will dimension this all-important theme from the global perspective of what contactless means to world commerce and how the race to be contactless can be nurtured sustainably by the relevant ecosystem and stakeholders

The conference will host the industry’s best to ensure that attendees have all the resources and notes required to expand their imagination, insight, and creativity for contactless payment, he stated.

“The first day of the Payments Summit will include thought-provoking keynote sessions from significant players in the industry. The lineup include; Bello Hassan, Chief Executive Officer, Nigeria Deposit Insurance Corporation (NDIC), Musa Jimoh, Director Payments System Management Department, Central Bank of Nigeria, Ademola Odeyemi, Managing Director/CEO Optimus Bank, Nigeria, Niyi Toluwalope Managing Director eTranzact International Plc, Deremi Atanda, Managing Director/ CEO Remita Payment Services, Chinwe Uzoho, Regional Managing Director, West & Central Africa Network International and emmanuel Obinne Head of Growth & Partnerships – West Africa BPC Banking Technologies.

“The second and final day of the event will feature Malik Kotadia, Board Chairman, Global Impact FinTech (GIFT) Singapore, Daniel Awe, Managing Director Africa Fintech Foundry, Branka Mracajac, Chief Executive Officer 9PSB, Adedamola Giwa, Managing Director Jumia Pay, Nigeria and Obi Emetarom, Group Chief Executive Officer AppZone,” Adeyemi revealed.