The $3 billion emergency crude repayment loan taken by the Nigerian National Petroleum Company Limited (NNPCL) from the African Export-Import (Afrexim) bank would create only a temporary respite in the foreign exchange market unless fundamental issues are addressed in the county, analysts have said.

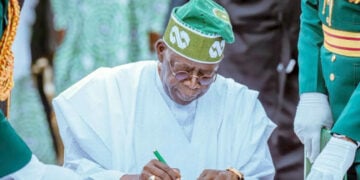

This is as President Bola Tinubu is said to have expressed approval for the $3 billion in crude-for-cash funding secured from the Afreximbank, saying it is gradually giving a breather to the foreign exchange market.

The NNPC Limited and Afreximbank recently signed the commitment letter and term sheet for the facility which is expected to support the federal government in its ongoing fiscal and monetary policy reforms to stabilise the forex market.

Sources at the presidential villa, Abuja, said the president was happy that the deal had been able to crash the dollar and allow the Naira to gain some value.

The nation has battled foreign exchange liquidity leading to the steep fall of the Naira since the unification of the foreign exchange windows by the Central Bank of Nigeria in June. The crash in the value affected the economy, triggering price hikes in the country and impacting access to imported raw materials by real industry operators. The effect is exemplified in the July inflation which peaked at 24.08 per cent.

The source said the president and his team of economic advisers are hopeful that the deal will help the government breathe fresh air into the sluggard economy, make inflation recede and crash the dollar which has risen to an unprecedented N950 to the $1 in the parallel market.

The $3 billion loan, according to the oil giant, is expected to support immediate disbursement that will enable the NNPC Ltd to support the federal government in its ongoing fiscal and monetary policy reforms aimed at stabilising the exchange rate market.

The Presidency source added that the “quick and proactive steps taken by the NNPC Limited show that this government has the capacity to turn around Nigeria’s economy positively in a short time. What the government needs right now is for forthright thinking appointees of the president to come up with novel ideas like this to better the economy.

The deal comes about 17 months after the NNPCL secured a $5bn funding commitment from the African Export-Import Bank (Afreximbank) to finance major investments in Nigeria’s upstream sector.

The loan secured by the NNPCL is the fourth transaction involving the oil company and Afreximbank over the last three years. It goes further to consolidate the mutual relationship between the two entities.

Both Nigeria and NNPCL are shareholders in Afreximbank, with the sole purpose of enhancing investments and growing prosperity in Africa. The agreement for the loan which was sealed on Wednesday in Cairo, saw the group chief executive officer of NNPC Ltd, Mele Kyari signing for the national oil company while George Elimbi, executive vice president Afreximbank signed for the bank.

Meanwhile, analysts at Cordros Securities, in an emailed note, said while the move is a quick fix that will address the liquidity pressure in the foreign exchange market, pressure will quickly rebuild if the country does not diversify its export base.

According to the NNPCL, the loan agreement is not a crude-for-refined product swap but an upfront cash loan against proceeds from a limited amount of future crude oil production.

Analysts at Cordros explained that the loan arrangement means that the NNPCL is collecting its future revenue from crude oil production in advance from the AFREXIM bank.

The analysts restated that diversifying the economy’s export base was paramount to solving the recurring exchange rate issues, saying Nigeria needs to look beyond crude oil and earn more from stable exports.

The analysts also said the loan agreement may negatively impact FAAC inflows when the NNPCL starts repaying the loan.

“Our prognosis is hinged on revenue flows from crude oil which may reduce if oil production does not improve significantly from current levels and a reduction in future taxes and royalties from NNPCL as the FGN now gets them in advance,” they said.

Noting that though the NNPCL is yet to publish sufficient information on the structure of the deal, the analysts say: “We suspect that the crude oil production repayment may follow the arrangement done in January 2022 when the company secured a $5 billion corporate finance commitment from the Afreximbank to fund major investments in Nigeria’s upstream sector.

“Precisely, under the agreement signed by both parties as of then, the repayment of the finance would be through a Forward Sale Arrangement (FSA), which would allow the funds provided to constitute the payment purchase of 90kb/d – 120kb/d of crude oil to be delivered to the lender over a period. Finally, given that the NNPCL received the loan with no sovereign guarantee, it implies that it would not be added to the public debt profile but sit in the NNPCL’s balance sheet,” they pointed out.

We’ve got the edge. Get real-time reports, breaking scoops, and exclusive angles delivered straight to your phone. Don’t settle for stale news. Join LEADERSHIP NEWS on WhatsApp for 24/7 updates →

Join Our WhatsApp Channel