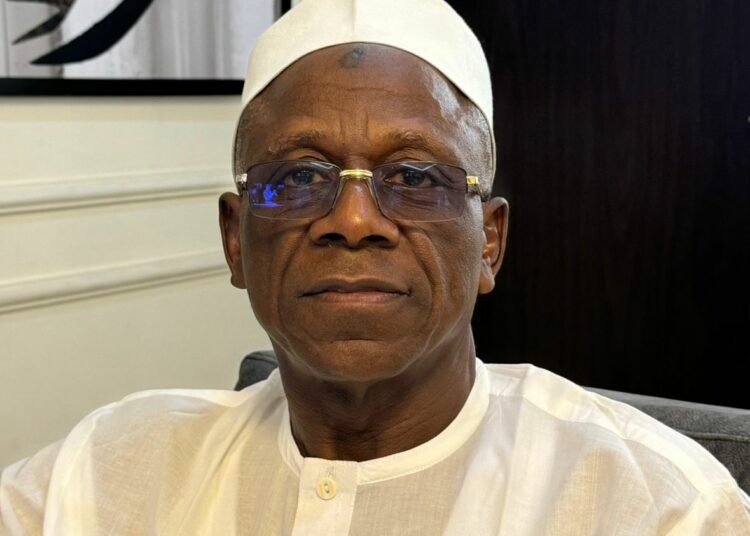

The newly appointed Chairman of the Securities and Exchange Commission (SEC), Alhaji Mairiga Aliyu Katuka, has shared his vision and strategic plans for addressing the prevailing issues within the regulatory agency and enhancing investor confidence in the Nigerian capital market.

In a recent chat with select journalists, Katuka acknowledged the longstanding challenges faced by the SEC, particularly concerning staff welfare.

“Before this new administration came on board, there were issues of staff not getting promotions for a long time and not having their salaries reviewed for over 10 years. The lack of promotion has been particularly disturbing,” he noted.

Addressing the concerns, Katuka emphasised the importance of human resources in achieving SEC’s goals and assured that the team was already working on strategic plans to revitalise the capital market.

Reiterating that building investor confidence was a top priority for the new administration, Katuka stated, “The capital market requires investor confidence, and we will do everything possible to ensure its success. Building investor confidence means ensuring that the market is transparent, dynamic, and fair, so investors can invest without fear.” He highlighted the need for credibility and integrity in the market and mentioned plans to engage stakeholders to support strategic initiatives.

One significant focus area was increasing public awareness about the SEC’s activities. Katuka pointed out that many Nigerians, including the elite, were hesitant to invest due to a lack of understanding of the capital market. To address this, he said the SEC planned to launch engaging sensitisation programs and involve the press to educate potential investors about the market’s benefits.

Katuka also emphasised the role of technology in modernising the SEC operations, stating, “We plan to make our IT robust to accommodate our goals.” With the SEC chairman’s 20 years of experience, the administration was confident in establishing a reliable market that both investors and stakeholders can trust.

Katuka ended by addressing the SEC staff issue, reassuring them of efforts to improve their working conditions and boost their morale. He urged all Nigerians to support the SEC’s initiatives to ensure the success of the capital market. With these strategic plans in place, the new SEC administration aims to resolve existing issues, enhance market transparency, and foster a culture of informed investment across Nigeria.

Born on February 15, 1961, in Keffi, present-day Nasarawa State, Alhaji Mairiga Aliyu Katuka obtained a Higher National Diploma in Accounting from Federal Polytechnic, Bida, in 1985, followed by a Master’s degree in Business Administration from Ahmadu Bello University in 2007. He holds numerous professional qualifications and certifications and is a Fellow of the Certified National Accountants of Nigeria (FCNA) and a member of the Nigeria Institute of Management (MNIM) and the Chartered Institute of Forensic and Certified Fraud Investigators of Nigeria (CCrFA).