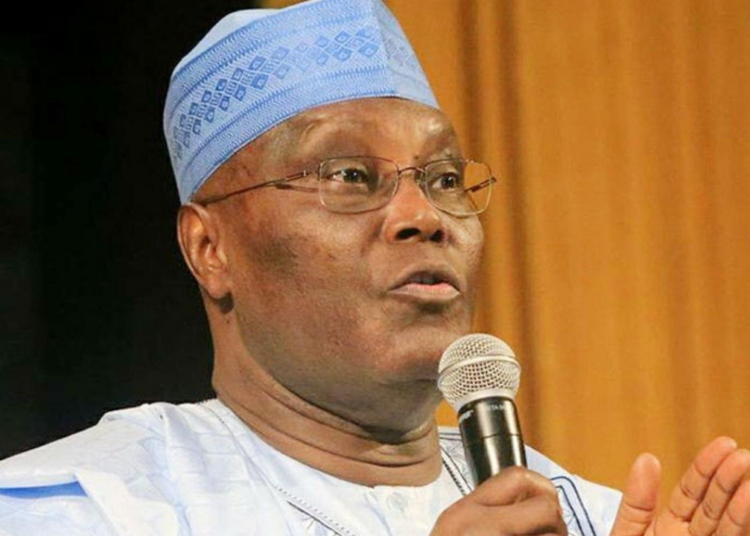

Former vice president Atiku Abubakar, has said the 2025 budget lacks the structural reforms and fiscal discipline to address Nigeria’s multifaceted economic challenges.

Atiku, in a statement on his assessment of the recently presented 2025 Federal Budget by President Bola Tinubu to the National Assembly, said the fiscal bill, amounting to N48 trillion with a revenue forecast of N35 trillion, resulting in a deficit exceeding N13 trillion or 4% of GDP reflects a continuation of business-as-usual fiscal practices.

The former Peoples Democratic Party (PDP) presidential candidate said weak budgetary foundations, disproportionate debt servicing, unsustainable government expenditure, insufficient capital investment, regressive taxation and economic strain, questions the capacity of the 2025 budget to foster sustainable economic growth and tackle Nigeria’s deep-rooted challenges.

He added that the budget proposal represented a persistent trend under the APC-led administration since 2016, wherein budget deficits have been consistently presented, accompanied by an increasing reliance on external borrowing.

Atiku, in a statement, said “To bridge this fiscal gap, the administration plans to secure over N13 trillion in new borrowings, including N9 trillion in direct borrowings and N4 trillion in project-specific loans. This borrowing strategy mirrors the approach of previous administrations, resulting in rising public debt and exacerbating the attendant risks related to interest payments and foreign exchange exposure.”

Questioning the capacity of the 2025 budget capacity to foster sustainable economic growth he said, “Weak Budgetary Foundations: The 2024 budget’s underperformance signals poor budgetary execution. By Q3 of the fiscal year, less than 35% of the allocated capital expenditure for MDAs had been disbursed, despite claims of 85% budget execution. This underperformance in capital spending, crucial for fostering economic transformation, raises concerns about the execution of the 2025 budget.

“Disproportionate Debt Servicing: Debt servicing, which accounts for N15.8 trillion (33% of the total expenditure), is nearly equal to planned capital expenditure (N16 trillion, or 34%). Moreover, debt servicing surpasses spending on key priority sectors such as defence (N4.91 trillion), infrastructure (N4.06 trillion), education (N3.52 trillion), and health (N2.4 trillion). This imbalance will likely crowd out essential investments and perpetuate a cycle of increasing borrowing and debt accumulation, undermining fiscal stability.

“Unsustainable Government Expenditure: The government’s recurrent expenditure remains disproportionately high, with over N14 trillion (30% of the budget) allocated to operating an oversized bureaucracy and supporting inefficient public enterprises. The lack of concrete steps to curb wastage and enhance the efficiency of public spending exacerbates the fiscal challenges, leaving limited resources for development.

“Insufficient Capital Investment: After accounting for debt servicing and recurrent expenditure, the remaining allocation for capital spending, ranging from 25% to 34% of the total budget, is insufficient to address Nigeria’s infrastructure deficit and stimulate growth. This equates to an average capital allocation of approximately N80,000 (US$45) per capita, insufficient to meet the demands of a nation grappling with slow growth and infrastructural underdevelopment.

“Regressive Taxation and Economic Strain: The administration’s decision to increase the VAT rate from 7.5% to 10% is a retrogressive measure that will exacerbate the cost-of-living crisis and impede economic growth. By imposing additional tax burdens on an already struggling populace while failing to address governance inefficiencies, the government risks stifling domestic consumption and further deepening economic hardship.

“In conclusion, the 2025 budget lacks the structural reforms and fiscal discipline required to address Nigeria’s multifaceted economic challenges. To enhance the budget’s credibility, the administration must prioritize the reduction of inefficiencies in government operations, tackle contract inflation, and focus on long-term fiscal sustainability rather than perpetuating unsustainable borrowing and recurrent spending patterns. A shift towards a more disciplined and growth-oriented fiscal policy is essential for the nation’s economic recovery,” the former vice president added.

We’ve got the edge. Get real-time reports, breaking scoops, and exclusive angles delivered straight to your phone. Don’t settle for stale news. Join LEADERSHIP NEWS on WhatsApp for 24/7 updates →

Join Our WhatsApp Channel