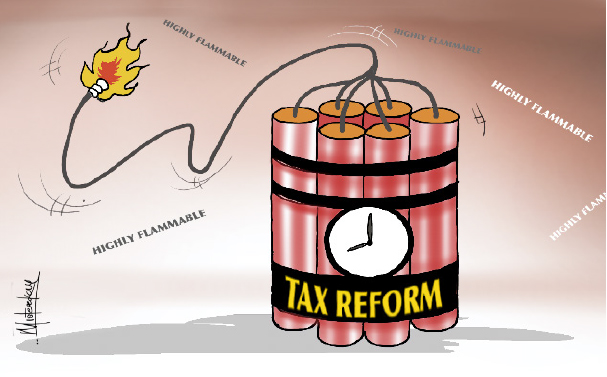

The much-anticipated tax reforms initiated by President Bola Ahmed Tinubu’s administration have become a battleground of competing interests, as the nation grapples with how to restructure its fiscal policies in a way that fosters growth while ensuring fairness. Four key tax bills, presented to the National Assembly in 2024, were supposed to set the stage for a new era of economic revitalization. Instead, they have ignited a series of debates that reveal deep fissures in Nigeria’s political economy. With state governors, major fiscal stakeholders, and the public all weighing in, the question remains: can the government navigate these choppy waters, or is it destined to crash upon the rocks of political resistance?

In the latest development, the Nigeria Governors’ Forum (NGF), representing the collective voice of all 36 state governors, issued a communiqué on January 16, 2025, signalling strong support for the overarching goal of reform, but expressing serious reservations about certain provisions of the bills. Their opposition, particularly to proposals on Value Added Tax (VAT) and Corporate Income Tax (CIT), has added another layer of complexity to an already fraught process. These concerns come at a time when the country’s fiscal policy is in urgent need of clarity, and the implications of these debates could be far-reaching.

VAT and CIT: Sticking Points in Reform

The debate over VAT has quickly become the focal point of the reforms. While the NGF has expressed its backing for the need to modernize Nigeria’s tax laws, it has strongly opposed any increase in VAT at this time. For an economy already burdened by inflation, rising costs of living, and economic policy shocks, a hike in VAT could exacerbate the financial strain on everyday Nigerians. From food to fuel, and basic services, the cost of living has soared, making any potential increase in the VAT rate a highly contentious issue.

The NGF’s opposition is not without merit. With many Nigerians already struggling to make ends meet, a VAT hike would be akin to adding insult to injury. The governors have also raised concerns about the distribution formula for VAT revenue, suggesting a more equitable approach that considers factors such as derivation and population distribution. In this, they argue that a 50% allocation based on equality, 30% based on derivation, and 20% based on population would better reflect the needs of the country’s diverse regions.

However, the proposed reforms are not only focused on VAT. The issue of CIT has also sparked significant debate. The NGF has opposed the reduction of CIT, largely due to the potential loss of revenue at the state level. This position reflects the governors’ concerns about the already strained financial situation of many states, which depend on federal allocations to meet their budgets.

Yet, reducing CIT could be an important tool in fostering business growth and economic development. Lowering the corporate tax rate could make Nigeria a more attractive destination for foreign investment, encouraging businesses to expand and create jobs. In the long term, this could result in higher economic output and a larger tax base, ultimately benefiting both the private and public sectors.

The Federal Government’s proposal to cut CIT is a gamble, but one that could potentially pay off if the right balance is struck. However, there is no denying that such a reduction would need to be carefully managed to ensure it doesn’t undermine essential state-level revenues, which are already under pressure.

TETFUND, NASENI, and NITDA: The Unseen Stakeholders

Another critical aspect of the tax reform debate centers on the handling of development funds for key agencies such as TETFUND (Tertiary Education Trust Fund), NASENI (National Agency for Science and Engineering Infrastructure), and NITDA (National Information Technology Development Agency). These agencies, which play crucial roles in education, technology, and infrastructure, have become the subject of controversy in the proposed reforms.

The NGF has called for the exclusion of a terminal clause for these agencies in the sharing of development levies, a position that highlights the governors’ concern about the potential erosion of funds meant for national development. These agencies rely on specific levies and allocations to support their vital work, and any changes to the distribution of these funds could have far-reaching consequences.

For instance, TETFUND is essential to Nigeria’s higher education system, ensuring that universities, polytechnics, and other tertiary institutions receive the financial support they need to develop infrastructure and improve academic standards. Any reduction in the funding available to TETFUND could lead to a deterioration in the quality of higher education, with long-term negative implications for the country’s human capital development.

Similarly, NASENI and NITDA play pivotal roles in the country’s push for technological advancement and infrastructure development. The funding these agencies receive supports crucial projects that could transform Nigeria’s technological landscape. Without adequate resources, these agencies could be left unable to fulfill their mandates, stalling progress in critical areas of the economy.

The NGF’s call for a more careful consideration of the funding mechanisms for these agencies is a valid concern, as reducing or altering the flow of funds could severely hamper Nigeria’s development goals.

A Flawed Budget: The Fallout from Miscalculations

If the National Assembly decide to align with the position of the NGF, it would have a direct impact on the 2025 appropriation of the Federal Government. It’s likely that the budget for the year was formulated based on the assumption that VAT would increase and CIT would be reduced, with projections reflecting these anticipated changes. Should these provisions be altered or blocked by the National Assembly, the Federal Government would be left with a budget built on faulty assumptions.

The ramifications of this could be significant. A shortfall in revenue, caused by the failure to implement the expected changes to VAT and CIT, would force the government to make tough decisions. It could either ramp up borrowing or scale back crucial projects in sectors like infrastructure, health, and education, areas that are already feeling the strain. Such adjustments could place additional pressure on an already fragile economy and lead to greater hardship for Nigerians. Essentially, the government may find itself scrambling to adjust its fiscal policy, possibly even revising its budget mid-year if the projected revenues fall short. In the end, these miscalculations could create an even deeper fiscal crisis and erode public confidence in the government’s ability to manage the economy effectively.

The Way Forward: Engagement and Dialogue

As the National Assembly deliberates on the proposed tax reforms, it is clear that more engagement and dialogue are needed between the federal government, state governments, and other key stakeholders. While the broader goal of tax reform is laudable, the implementation details are crucial. The government must carefully consider the concerns raised by the NGF and other stakeholders, and work to address these issues in a way that balances the need for revenue generation with the imperative to protect vulnerable Nigerians and foster business growth.

Ultimately, the success of these reforms will depend on the ability of all parties to find common ground and ensure that the tax system is both equitable and efficient. If the government can navigate these challenges, the reforms could lay the foundation for a stronger, more sustainable economy. However, if the government fails to address the concerns of stakeholders, the reforms could falter, and Nigeria’s fiscal future could be left in limbo.