The Nigerian Association of Chambers of Commerce, Industry, Mines, and Agriculture (NACCIMA), has disagreed with the raising of interest rate as the move in an unexpected, non-supposing time and one directional.

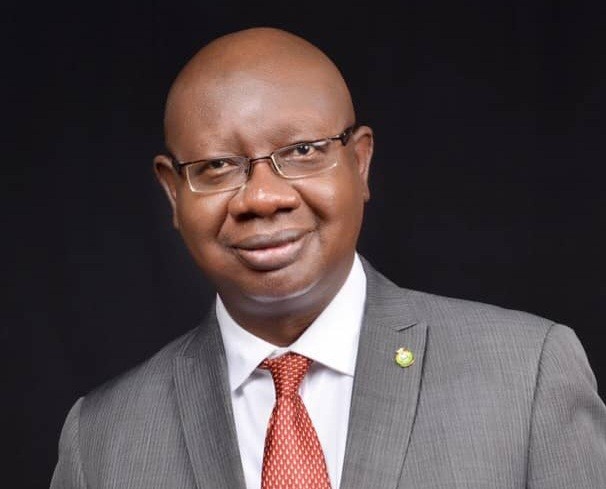

On NACCIMA position on the rising interest rate, its director-general, Mr Olusola Obadimu said the decision of the Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN) to raise the Monetary Policy Rate from 14 per cent to 15.5 per cent is the third move by the central bank in 2022 in response to the continuous increase in inflation rate.

He said this approval reflects the resolve of the MPC of the CBN to stem the rising rate of inflation. Nonetheless, this should have been accomplished in close cooperation with the Organised Private Sector (OPS).

He explained that the persistent increase in interest rates may not be sufficient to reduce the inflation rate, saying “we feel that this is primarily a strategy to manage inflation and does not address the underlying cause of inflation, which is rising food costs caused by several variables, including the devaluation of the naira and the cost of energy, which has impacted production and transportation.

“To attain low inflation rates, the government must assure monetary stability, a continuous electricity supply, and security to promote inclusive economic growth.

“While we suspected that the government believed that the country’s inflation could be controlled by a one-directional review, we as the organised private sector feel that the country’s pressing inflationary condition is the result of multiple factors.

“Relying just on monetary policy to restrain its unabated growth may be ineffective as opposed to producing the desired outcome. The ramifications of the increase in the interest rate would negate the proliferation of ease of doing business, the impact of which most businesses are still uncertain about,” Obadimu noted.

CBN Raising Interest Rates Is Unidirectional, To Affect Businesses Negatively– NACCIMA

Advertisement