Some stakeholders, on Wednesday, rejected the four tax reform bills before the National Assembly – Nigeria Tax; Nigeria Tax Administration; Nigeria Revenue Service, and Joint Revenue Board of Nigeria (Establishment) Bills, 2024.

The stakeholders made their positions known at a public hearing organised by the House of Representatives Committee on Finance at the National Assembly Complex in Abuja on Wednesday.

In its presentation, Kano State government challenged the constitutionality of certain provisions of the tax reform bills, particularly those granting the federal government extensive powers over state and local tax authorities.

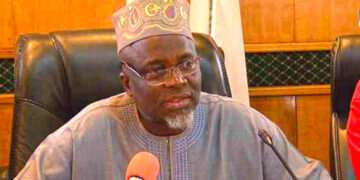

Making the presentation, the Permanent Secretary, Office of the Secretary to the State Government, Umar Mohammed Jalo, called for the expunction of provisions that grant the tax reform bills constitutional supremacy over other laws.

He said: “This clause is objectionable as it grants this bill a constitutional status similar to military rule, which cannot withstand the scrutiny of constitutional validity. The supremacy provision should be deleted.

“These provisions are substantially in breach of the Constitution of the Federal Republic of Nigeria, 1999, as the National Assembly lacks the competence to legislate on matters exclusively affecting state and local governments.

“Reducing funding to these strategic agencies will affect national interests in education, engineering, and information technology in adverse ways. TETFund, NITDA and NASENI should continue to be funded to support the nation’s aspirations for technological advancement, prosperity, and sustainable development.

“Increasing the VAT rate at a time when Nigerians are facing an unprecedented cost-of-living crisis will create more difficulties for families and elevate their levels of vulnerability and deprivation.

“Available information suggests ample room for improvement in coverage and collection efficiency. Weak compliance accounts for a significant portion of the inefficiency,” he stated.

However, the Kano State government expressed support for fiscal reforms while highlighting key concerns regarding the federal government’s ongoing tax system overhaul.

“The fiscal space needs to be enlarged. Public revenues at approximately 10% of GDP are currently too small relative to the daunting challenges of development. A more auspicious fiscal space will provide tremendous opportunities for the governors to deliver on their promises, including achieving the Sustainable Development Goals (SDGs), reducing poverty, and rebuilding infrastructure for growth, wealth, and job creation,” he added.

In its presentation, the Supreme Council for Shariah in Nigeria (SCSN), represented by its Secretary General, Nafiu Baba-Ahmed, also expressed worry over five areas of the Bills.

He called the attention of the National Assembly to “Reduce VAT rates back to 5% or in worst case scenario maintain the present 7.5 %. Section 146 of the Nigeria Tax Bill, 2024 should read that: “Subject to the provisions of part IV of chapter eight of this Act, VAT shall be charged at 5% or 7.5% if necessary.

“Delete S. 154(4) that requires ‘person whose supplies are chargeable to VAT at zero per cent, shall pay VAT on taxable supplies consumed in the production of its supplies, and may there after request for a refund of the VAT paid’. List of VAT Exempted Items S.190 of NTB should retain all VAT exempted items listed in Finance Act (2020).

“The Council wishes to recommend as follows: Expunge the Chapter on Development Levy covering Section 59 (1-5) of the NTB and revert to status quo by retaining the sources of funding for the three agencies as provided in their Acts.

“Delete the consequential amendments to Sections 1, 2 and 3(3) of the TETfund Act, 2011 proposed in Section 198(5) of the NTB. Similarly, delete the consequential amendments proposed in Section 198(4 & 6) of the NTB affecting Sections 12 (2a) and 16, and the Third Schedule of the NITDA Act 2007, and Sections 20(2) paragraphs b(i) and b(ii) of the NASENI Act 2004.

“If the government retains the Chapter on Development Levy, retain Section 59(1) without (a-c), retain 59(2), retain 59(3) without (a-d), expunge 59(4), and retain 59(5), and share its revenue am ongst TETFund (60%). NITDA (15%), NASENI (15%), and the Student Education Loan Fund (109%).

“On Inheritance Tax Section 4 (3) of Chapter 2, Part 1 of the draft NTB provides that”. the income of a family recognised under any law or custom in Nigeria as family income, in which several interests of individual members of the family cannot be separately determined, is taxable.”

On the Nigeria Tax Administrative Bill, the council suggested some amendments to clarify the term “derivation” and address related concerns: Clearly define ” derivation” in the Bill as the location where actual consumption takes place, regardless of which office files the VAT returns.

“To provide clarification of VAT attribution, replace “supply or supplies” with “consumption and consumptions” in Chapter 6, Part 1, Sections 143, 144, 145, and 147 to attribute derivation tO consumption. Retain the current 20% share for derivation, attributed to the location of consumption.

“If adopting the 30% share for derivation suggested by the NGF, apply to only local VAT (55% of total VAT revenue according to information provided by the Presidential Committee), and share Customs and International VAl equally…”

In the same vein, Trade Union Congress (TUC) rejected the increment of VAT from the current 7.5% to 15%, saying it would place an additional burden on Nigerians, many of whom were already struggling with their economic challenges and realities.

According to the union’s secretary general, Nuhu Toro: “the gradual increment of VAT from the current 7.5% to 15%. Mr. Chairman and respected members, the TUC unequivocally rejects this proposition.

“Our reason is simple, allowing the VAT rate to remain at 7.5% is in the best interest of the nation. Increasing it would place an additional burden on Nigerians, many of whom are already struggling with their economic challenges and realities.

“At a time when inflation is on the rise, and unemployment is becoming an ever-growing concern, higher taxes will only further strain households and businesses alike. We must be mindful, Mr. Chairman, that such measures could slow down the economy.”

Speaking in defence of the bills, the Comptroller General, Nigerian Customs Service, Adewale Adeniyi said the proposed legislation is aimed at making Nigeria more business-friendly and competitive but raised concerns about potential jurisdictional conflicts.

He said :”Our concerns are laid out in a 17-page document, but key areas of conflict include Section 23, 29, and 41A of the Joint Revenue Bill,” said the representative. They pointed out that Section 162 of the bill essentially “legislates the Nigerian Customs Service out of existence.”

Adeniyi further argued that while tax is a vital revenue-generating tool, customs duties go beyond fiscal policy to promote industrialization, prevent environmental pollution, and uphold public health.

“The UK experience is instructive,” the representative continued, referencing the 2005 merger of customs and tax functions in the UK, which was later reversed due to operational inefficiencies. “In 2012, the UK separated border control functions, acknowledging the distinct nature of customs operations.

“With success stories like Morocco’s customs modernization, which increased revenue by 37% and reduced clearance times by 65%, Nigeria’s Customs Service argued for preserving its autonomy. In fact, the NCS noted that since the enactment of the NCS Act in 2023, Nigerian customs revenue had surged by 92%, and trade facilitation had markedly improved.

We should encourage collaboration between customs and tax authorities, not abolish customs or repeal an existing law.”