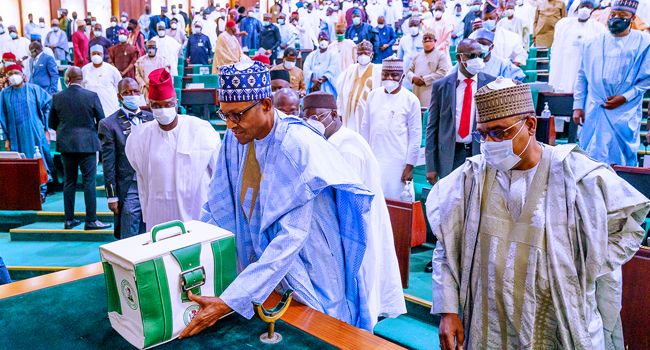

President Muhammadu Buhari last week Friday accompanied by the Vice President, Yemi Osinbajo and members of the Federal Executive Council(FEC) presented the proposed 2023 fiscal budget of N20.5 trillion tagged “Budget of Fiscal Sustainability and Transition” to the joint session of the National Assembly in Abuja.

The 2022 fiscal budget, as revised, was based on the 2022-2024 Medium Term Fiscal Framework and Fiscal Strategy Paper (MTFF/FSP) which was in line with the government’s National Development Plan 2021-2025. It comes on the assumptions of a 13 per cent inflation rate, an exchange rate of N410.15 to the dollar and an oil benchmark of $73 per barrel with the nation producing an average of 1.60 million barrels of crude oil daily.

Currently, inflation is 20.52 per cent while the naira changes at N439 to the dollars at the official market as against N730 to the dollar which it is changing at the parallel market. With crude oil theft and pipeline vandalism as well as lack of investment into the oil sector, Nigeria reported daily crude oil production at 1.03 million barrels daily as of June 2022. Thus the $123.23 price rally at the global oil market did not have much impact on Nigeria’s revenue.

For the 2023 budget, the federal government is estimating a lower oil price of $70 per barrel, daily oil production estimate of 1.69 million barrels, exchange rate of N435.57 per dollar, a projected GDP growth rate of 3.75 per cent and 17.16 per cent inflation rate.

The budget houses distributable revenue of N11.09 trillion plus N10.8 trillion deficits in the 2023 fiscal year. According to the president, the total expenditure of N20.51 trillion includes N2.42 trillion spending by Government-Owned Enterprises, Statutory Transfers of N744.11 billion; Non-debt Recurrent Costs of N8.27 trillion; Personnel Costs of N4.99 trillion; Pensions, Gratuities and Retirees’ Benefits of N854.8 billion.

President Buhari furthered that “it also includes Overheads of N1.11 trillion and Capital Expenditure of N5.35 trillion, including the capital component of Statutory Transfers; Debt Service of N6.31 trillion; and sinking Fund of N247.73 billion to retire certain maturing bonds.

The N20.15 trillion budget estimates presented by the president on Friday assume that Nigeria will produce 1.69 million barrels of crude oil daily and without interruptions from vandals, to realize a total of N1.92 trillion in revenue from oil. Also, it is expected that revenue from non-oil sources will be at N2.43 trillion, FGN independent revenue at N2.21 trillion.

From the expenditure framework, the sum of N8.80 trillion has been estimated to come from borrowings. President Buhari said it is expected that the total fiscal operations of the Federal Government to result in a deficit of N10.78 trillion which represents 4.78 per cent of the estimated GDP, above the three per cent threshold set by the Fiscal Responsibility Act 2007.

With this level of deficits, the government is expected to seek N1.77 trillion as drawdowns from bilateral and multilateral lenders as well as N266.1 billion for grants/donor-funded project and raise the rest from local and external debt markets.

Analysts at Cowry Assets Management commenting on the budget noted that “Nigeria requires a huge outlay of financial resources to drive all-inclusive growth which is sustainable as one of many ways to implement major economic reforms. That said, FG may be unable to provide for treasury-funded capital projects next year, especially with dwindling revenue and payment of subsidies on PMS which it has projected in the MTEF to gulp N6.7 trillion, and constitutes a major threat to the country’s revenue growth targets.

“A look at Nigeria’s revenue generation power over the years has shown how important it is to cut the cost of governance as it plans to introduce the payroll system in the area of personnel cost as means to monitor ghost workers. Also, efforts must be implemented to bring about an improved and enabling business environment.”

According to the recently released Q2-22 Budget Implementation Report (BIR) by the Budget Office of the Federation, the government’s fiscal deficit settled at N5.50 trillion or 5.97 per cent of prorated GDP, in the first half of 2022, 77.2 per cent higher than the projected deficit of N3.10 trillion for the review period.

The increased deficit was primarily driven by a 41.4 per cent shortfall in the government’s retained revenue. Analysts at Cordros Research notes that at this rate, the fiscal deficit could settle at an estimated N11 trillion in 2022.

“Given that the external financing conditions are unfavourable, it implies that much of the deficit financing would be channelled towards the domestic debt market amid an increased reliance on the CBN’s Ways and Means (W&M) advance.