Analysts on the Nigerian stock market said, the increased fixed income (FI) yields may continue to constrain buying activities on the market.

Part of the factors responsible for market bearish is investors’ preference for fixed income investments.

Analysts Optimism

Looking ahead, Cordros Securities Limited expected investors to rebalance their portfolios based on an assessment of corporate earnings released for Q3-22.

Cordros stated that, “however, the increased FI yields may continue to constrain buying activities. Consequently, we expect market performance to remain mixed in the week ahead as investors rotate their portfolios towards stocks with attractive dividend yields amid intermittent profit-taking activities.

“Overall, we advise investors to take positions in only fundamentally justified stocks as the weak macro story remains a significant headwind for corporate earnings.”

Going into the new week, analysts at Cowry Assets Management Limited expected the market to trade in like manner as last week in the absence of a major trigger that is likely to drive activities in the market for investors seeking alpha.

“However, we continue to advise investors to trade on companies’ stocks with sound fundamentals and a positive outlook amid the macro-dynamics which remains a headwind,” they said.

Afrinvest Limited noted that, this week, we expect bargain hunting activities to drive marginal gains.”

Last Week’s Trading Activities

There was upbeat in momentum in the local equities this week and was buoyed by the outpour of company releases into the market to aid investment decisions and creating entry opportunities for equities traders.

Through the week, we saw demand pressure in industrial goods sector and driven by price appreciation and demand pressure seen in some of the large and mid-cap companies within the sector such as Dangote Cement and Nigerian Aviation Handling Company (NAHCO), which drove positive sentiments in the benchmark index.

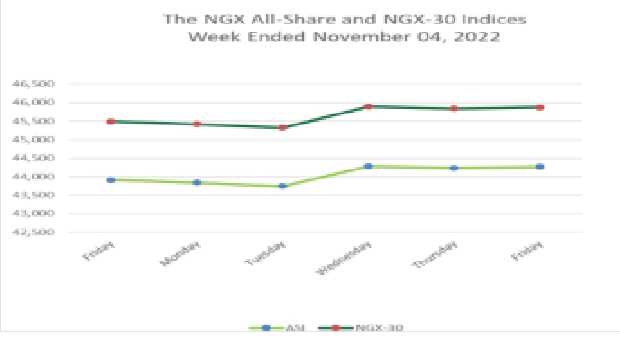

Accordingly, the All-Share Index advanced by 0.81 per cent week-on-week (W-o-W) to close at 44,269.18 points. Similarly, market capitalisation increased by N194 billion to close the week at N24.112 trillion.

Sectoral performance was largely bearish following losses in the Oil and Gas index with a weekly decline of 5.4 per cent. Consumer Goods index recorded a weekly loss of 2.3 per cent, while Banking and Insurance indices shed 1.9 per cent and 1.3 per cent, W-o-W. On the flip side, the Industrial Goods index gained 5.4 per cent for the week.

Market breadth for the week was negative as 20 equities appreciated in price, 43 equities depreciated in price, while 94 equities remained unchanged. FTN Cocoa Processors led the gainers table by 13.33 per cent to close at 34 kobo, per share. Nigerian Aviation Handling Company (NAHCO) followed with a gain of 10.47 per cent to close at N5.70, while Dangote Cement went up by 8.84 per cent to close to N240.00, per share.

On the other side, Chams Holding Company led the decliners table by 14.81 per cent to close at 23 kobo, per share. Ikeja Hotel followed with a loss of 12.96 per cent to close at 94 kobo, while Cornerstone Insurance declined by 12.00 per cent to close at 44 kobo, per share.

Overall, a total turnover of 1.410 billion shares worth N15.510 billion in 19,025 deals was traded last week by investors on the floor of the Exchange, in contrast to a total of 598.817 million shares valued at N14.234 billion that exchanged hands last week in 15,859 deals.

The Financial Services Industry (measured by volume) led the activity chart with 804.570 million shares valued at N6.300 billion traded in 9,922 deals; contributing 57.04 per cent and 40.62 per cent to the total equity turnover volume and value respectively. The Agriculture Industry followed with 357.623 million shares worth N287.992 million in 560 deals, while the Conglomerates Industry traded a turnover of 68.309 million shares worth N97.051 million in 530 deals.

Trading in the top three equities; Access Holdings, FTN Cocoa Processors and Fidelity Bank, (measured by volume) accounted for 800.622 million shares worth N3.373 billion in 2,051 deals, contributing 56.76 per cent and 21.75 per cent to the total equity turnover volume and value respectively.

We’ve got the edge. Get real-time reports, breaking scoops, and exclusive angles delivered straight to your phone. Don’t settle for stale news. Join LEADERSHIP NEWS on WhatsApp for 24/7 updates →

Join Our WhatsApp Channel