The Mortgage Bankers Association of Nigeria (MBAN) has described federal government’s approval of the guidelines, which allows pension funds account holders to access 25 per cent of their balances for mortgage purposes, as a major solution to the nation’s housing deficit.

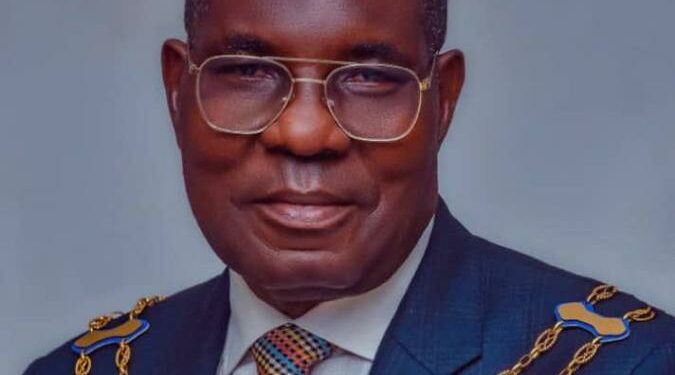

MBAN, in a statement issued by its president, Mr. Ebilate Mac-Yoroki, and executive secretary, Mr. Kayode Omotoso, yesterday, was reacting to the approval of guidelines by the National Pension Commission (PenCom), allowing Retirement Savings Account (RSA) holders to access 25 per cent of their savings for residential mortgage.

It, however, charged the federal government to take the next step of firming up the effectiveness of the financing initiative by setting up and operationalizing the Nigeria Mortgage Guarantee Company (NMGC), a credit enhancement platform, which it said is already being finalised by the FSS2020, a department of the Central Bank of Nigeria (CBN).

PenCom had, on Friday, announced the approval of the guideline, which now allows eligible RSA holders to approach their Pension Fund Administrators (PFA) in order to gain access to 25 per cent of their pension savings, strictly for mortgage purposes.

The body also lauded President Muhammadu Buhari and PenCom for taking a decision that will make it easier for working-Nigerians to become home owners.

It commended the initiative that resulted in the approval, saying it is one of the landmark steps and decisions for which the Muhammadu Buhari-led administration will be remembered, praising the director-general of PenCom, Mrs. Aisha Dahir-Umar, for her role in the approval.

According to the statement, Mac-Yoroki described the approval as an elixir for the staggering housing deficit, as well as positively impact the economy generally.

It expressed delight at the fruition of a move it claimed to have initiated as an advocacy issue with PenCom, and later further escalated by other stakeholders in the sector.

“We are indeed glad and elated that this novel idea has finally become a reality. It commenced silently as an advocacy issue with PenCom that originated from MBAN, which thereafter was escalated to full advocacy issue by stakeholders on the platform of the former Nigerian Housing Finance Program (NHFP).

“However, all the continuous efforts were in the last few months finally coordinated with PenCom by FSS2020 and MBAN, which culminated into the broad guidelines issued by PenCom on the idea.

“The Mortgage Bankers Association of Nigeria wishes to commend the federal government, under the watch of President Muhammadu Buhari, the Central bank of Nigeria (CBN) and particularly the National Pension Commission (PenCom), for this landmark approval. This is another reason for which the President’s name will be remembered positively.

“The estimated over 28 million units of housing deficit is staggering indeed and will be requiring trillions of naira to offset. This new approval, though not all that might be needed to solve the problem, will be a giant step towards bridging the housing gap for many Nigerians, whose major setback has been financing.

“With granting of the approval that allows Retirement Savings Account (RSA) holders to access 25 per cent of their balance towards payment of equity for residential mortgage, government will be solving more than just the problem of housing, but will also be giving the economy a boost as many mortgage-related sectors, like construction and banking, will receive more vigour.

“As an association, which is directly concerned with the mortgage market, MBAN will, in its usual approach, be doing everything necessary to support government in ensuring that the primary target of giving the approval, which is eliminating the housing gap and creating an easy environment for beneficiaries to acquire their dreamed homes, is achieved to the adequately.

“This step by government will have a rippling impact on our nationhood and the achieve the sort of reform we have hoped for in the work place, either private or public. For instance, it will rejuvenate the work ethics and culture across the sectors because, as they say, a man or woman who has solved his housing question is a more productive employee”, the statement said.

On how the approval will achieve its designed potential, the statement said “its breadth and depth would only be fully achieved with the setting up and take-off by the Nigeria Mortgage Guarantee Company (NMGC), a credit enhancement initiative that is currently being finalised by FSS2020, NMRC, MBAN/mortgage banks, for Nigerians to take the fullest advantage”.

It also appealed to the federal government to give incentives to local companies in the business of manufacturing building materials like tiles, wires, cement, doors and other building accessories, saying it will help in the reducing the cost of buildings, just as it will positively affect the economy.