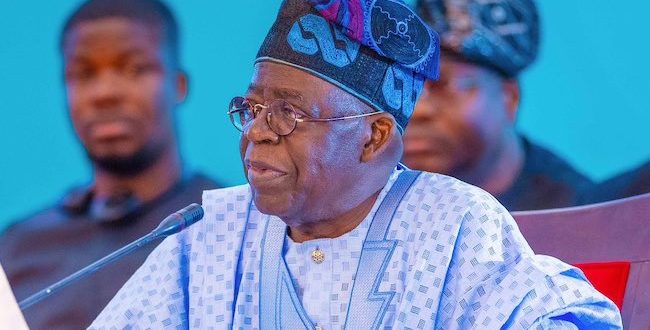

Civil Society Organizations (CSOs) have commended the Revenue Mobilisation Allocation and Fiscal Commission (RMAFC) for supporting President Bola Tinubu, in his efforts to establish a fair and constitutionally compliant Value Added Tax (VAT) sharing formula.

The groups described the move as a critical step toward fostering national unity, equity, and transparency in revenue allocation.

In a statement issued on Tuesday, the Coalition of Civil Society Network of Nigeria expressed its support for the Commission’s role in aligning with the government’s vision for equitable revenue distribution.

The statement was signed by Comrade Muhammad Bello Alhasan, Secretary of the Coalition, and noted the importance of RMAFC’s leadership in the ongoing debate between federal and state governments over VAT allocation.

The CSOs urged stakeholders, including the federal, state, and local governments, to work collaboratively to adopt a consensus-driven VAT allocation formula that promotes fairness and avoids legislative or executive overreach.

They emphasized that RMAFC remains the constitutionally mandated arbiter for developing and implementing revenue-sharing formulas in the country.

The coalition further highlighted the current VAT distribution structure, where revenues are pooled and shared as 50% to states, 35% to local governments, and 15% to the federal government.

They advised that any new formula should reflect VAT’s unique nature as a consumption tax while ensuring equity among all tiers of government.

The statement reads, “Under Nigeria’s VAT system, collected VAT is pooled nationally and distributed based on a formula: 50% to States, 35% to Local Governments, and 15% to the Federal Government.

“Lagos, as the point of collection, could argue for derivation rights. Kano, as the consumer’s residence and point of use, could also claim derivation rights because it is a consumption tax which is borne by the final consumer.

“VAT allocation and derivation shall be based on a formula developed by the RMAFC, which considers VAT’s unique nature as a consumption tax and ensures equitable distribution.

“The Commission’s position, aligned with the government’s constitutional mandate, ensures that VAT allocation adheres to the principles of fairness, justice, and equity, avoiding any arbitrary apportionment.

“The Commission remains the sole arbiter in producing allocation formulae that are fair, just, and equitable for the three tiers of Government.

“By maintaining transparency and collaboration, the government’s approach fosters trust and unity among all tiers of government, avoiding divisions that could arise from arbitrary revenue distribution.”

We’ve got the edge. Get real-time reports, breaking scoops, and exclusive angles delivered straight to your phone. Don’t settle for stale news. Join LEADERSHIP NEWS on WhatsApp for 24/7 updates →

Join Our WhatsApp Channel