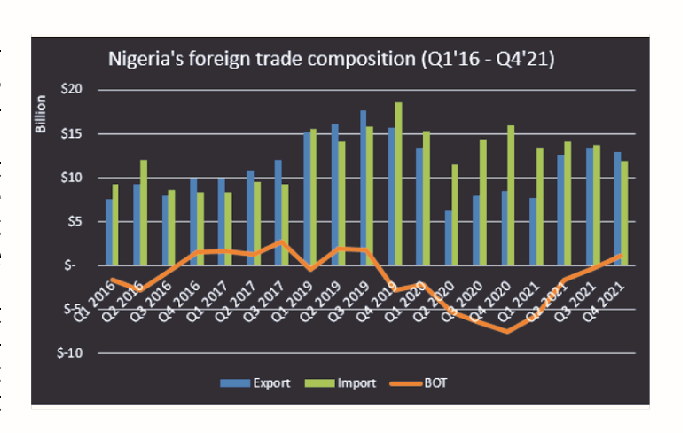

The latest Foreign Trade Statistics report as released by the National Bureau of Statistics(NBS) show that the country’s exports in the second quarter of 2022 grew by 4.31 and 47.55 per cents over the figure recorded in the first quarter of the year and the corresponding quarter of 2021 respectively.

This, alongside a decline in the import value saw the country recording a trade surplus of N2 trillion in the second quarter compared to N1.2 trillion recorded in the first quarter and the highest in the last 16 quarters.

In the second quarter of 2022, total trade stood at N12.84 trillion, lower than N13 trillion recorded in the first quarter of 2022 but higher than N9.71 trillion recorded in the corresponding period of 2021. Total Exports were N7.4 trillion of which Re-exports stood at N9.63 billion, while total imports stood at N5.43trillion.

The trade surplus was supported by the twin effect of the expansion in export earnings which was up 4.3 per cent and the decline in import bills which declined by 7.9 per cent quarter on quarter. Crude oil exports had the biggest chunk of the export figure with N5.91 trillion.

This is a 5.11 per cent and 45.08 per cent improvement over the export value recorded in the first quarter of the year and the corresponding period of 2021 where N5.62 trillion and N4.07 trillion had been recorded respectively.

Analysts also linked the decline in import value to the devastating impact of the high domestic inflation rate on the demand level, and the reduced activities of importers and manufacturers due to the lingering foreign exchange quagmire.

Concerns are however still rife on the both the percentage of crude exports as well as slow growth in the non-oil exports and particularly the decline in manufactured and agricultural goods exports. The report showed that the value of agricultural goods exports stood at N141.77 billion in Q2, 2022 indicating a decrease of 29.67 per cent compared to N201.59 billion that recorded in Q1, 2022 and also decreased by 14.32 per cent when compared to N165.46 billion that was recorded in Q2, 2021.

Similarly, the value of manufactured goods exports stood at N119.53 billion in Q2, 2022 showing a decline of 45.44 per cent compared to N219.08 billion recorded in Q1, 2022 and also decreased by 14.84 per cent compared to the value of N140.36 billion recorded in Q2, 2021.

Analysts at Afrinvest West Africa, in an emailed note on the trade statistics said: “diving deep into the sub-component performance, we observed that receipts from crude oil sales up 5.1 per cent quarter on quarter to N5.9 trillion and non-crude oil exports up 1.3 per cent to N1.5 trillion were the catalysts to the growth in trade surplus given that non-oil exports earnings caved in 5.6 per ent quarter on quarter to N675.1 billion.

“To our mind, the decline in the non-oil exports earnings amid elevated prices of commodities in the global market and the several export promotion initiatives by the CBN such as the 100-for-100 PPP, underscores the need for coordinated fiscal and monetary policy actions to fix the fundamental challenges bedeviling the non-oil sector.”

On his part, the former director general at the West Africa Institute for Financial and Economic Management (WAIFEM) and chairman of the Foundation for Economic Research and Training, Professor Akpan Ekpo, said the country needs to shift from its dependence on oil whilst strongly reducing imports.

Professor Ekpo, noted that, the solution to solving the country’s foreign exchange crisis is building a productive economy and exporting non-oil goods and services to earn foreign exchange while reducing dependence on oil.

“There is a trade surplus and looking at the data we exported more crude oil which is why we have surplus. But if we have refineries that are working and we produce enough for local consumption, we will now see a lot of foreign exchange,” he said.

The value of the naira has been seeing a downturn at the Investors’ and Exporters’ window in recent times.

Last week, the value of the naira depreciated by 0.4 per cent week on week to N436.33 to the dollar from N434.75/ at the I&E window, stemming from pressures from low crude oil earnings for Nigeria despite the Brent Crude trading at a level above the 2022 budget benchmark.

Similarly, panic buying in the market resulting from the news that some foreign airlines plan to sell flight tickets in foreign currencies, drove many forex users to begin a prowl for the greenback for personal and business travels while the apex bank’s interventions in the forex space has always seen the street traders being ignored with funding.

At the parallel market, the naira further depreciated by N6 or 0.9 per cent week on week to close at N708 to the dollar from N702 as continued demand pressure stay unabated for another week in the face of declining reserves and low earnings from oil exports.

Analysts at Cowry Assets Management said, they expect the naira to depreciate further across all segments of the FX market as a result of growing dollar demand pressure

We’ve got the edge. Get real-time reports, breaking scoops, and exclusive angles delivered straight to your phone. Don’t settle for stale news. Join LEADERSHIP NEWS on WhatsApp for 24/7 updates →

Join Our WhatsApp Channel