Bauchi State Chamber of Commerce, Industry, Mines and Agriculture (BACCIMA) has declared that Nigeria cannot achieve sustainable economic growth under a one-sided system of accountability where only businesses are compelled to comply promptly, while government institutions delay their obligations without consequences.

The chamber called for the enforcement of equal standards of timeliness, penalties, and interest on both the public and private sectors. According to BACCIMA, accountability goes beyond financial compliance, it embodies fairness, justice, and the creation of a business environment built on trust and mutual respect.

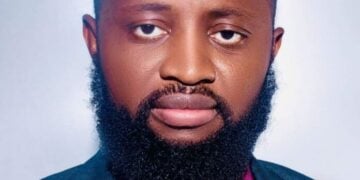

Speaking at a press briefing in Bauchi yesterday, the chairman of BACCIMA, Hon. Aminu Mohammed Danmaliki, said the chamber’s position was not a demand for privilege but a call for balance and fairness.

“If businesses are required to meet strict tax deadlines under threat of penalty, then government agencies like the FIRS must also be obligated to fulfill their commitments promptly, with consequences for failure,” he stated.

Describing fairness as the foundation of a credible tax system, Danmaliki noted that Withholding Tax (WHT) refunds belong to the private sector until full reconciliation is made.

He explained that the Federal Inland Revenue Service (FIRS) currently enforces a 10% WHT deduction on contract sums to ensure compliance. However, when a company fully meets its tax obligations, the deducted funds are supposed to be refunded, a provision that is rarely respected.

Aminu proposed that WHT funds be held in jointly managed accounts, co-supervised by the FIRS and the Organized Private Sector under the Nigerian Association of Chambers of Commerce, Industry, Mines and Agriculture (NACCIMA).

He stressed that Small and Medium Enterprises (SMEs), which make up the majority of service providers, are the worst affected by delayed payments and refunds.

According to him, prompt settlement is critical to protect jobs, stabilise businesses, and promote economic growth.

“Federal, state, and local governments must be legally bound to pay certified executed contracts within a fixed timeline, say 30 days. Any delay beyond this period must attract interest and penalties, just as companies are penalized for tax delays,” he added.

Danmaliki also called for the establishment of a Joint WHT Refund Account in selected banks, co-managed by FIRS and NACCIMA, to ensure refunds are processed within 30 days. Any delay, he insisted, should automatically attract interest.

He criticised the prevailing system where government agencies impose penalties for delayed tax remittance but face no repercussions for withholding payments or refunds.

“This asymmetry of power is fundamentally unfair and economically destructive. If taxpayers face penalties for delay, government must also face penalties for failing to refund or pay contractors on time,” the chamber asserted.