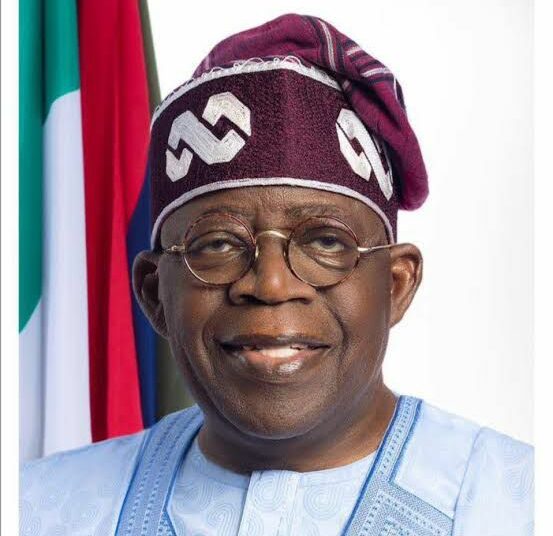

In a bold and unprecedented move, President Bola Tinubu has shaken up the country’s economic landscape by suspending key tax measures, sending shockwaves through the business community and sparking intense discussions about the potential implications.

With the aim of addressing concerns raised by manufacturers and stakeholders, this decision marks a significant turning point in the ongoing debate surrounding tax policies and their profound impact on the nation’s economy. As Nigeria braces itself for a new era of tax reforms, it is crucial to delve into the rationale behind President Tinubu’s decision, assess its potential effects on businesses and the overall economy, and closely examine the reactions and expectations of stakeholders who are now navigating uncharted territory.

President Tinubu’s first executive order, the Finance Act (Effective Date Variation) Order, 2023, defers the implementation of changes outlined in the Act from May 23, 2023, to September 1, 2023. By extending the effective date, the government ensures compliance with the stipulated 90-day advance notice for tax changes. This decision provides manufacturers and other stakeholders with additional time to adjust their operations and align their finances accordingly. It reflects the government’s commitment to transparent and predictable tax policies that support economic growth and stability.

The second executive order signed by President Tinubu is the Customs, Excise Tariff (Variation) Amendment Order, 2023. Originally scheduled to take effect from March 27, 2023, the tax changes will now be implemented from August 1, 2023.

This adjustment aligns with the National Tax Policy guidelines, further contributing to the government’s efforts to provide clarity and adequate notice to stakeholders. By extending the timeline, businesses can effectively plan and adapt to the changes, ensuring minimal disruption to their operations.

President Tinubu has also suspended the 5% Excise Tax on telecommunication services and the newly introduced Green Tax, an Excise Tax on Single Use Plastics. These decisions showcase the government’s responsiveness to the concerns of citizens and businesses. By suspending the Excise Tax on telecommunication services, the government acknowledges the importance of fostering a favorable environment for the telecommunications industry, which plays a vital role in driving economic growth and connectivity.

The suspension of the Green Tax on Single Use Plastics is another notable move by President Tinubu. It reflects the government’s commitment to addressing environmental concerns while carefully considering the impact on businesses that rely on plastic packaging and containers. This decision provides an opportunity for further assessment of sustainable alternatives and solutions to reduce plastic waste without unduly burdening the affected industries.

According to the special adviser special duties, communication and strategy to the president, Dele Alake, President Tinubu’s intention is to listen to the concerns of the Nigerian people and alleviate the negative impacts of the tax adjustments, rather than exacerbate the challenges faced by citizens.

“The President wishes to reiterate his commitment to reviewing complaints about multiple taxation, local and anti-business inhibitions. The federal government sees business owners, local and foreign investors as critical engines in its focus on achieving higher GDP growth and appreciable reduction in unemployment rate through job creation.

“The government will, therefore, continue to give requisite stimulus by way of friendly policies to allow businesses to flourish in the country. President Bola Tinubu wishes to assure Nigerians by whose mandate he is in power that there will not be further tax raise without robust and wide consultations undertaken within the context of a coherent fiscal policy framework,” he added.

According to him, some of the problems identified with the tax changes include the 2017 National Tax Policy approved by the President Muhammadu Buhari administration, prescribing a minimum of 90 days notice from government to tax-payers before any tax changes can take effect.

Indeed, the suspensions of these tax measures are expected to have a positive impact on both businesses and citizens. By providing relief from the burden of increased taxes, President Tinubu aims to stimulate economic growth and encourage investment. The decision to suspend the Excise Duties escalation on locally manufactured products also serves as a boost for domestic industries, allowing them to compete more effectively and contribute to job creation. These measures not only alleviate the financial strain on businesses but also have a ripple effect on households, as reduced tax burdens can lead to increased disposable income and improved standards of living.

Needless to say that President Tinubu’s decision to suspend these key tax measures exemplifies his commitment to stakeholder engagement and responsiveness. By listening to the concerns of the Nigerian people and prioritizing their well-being, the government aims to create an enabling environment that supports economic growth and development.

The suspensions provide an opportunity for further dialogue between the government and stakeholders, facilitating the identification of potential alternatives or modifications to tax policies that can better serve the interests of all parties involved.

Consequently, in consonance with his promise to remove all barriers impeding business growth in Nigeria, President Tinubu approved the establishment of a Presidential Committee on Fiscal Policy and Tax Reforms.

The committee will be chaired by Fiscal Policy Partner and Africa Tax Leader at PriceWaterhouseCoopers (PwC), Mr. Taiwo Oyedele.

It will comprise experts from both the private and public sectors and have responsibility for the various aspects of tax law reform, fiscal policy design and coordination, harmonization of taxes, and revenue administration.

Special Adviser to the President on Revenue, Adelabu Zacch Adedeji, explained that President Tinubu recognizes the importance of a sound fiscal policy environment and an effective taxation system for the functioning of the government and the economy.

‘’Nigeria ranks very low on the global ease of paying taxes while the country’s Tax to GDP ratio is one of the lowest in the world and well below the African average.

‘’This has led to an overreliance on borrowing to finance public spending which in turn limits the fiscal space as debt service costs consume a greater portion of government revenue, annually resulting in a vicious cycle of inadequate funding for socio-economic development.

‘’While some incremental progress has been recorded over the years, the outcomes have not been transformative enough to change the narrative,’’ he said.

Adedeji outlined the key challenges in Nigeria’s tax system to include multiple taxes and revenue collection agencies, fragmented and complex tax system, low tax morale, high prevalence of tax evasion, high cost of revenue administration, lack of coordination between fiscal and economic policies, and poor accountability in the utilization of tax revenue.

The establishment of this committee reflects President Tinubu’s commitment to addressing these challenges and bringing about transformative reforms in fiscal policy and taxation.

It is pertinent to note that President Tinubu’s decision to suspend key tax measures has been commended by financial and business experts in the country.

The thinking is that it demonstrates a proactive approach towards addressing concerns raised by manufacturers and stakeholders. By deferring the implementation dates and suspending certain taxes, the government aims to provide clarity, adequate notice, and relief to businesses and citizens.

These measures are expected to stimulate economic growth, foster a business-friendly environment, and improve the overall standard of living for Nigerians. As the government continues to engage with stakeholders, it is crucial to maintain open lines of communication and work towards mutually beneficial solutions that support long-term sustainable development.