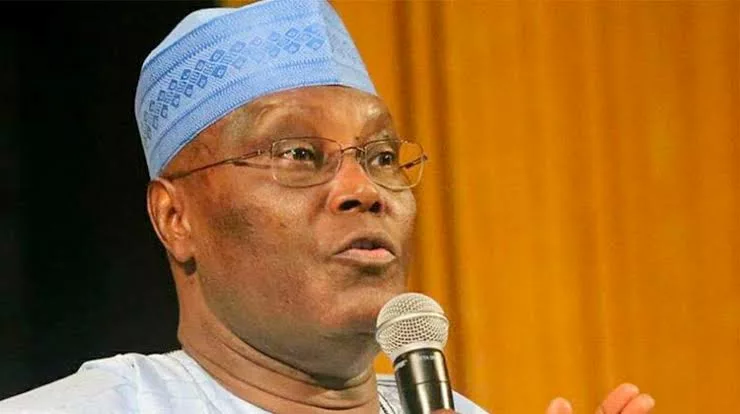

Former vice president Atiku Abubakar has asked President Bola Tinubu to tell Nigerians what has happened to the $3.3 billion emergency crude repayment loan secured by the federal government last year through the Nigerian National Petroleum Company Limited (NNPCL) to support the Naira and stabilise the foreign exchange market.

Atiku in a statement said it was curious that the federal government continues to keep mum about it, noting that the only information on the mega deal is coming from unofficial NNPC sources.

The former vice president however posed some questions thus “ Has the Federal Government accessed the loan? Is the loan in the government’s borrowing plan as approved by the National Assembly? Who are the parties to the loan, and what specific roles are they expected to play?”

He also asked “What are the conditions to the loan, including tenor, repayment terms, the collateral, and the interest rate? And, lastly, why register an SPV in the Bahamas knowing the recent scandal of the country’s notoriety for warehousing unclean assets?”

Atiku recalled that the Tinubu-led federal government, precisely on August 16, 2023 through the Nigerian National Petroleum Company (NNPC) secured a $3.3 billion emergency crude repayment loan, which according to the NNPC, was to help give support to the Naira and stabilize the Foreign Exchange market.

He however said, “The curious thing about this transaction is that up till now, the Federal Government continues to keep mum about it, and the only information available to the public on the mega deal is coming only through unofficial sources from the NNPC.”

The former vice president, who said the deal is supposed to be a crude-for-cash loan arranged by the African Export-Import Bank, added that according to information available to him, a Special Purpose Vehicle called Project Gazelle Funding Limited is driving the deal, and it was incorporated in the Bahamas.

“The SPV is the borrower while the NNPC is the sponsor, with an agreement to pay with crude oil to the SPV in order to liquidate the loan at an interest rate that is a little over 12 percent.

“What is even more confounding about this deal is why the Federal Government would register a company in the Bahamas, knowing full well the recent scandal of the Paradise Papers that involved that country.

“Curiously also, Nigeria’s current Barrels Produced Daily (BPD) is 1.38 million, and according to the Project Gazelle deal, Nigeria is to supply 90,000 Barrels of its daily production, starting from 2024 till it is up to 164.25 million barrels for the repayment of the loan.

“Now, this is where the details get disturbing because Nigeria’s benchmark for the sale of crude per barrel in 2024 is $77.96. A simple multiplication of that figure by 164.25 will give us a whooping $12 billion.

“It is on this note that we are calling on the Federal Government to speak up on this shady deal.”

He added that it is inconceivable that the federal government will lead the country to take a loan of $3.3 billion with an interest rate that is not more than 12 percent, but with estimated repayment amounting to $12 billion.

“That is a humongous differential of about $7b between what is in the details of the deal on paper and what indeed is the reality.

“There are questions to be answered on the integrity of this deal, and we earnestly request the federal government to talk directly on these cloudy details behind the deal,” he said.