Despite significant revenue accrual to the federation, available data show that the Nigerian government still borrowed N18.65 trillion in 12 months, equivalent to N1.55 trillion per month.

Between June 2023 and June 2024, the government raised its total public debt from N87.38 trillion, representing $113.42 billion to N134.3 trillion — equivalent of $91.35 billion, a data company, StatiSense showed in a new datasheet while quoting official documents from the Debt Management Office (DMO).

The public debt decreased in dollar terms between June 2023 and June 2024. However, when converted to naira, it jumped to N134.3 trillion, largely due to currency devaluation.

Nigeria’s volatile exchange rate regime saw the naira fall against the United States dollar from $1/N770.38 in June 2023 to $1/N1,470.19 in June 2024. The local currency has further weakened to $1/N1,730 before the close of work on Monday, November 11, 2024.

“This sharp increase in debt could lead to tighter budgets, potentially affecting public services and everyday costs for Nigerians,” said Intelpoint, a market research and analyses firm.

Despite various cash assistance programmes, including the federal government’s conditional cash transfer scheme, and extensive macroeconomic reforms such as the unification of the exchange rate and the removal of fuel subsidies, poverty in Nigeria rose to 38.9 percent in 2023, leaving 87 million Nigerians in poverty.

A breakdown of the latest data shows domestic debt rose from N48.31 trillion in June 2023 to N66.96 trillion in June 2024. External debt decreased from $38.81 billion in June 2023 to $38.01 billion as of June 2024 due to reduced foreign borrowing by the current administration.

The current administration says it has significantly raised the country’s revenue since taking office. In the first half of 2024, the government said it raised total revenue to N9.1 trillion while defending the removal of fuel and electricity subsidies, which have been largely criticised as harsh policies designed to further impoverish the citizenry.

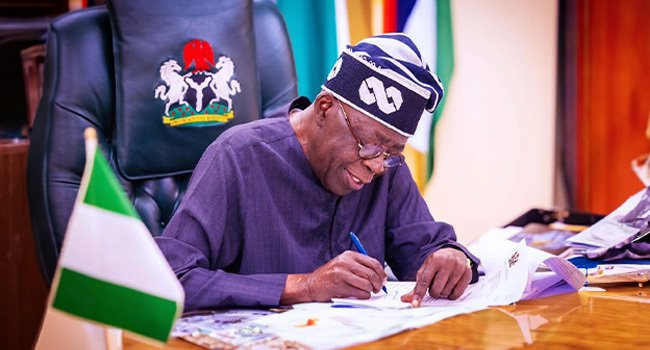

President Bola Tinutu recently bragged that his administration reduced sovereign debt servicing from 97 per cent to 65 per cent of government revenue, describing the shift as a sign of the nation’s economic revival.

“For us, it was a challenge when the nation was servicing its debt with 97 per cent of its revenue; it was nothing but the end of the cliff,” the President said recently at the swearing-in of seven new ministers.

He announced that the ratio has now been reduced to 65 per cent, emphasising that Nigeria has never defaulted on its obligations, both foreign and domestic. “We have our head above water,” he declared.