First Bank of Nigeria Limited (FirstBank) has successfully redeemed its $350 million Eurobond upon maturity, demonstrating effective assets and liability management.

The Eurobond was issued as Senior Notes in October 2020 at 8.625 per cent with semi-annual coupon payments, which was 70 per cent oversubscribed at the time, evidencing FirstBank’s deep market access and investor confidence.

The proceeds of the Senior Notes were used to, among others, finance various customer projects and activities, some of which were of vital national and economic importance.

This redemption reflects FirstBank’s effective liability management strategy and further demonstrates the Bank’s robust foreign currency liquidity and unrivalled franchise strength, while cementing the Bank as a preferred issuer in the international investment community.

With this redemption, FirstBank has now successfully redeemed $1.275 billion over 4 maturities, since it 2007 vintage issue.

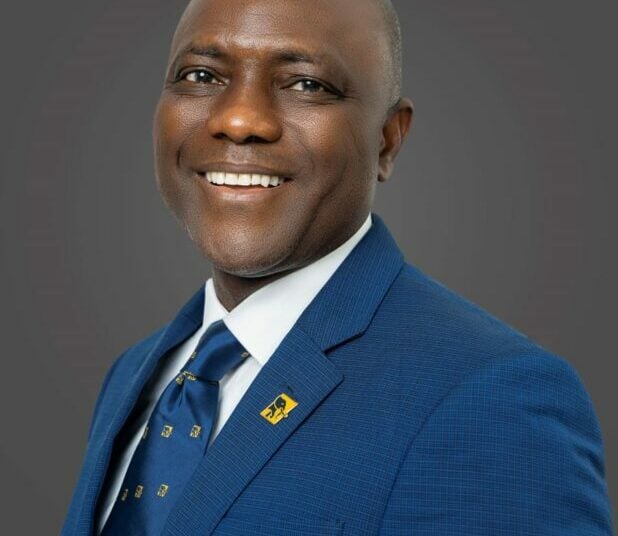

Speaking, the CEO, FirstBank Group, Olusegun Alebiosu, stated, “this redemption is entirely from the Bank’s balance sheet, reflecting FirstBank’s superior assets and liabilities management, the unrivalled franchise strength and reinforces the confidence that the investment community reposes in FirstBank.”

Alebiosu reaffirmed FirstBank’s 131-year legacy as a leader in corporate banking in Nigeria and across Sub-Saharan Africa.

He also assured customers of the Bank’s commitment to meeting their transaction banking, treasury and cash management needs, through differentiated product offerings, powered by recent cutting-edge technological investments aimed at further streamlining its processes and improving customer experience.

Recently, Fitch affirmed FirstBank’s Long-Term Issuer Default Ratings (IDRs) at ‘B’ and upgraded the bank’s National Long-Term Ratings to ‘A+(nga)’ from ‘A(nga)’, both with ‘Stable’ outlooks, further reinforcing the Bank’s credit capacity and excellent balance sheet quality.

In recognition of FirstBank’s leadership in corporate and transaction banking in Nigeria, the Bank was awarded the Best Bank for Corporates in 2024 by Euromoney, Global Finance and World Economic Magazine.

First Bank of Nigeria Limited established in 1894, is the premier bank in West Africa, a leading financial inclusion services provider in Africa, and a digital banking giant.

FirstBank’s international footprints cut across three continents ─ Africa, Europe and Asia, with FirstBank UK Limited in London and Paris; FirstBank in The Democratic Republic of Congo, Ghana, The Gambia, Guinea and Sierra Leone; FBNBank in Senegal; and a FirstBank Representative Office in Beijing, China. All the subsidiary banks are fully registered by their respective Central Banks to provide full banking services.

Besides providing domestic banking services, the subsidiaries also engage in international cross-border transactions with FirstBank’s non-Nigerian subsidiaries, and the representative offices in Paris and China facilitate trade flows from Asia and Europe into Nigeria and other African countries.