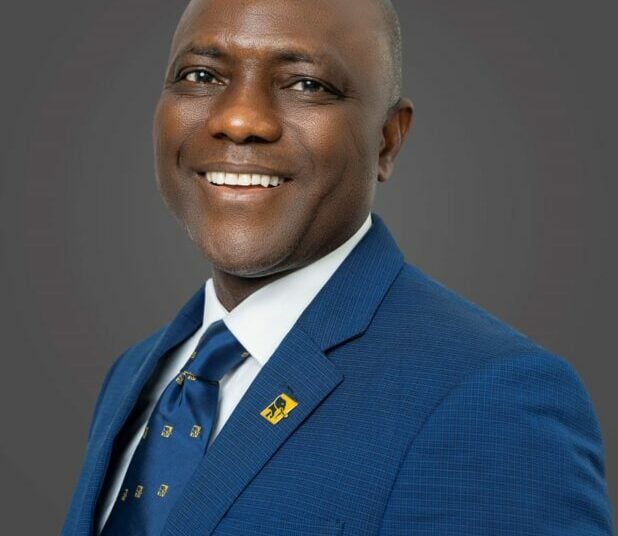

The Managing Director of FirstBank Group, Mr Olusegun Alebiosu, has said that the bank was committed to bridging financing gaps and leveraging digital solutions to tackle business challenges across key sectors of the economy.

Alebiosu stated this at a breakfast session during the ongoing 31st Nigeria Economic Summit, themed “Expanding Access to Finance and Driving Growth Across Middle Market and Emerging Corporate Segments,” held in Abuja.

He said that a prosperous nation is built on the backbone of its real sector, adding that access to finance remains fundamental to unlocking the sector’s full potential.

“That is why we have placed this subject at the heart of our discussion — to catalyse sustainable growth and inclusion where it matters most,” he said.

According to him, FirstBank empowers Small and Medium Enterprises (SMEs) and emerging corporates through tailored products and services designed to stimulate growth across their value chains and support Nigeria’s economic evolution.

He stressed that collaboration among policymakers, industry players, and technology partners was vital to achieving lasting impact.

“By forging partnerships across policy, industry, and technology, we can create an enabling environment that unlocks new opportunities for businesses to thrive. That is the driving purpose of today’s session,” Alebiosu said.

He highlighted that with a legacy spanning 131 years, FirstBank remains a trusted partner to SMEs and large corporates, offering comprehensive banking solutions that enhance innovation, resilience, and economic diversification.

Also speaking, the Group Executive, Commercial Banking, North Division, Mrs Aishatu Bubaram, said the middle market and emerging corporates are central to Nigeria’s future prosperity.

She described these enterprises as vibrant job creation, innovation, and diversification drivers across key sectors such as agribusiness, healthcare, digital services, and light manufacturing.

Bubaram noted that despite their potential, these businesses face persistent challenges, including limited access to finance, inadequate advisory support, and fragile operational ecosystems.

“FirstBank recognises that addressing these barriers is not just a banking imperative; it is a national imperative,” she said.

According to her, the bank has continued to support enterprise growth and resilience over its 131-year history, reaffirming its commitment to expanding access to financial solutions, deploying technology to unlock opportunities, and forging partnerships that empower businesses.

“This session is not merely about banking; it is about reimagining how finance can accelerate inclusion, how policy can create enabling environments, and how collective action can turn Nigeria’s vast entrepreneurial energy into shared prosperity,” Bubaram added.