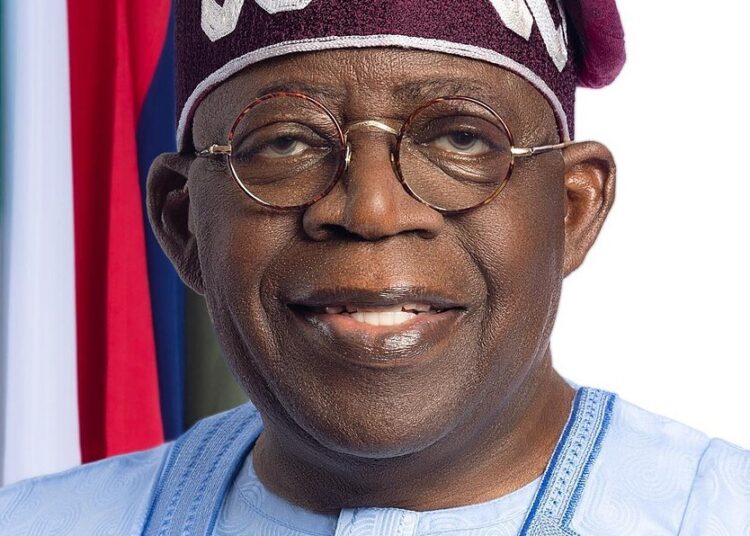

As the President Bola Tinubu administration marked two years in office, there are divergent views as to where the nation’s economy is actually headed. The Federal Ministry of Finance and the Federal Ministry of Budget and Economic Planning, who are the frontline drivers of the fiscal policies of the administration, have played central roles in implementing the administration’s fiscal reforms.

From restructuring the national budget framework to managing inflationary shocks and expanding revenue generation, these ministries have been at the heart of an economic transition whose impact continues to unfold across homes, markets, and industries.

As Nigerians continue to grapple with the ripple effects of subsidy removal, electricity tariff hike, a floating naira and persistent inflation, this report critically examines the fiscal performance of the Tinubu-led federal government over the last two years – focusing on verifiable policies, measurable outcomes and public accountability.

Announced during President Tinubu’s inaugural address on May 29, 2023, his first policy statement – the removal of fuel subsidy – marked a watershed moment in Nigeria’s fiscal history. Long seen as an unsustainable drain on public finances – reportedly costing over ₦4 trillion annually – the policy move was justified as a necessary step to free-up resources for development. However, while the subsidy removal arguably restored fiscal space and reduced government borrowing, the economic backlash was swift. Fuel prices surged by over 200 per cent, triggering an inflationary wave that pushed the national inflation rate above 33 per cent by early 2025, with food inflation exceeding 40 per cent. Transport and living costs rose sharply, squeezing households and businesses.

The Federal Ministry of Finance responded with about ₦500 billion palliative package aimed at cushioning the impact. Disbursements targeted vulnerable groups, micro-enterprises and transportation workers. However, rollout challenges, including issues of data integrity and unclear targeting mechanisms, meant many Nigerians felt little relief.

Despite these shortcomings, the authorities claim that the policy has saved the country over ₦6 trillion by mid-2025, according to budget records. Yet, critics argue that without simultaneous investments in local refining and mass transportation, the removal created more short-term pain than gain.

The MD/CEO of Macrostrat Nigeria Limited, Dr Justin Amase, said the upsides of the reforms are evidenced in forex rate stability (fragile though), increased oil production, service sector growth resilience, higher foreign investment inflows, growth in fiscal revenues, prospects for enhanced financial sector stability and funding capacity. Foreign exchange rate stability supported manufacturing and consumer-facing businesses that rely on imports for their operations.

Dr Amase argued that the ongoing banking and finance sector recapitalisation by the Central Bank of Nigeria (CBN) has increased the volume of capital market activities, making the Nigerian stock exchange one of the best performing in 2024, while the enhanced capital base of finance houses will create greater financial sector stability, reduce sector risk and strengthen their capacity to fund higher consumer credits and large risk assets tickets.

In 2024, the administration introduced the “naira-for-crude” policy to stabilise petrol supply and reduce the forex burden associated with fuel imports. Under this arrangement, local marketers were allowed to buy crude oil using the naira, with the aim of dampening pressure on the foreign exchange market.

The policy, jointly coordinated by the Ministries of Finance and Budget, helped ease petrol scarcity in the short term. However, industry experts raised concerns over its opacity and potential to create new rent-seeking opportunities. Without a market-determined pricing structure and proper audit trail, stakeholders warned that the programme risks becoming a backdoor subsidy.

The director-general of the Manufacturers Association of Nigeria (MAN), Segun Ajayi-Kadir, said the impact on the manufacturing sector has been especially severe. He claimed that companies spent N1.11 trillion on alternative energy in 2024, a 42 percent rise from the previous year.

Like most Nigerians, the incessant power outage largely due to frequent national grid collapse amid higher electricity tariff wheeled by inefficient distribution companies combined to make business operation more difficult in Nigeria. The major concern is that the increase in cost of electricity has not translated to improved power supply to boost economic activities.

“This remains a major concern,” MAN said in a recent report titled “MAN Economic Review for the Second Half of 2024.”

Nigeria’s electricity tariffs surged by over 200 percent for Band A consumers, significantly increasing manufacturing costs under the current administration.

“You can’t give it an excellent mark; I mean, you just can’t. I don’t feel like they’ve done too well on the economy,” the co-founder of BudgIT, Seun Onigbinde, said in an interview with BusinessDay, assessing the performance of the administration since its inauguration in May 2023.

He opined that the removal of gasoline subsidy has left many Nigerians in deep economic hardship.

“There was too much lag between when the subsidy was removed and when the palliatives came. It took more than a year to even approve the new minimum wage. Even till now, many states haven’t implemented it. The federal government itself is still struggling. See how much pressure that had to be applied for the NYSC to comply,” he said.

Perhaps, the most pressing challenge confronting fiscal authorities has been inflation management. With the cost of living rising sharply since 2023, the Ministry of Finance and the Ministry of Budget and Economic Planning had to work closely with the Central Bank of Nigeria to address structural drivers of inflation.

The Budget Ministry launched the National Inflation Management Framework in collaboration with state governments to boost agricultural production and fix supply chain inefficiencies. Targeted subsidies on fertilisers, grains and rural logistics were introduced, though impacts have been gradual. To that extent, the government also rebased its inflationary model to align with “best practices.”

Meanwhile, the country’s public debt profile worsened – from ₦77 trillion in mid-2023 to over ₦97 trillion in early 2025 – due largely to exchange rate depreciation and increased domestic borrowing. The 2024 and 2025 budgets allocated over 30 per cent to debt-servicing, raising alarms about fiscal sustainability.

Nonetheless, officials argue that the increased borrowings were channeled into infrastructure and social programmes with medium-term economic benefits.

One of the quiet achievements of the Tinubu administration has been its budget process reform. Under the leadership of Senator Atiku Bagudu, the Federal Ministry of Budget and Economic Planning adopted a more data-driven, multi-year planning framework.

The Medium-Term National Development Plan (MTNDP) 2021-2025 was aligned with the 2024 and 2025 budgets, both of which featured realistic oil production benchmarks and capital expenditure priorities. A major milestone was the digitalisation of budget planning and monitoring using the Government Integrated Financial Management Information System (GIFMIS).

However, implementation remains a weak link. Capital budget utilisation was 52 per cent in 2023 and improved marginally to 60 per cent in 2024 due to procurement delays, revenue underperformance and bureaucratic inefficiencies. While the ministries have committed to improving performance-based budgeting, they face an uphill task in reforming a decades-old system plagued by inertia.

Amid dwindling oil revenues and increasing obligations, the Ministry of Finance stepped up efforts to grow non-oil revenues. Central to this drive was the Presidential Fiscal Policy and Tax Reforms Committee, chaired by a tax expert, Taiwo Oyedele, which was tasked with cleaning up Nigeria’s fragmented tax system.

Between 2023 and 2025, the Federal Inland Revenue Service (FIRS) recorded its highest-ever collections – ₦12.5 trillion in 2024 – largely on the back of improved digital compliance, VAT collection and corporate income tax reforms.

Yet, proposals to increase excise duties on beverages and telecommunications met resistance from businesses and consumers alike. The implementation of some tax measures was suspended following public outcry, highlighting the difficulty of raising revenues without hurting a fragile economy.

Despite these tensions, the ministries have maintained their stance on the need to broaden the tax-base while reducing multiple taxation and harmonising levies across tiers of government.

In the same vein, the Nigeria Customs Service announced a boost in its revenue collection in the 2024 fiscal year. The agency’s revenue reached ₦6.1 trillion, representing a substantial rise compared to the ₦3.2 trillion recorded in 2023, a 90.4 per cent increase. The year also saw Customs exceeding its target of ₦5.07 trillion by ₦1.026 trillion, a 22 per cent increase, a feat that was attributed to the various reforms introduced under the present administration.

On the social front, the administration sought to protect vulnerable populations through an expanded social safety net. The Ministry of Budget and Economic Planning relaunched the National Social Investment Programme (NSIP), deploying over ₦200 billion in 2024 alone to support the poor.

New initiatives such as the National Skills Acceleration Programme (NSAP) also aimed to address youth unemployment by linking technical training to market demand.

However, recurring issues around duplication, politicisation and poor targeting undermined impact. Calls have intensified for a unified national social register and stronger monitoring and evaluation frameworks to ensure transparency and efficiency.

In line with global best practices, the Ministry of Finance resumed quarterly publication of budget implementation reports and launched a user-friendly “Citizens’ Budget” in 2024. These measures aim to improve fiscal transparency and encourage citizen engagement.

Nevertheless, loopholes in public procurement, off-budget expenditures and limited civil society oversight continue to pose serious governance challenges. While reform momentum is evident, experts argue that institutional capacity and political will must be strengthened to sustain transparency gains.

As the Tinubu administration enters its third year, its fiscal reforms present a mixed scorecard. The removal of fuel subsidy and push for non-oil revenue growth were bold and arguably necessary. Budget reforms and digital tax systems mark real progress. However, the social costs of the reform – especially in the form of inflation, rising debt and implementation gaps – remain significant.

The Ministries of Finance and Budget have shown initiative and ambition but structural inefficiencies, public distrust and global headwinds have complicated their mandate. Moving forward, many people believe that success will only depend on policy coherence, transparency and a focus on inclusive, human-centred development.

Whether this administration’s fiscal legacy will be remembered as a foundation for economic transformation – or an experiment in austerity without inclusion – will depend largely on how it responds to the realities of Nigerians in the years ahead.

In spite of what he described as positive impacts of the Tinubu reforms, Dr Amase said key headwinds from structural weaknesses such as huge infrastructural gap (especially power and transport), negative impact of insecurity on agricultural production and manufacturing, inflation which is expected to stay elevated above the 20 percent mark in 2025, volatile reserve buffers and foreign exchange rate, oil sector underperformance and weakening global oil prices, pose major downside risks to economic stability.

He also lamented that rising national debt and debt repayment obligations, declining agricultural production due to insecurity, increasing poverty and tight fiscal space with a huge revenue to expenditure gap, cloud the short to medium term growth outlook.

Given the above scenarios of the impact of President Tinubu’s reforms, he said the required growth policy focus for responding to these headwinds to achieve further economic recovery and drive higher growth momentum will be on rebalancing growth.

“This will be achieved through greater structural reforms aimed at improving the competitive environment in order to encourage greater domestic and foreign private sector investment inflows. The rebalancing from primary service sector-growth leadership to a private sector investment-driven growth model will create more sustainable growth momentum, diversify the economy and export revenues, bridge the huge infrastructure gap and create new jobs to reduce unemployment and grow income,” Amase said.