Analysts on the Nigerian stock market expect mixed sentiments on the market this week, as investors rotate their portfolios towards stocks with attractive dividend yields amid intermittent profit-taking activities.

They expect the mixed sentiment and recovery in the equity space to continue on the back of positive sentiments in the financial service stocks, blue chip companies and large cap equities on the strength of their impressive Q1 numbers so far, while market players look at fundamentally sound stocks and the prospect considering their sectors and current prices.

The prevailing low prices of many stocks due to price adjustments for dividend has made them attractive for new entry and repositioning of portfolios in the midst of high inflation and improving economic activities, despite the high cost of funds.

Analysts Optimism

Analysts at Cordros Securities Limited said: “looking ahead, we expect investors to rebalance their portfolios based on an assessment of corporate earnings released for Q1, 2023. Nevertheless, increased FI yields may continue to constrain buying activities.

“Thus, we expect market performance to remain mixed in the week ahead as investors rotate their portfolios towards stocks with attractive dividend yields amid intermittent profit-taking activities. Overall, we advise investors to take positions in only fundamentally justified stocks as the weak macro story remains a significant headwind for corporate earnings.”

In the week to come, analysts at Cowry Assets Management Limited expected to see mixed sentiment on profit taking and reaction to dividend earning season, as more Q1 earnings hit the market while investors target sound defensive stocks to protect their portfolios post-markdown dates. However, we continue to advise investors to trade on companies’ stocks with sound fundamentals and a positive outlook.

Meanwhile, analysts at Afrinvest Limited said: “in the coming week, we expect the positive performance to persist as investors cherry-pick stocks with sound fundamentals.”

Last Week’s Trading Activities

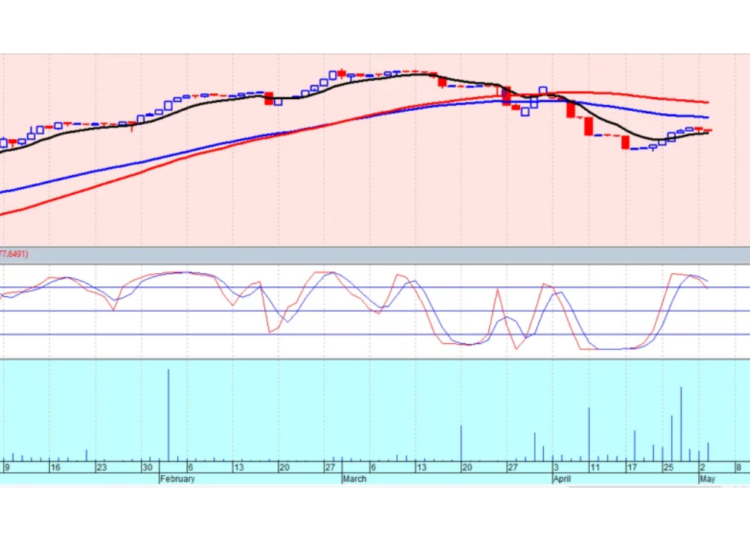

The local bourse continued its recent resurgence as the All-Share Index rose 0.12 per cent week-on-week (W-o-W) to close at 52,465.31 points. As a result, market capitalisation expanded by N34 billion to close the week at N 28.568 trillion.

Across the sectors last week, performance was bullish with the NGX Banking index recorded a weekly gain of 5.23 per cent. NGX Oil & Gas index rose by 5.08 per cent, while NGX Insurance index up by 3.08 per cent for the week.

NGX Industrial Goods index gained 0.09 per cent and NGX Consumer Goods index appreciated by 0.02 per cent W-o-W.

The market breadth for the week was positive as 51 equities appreciated in price, 26 equities depreciated in price, while 79 equities remained unchanged. CWG Plc led the gainers table by 25.71 per cent to close at N1.32, per share. Academy Press followed with a gain of 20.00 per cent to close at N1.74, while Wema Bank went up by 16.58 per cent to close to N4.43, per share.

On the other side, Transnational Corporation led the decliners table by 30.96 per cent to close at N1.94, per share. McNichols followed with a loss of 17.72 per cent to close at 65 kobo, while Geregu Power declined by 10.00 per cent to close at N290.70 per share.

Overall, a total turnover of 2.973 billion shares worth N22.828 billion in 23,765 deals was traded last week by investors on the floor of the Exchange, in contrast to a total of 14.029 billion shares valued at N59.007 billion that exchanged hands previous week in 24,048 deals.

The Financial Services Industry (measured by volume) led the activity chart with 1.458 billion shares valued at N14.082 billion traded in 13,115 deals; contributing 49.04 per cent and 61.69 per cent to the total equity turnover volume and value respectively. The Conglomerates Industry followed with 1.254 billion shares worth N3.123 billion in 1,662 deals, while the Consumer Goods Industry traded a turnover of 71.425 million shares worth N1.468 billion in 3,177 deals.

Trading in the top three equities; Transnational Corporation, Access Holdings and Fidelity Bank, (measured by volume) accounted for 2.074 billion shares worth

N11.297 billion in 5,966 deals, contributing 69.76 per cent and 49.49 per cent to the total equity turnover volume and value respectively.

We’ve got the edge. Get real-time reports, breaking scoops, and exclusive angles delivered straight to your phone. Don’t settle for stale news. Join LEADERSHIP NEWS on WhatsApp for 24/7 updates →

Join Our WhatsApp Channel