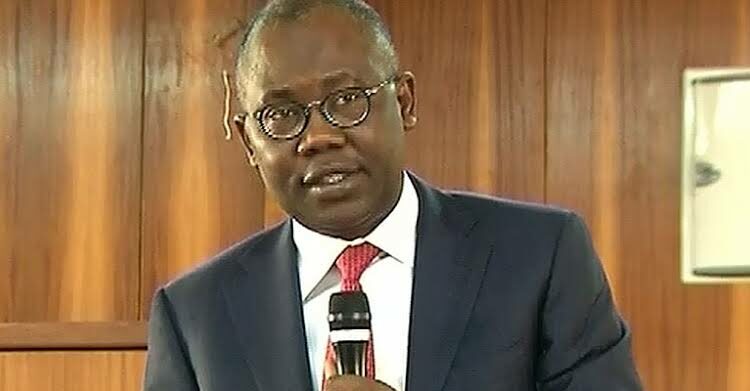

Justice Inyang Ekwo of the Federal High Court, Abuja on Friday upheld the “no case” submission by former Attorney-General Of The Federation and Minister of Justice, Mohammed Adoke, on charges bodering on money laundering.

The Economic and Financial Crimes Commission (EFCC) had in 2017 charged Adoke and Abubakar Aliyu, a property developer, alleging money laundering to the tune of N300 million.

While the EFCC admitted before Justice Ekwo, that the money was a mortgage Adoke took from Unity Bank, it however alleged before Justice Suleiman Kutigi of the FCT High Court that it was a bribe from the sale of the Oil Block by Malabu Oil & Gas Ltd in 2011.

On March 28, 2024, Justice Kutigi pointed out the contradiction, while dismissing the charges against Adoke and other defendants while chiding the anti-corruption agency for wasting the court’s time for four years.

In his own ruling on Friday morning, Justice Ekwo said the EFCC did not provide any evidence to prove the essential elements of the offence against Adoke, who was listed as the first defendant.

The court therefore upheld the no case submission, discharging and acquitting Adoke.

However, Ekwo ruled that Aliyu, the second defendant, has to open his defence because he has a case to answer on some of the charges against him.

After the EFCC closed its case against Adoke and Abubakar in November 2023, both had made a no-case submission, asking the Federal High Court to dismiss the charges because the commission did not establish a case.

Adoke described the charges as “baseless and frivolous”.

In 2011, Adoke had taken a mortgage of N300 million from Unity Bank to buy a property valued at N500 million from Abubakar.

However, he failed to pay his own equity contribution of N200 million and the mortgage was cancelled in 2013.

Abubakar said he returned the N300 million to Unity Bank after finding a new buyer — the Central Bank of Nigeria (CBN).

But in 2017, the EFCC accused Adoke of handing the dollar equivalent of N300 million to Rislanudeen Mohammed, then acting Managing Director of Unity Bank, to refund the loan.

The Commission described this as a breach of money laundering laws as it was above the N10 million threshold allowed, arguing further that a bureau de change (BDC) — which the bank used to convert the dollar to naira — is not a financial institution.

The EFCC also accused Adoke and Abubakar of conspiring to commit the offence of money laundering.