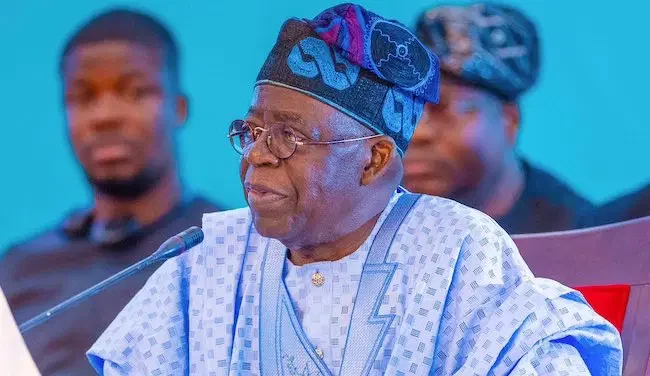

The National Assembly has approved President Bola Tinubu’s request to raise $2.347 billion from the international capital market to part-finance the 2025 budget deficit and refinance maturing Eurobonds.

The approval followed the consideration and adoption of a report presented by the chairman of the House Committee on Aids, Loans, and Debt Management, Hon. Abubakar Hassan Nalaraba (APC, Nasarawa), at plenary on Wednesday.

The committee’s report indicated that the borrowing plan is split into two components — $1.23 billion to fund the 2025 budget deficit and $1.12 billion to refinance Nigeria’s Eurobond maturing in November 2025.

The committee stated that the facility would be sourced from the international capital market through Eurobond issuance, loan syndication, bridge financing, or direct borrowing from multilateral institutions.

In adopting the committee’s recommendations, the House gave the Federal Government the nod to implement the external borrowing component of the 2025 Appropriation Act, amounting to N1.84 trillion (approximately $1.23 billion) at a budget exchange rate of N1,500 to a dollar.

The Green Chamber also approved the issuance of Nigeria’s first-ever Sovereign Sukuk of up to $500 million in the international capital market — a landmark initiative designed to attract Islamic-compliant investors and diversify the country’s external borrowing instruments.

Presenting the report, Nalaraba explained that the request was in line with Section 41(1A) of the Fiscal Responsibility Act, 2007, which allows government borrowing for capital expenditure and human development, provided the loans are used prudently and remain within sustainable limits.

He said the committee, after deliberations with relevant agencies including the Ministry of Finance, the Debt Management Office (DMO), and the Central Bank of Nigeria (CBN), was satisfied that the proposed loans were necessary to bridge the gap between projected revenue and expenditure while ensuring that Nigeria meets its existing debt obligations as they mature.

“The borrowings are within the limits of our debt sustainability threshold and will not push Nigeria into a debt distress category,” Nalaraba told lawmakers. “Instead, they are meant to refinance maturing debts and provide liquidity for the 2025 fiscal year, ensuring that government obligations are met without disruption,” the lawmaker added.

President Bola Tinubu sent a request to the House early this month seeking approval to access aggregate external capital of $2.347 billion

This comprised New External borrowing of N1.843 trillion, at the budget exchange rate of $1.00/N1,500.00, in the 2025 Appropriation Act for the part-financing of the budget deficit and refinancing of $1.118 billion Eurobonds.

Tinubu, in a letter to Speaker Abbas Tajudeen, also sought the House’s resolution to approve the issue of a stand-alone debut Sovereign Sukuk of up to $500m in the ICM with or without credit enhancement (Guarantee).