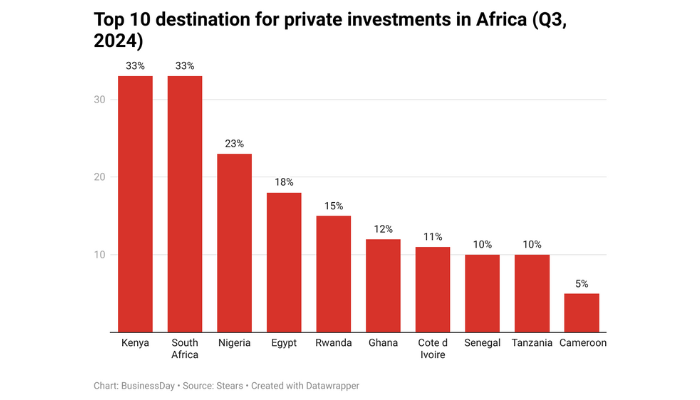

Nigeria attracted only 23 per cent of private capital in the third quarter (Q3) of 2024, significantly trailing South Africa and Kenya, which each captured a third of all private market deals, according to a latest report by Stears, a financial data and software company focused on African markets.

This decline is attributed to economic policies that have exacerbated inflation and currency volatility, prompting over 15 companies to exit Nigeria in the past 17 months.

In contrast, single-country investments surged, particularly in agriculture and consumer goods, highlighting a shift towards localised growth opportunities in more stable markets like South Africa and Kenya.

The “Private Capital in Africa Report” revealed that while Nigeria led the West African region, accounting for 71 per cent of market transactions, it was lower than Egypt’s 93 per cent, Kenya’s 80 per cent and South Africa’s 73 per cent.

“South Africa and Kenya were standout performers, each accounting for a third of all private market deals in Q3,” the report stated.

This is as private capital investment across Africa in the third quarter of 2024 recorded a combined value of $2.27 billion of which equity investment dominated debt, the Stears report noted.

The ‘Stears Private Capital in Africa Report for Q3 2024’ disclosed that out of the 73 recorded private market deals, equity was the most preferred choice.

Many economists and analysts have attributed the decline in the investment appetite of private capital into the Nigerian market to the raft of policies implemented last year which has worsened inflation and put the exchange rates at its most volatile state.

Not less than 15 companies had exited the country in the past 17 months, citing fluctuation of the exchange rate and inconsistent government policies as reasons for living.

Nigeria embarked on some series of reforms last year among which was the flotation of its currency, allowing the local unit to be driven by market fundamentals.

But the reforms have led to a steep decline in the currency which has shed over 80 per cent of its value since June last year.

On the flip side, the report showed that 64 per cent of recorded private market deals in Q3 2024 were single-country investments, reflecting investor attention on localised opportunities within Africa’s dynamic markets.

However, South Africa, Egypt and Kenya, which are among the top 10 economies in Africa, accounted for 60 per cent of all single-country transactions during the quarter.

Single-country investments refer to investments where the target company only operates in one market.

According to the statement , South Africa led single-country transactions, contributing nearly one-third of all single-country deals, followed by Egypt and Kenya, parting with 17 per cent each.

It also noted that agriculture was the most localised sector, with 91 percent of deals involving single-country investments, underscoring the sector’s reliance on domestic markets and its critical role in regional food security.

The report stated that the consumer goods sector also showed strong localisation, having 69 percent of its transactions focused on single-country operations. This highlights the growing relevance of domestic consumption markets.

In contrast to localised investments, multi-country transactions were more prevalent in sectors like energy and financial services, where regional scale and integration drive growth.

“Our findings emphasise the importance of single-country investments as a cornerstone of Africa’s private capital landscape,” head of research and co-founder at Stears, Michael Famoroti, said.

“This trend reflects a strategy toward tapping into localised growth potential while balancing risk within defined markets.”

Stears noted that the trend in single-country investments may signal a growing appetite for targeted opportunities that cater to the unique strengths and needs of individual African markets.

This trend, it said, also aligns with the increasing ability of countries like South Africa and Kenya to attract and sustain private capital flows through enabling environments for localised growth.

“75 per cent of the transactions included an equity component, with 71 per cent being strictly equity-based, compared to 19 percent utilising debt.”

The report shows that consumer goods and technology were the sectors that led equity investments by 86 percent and 90 percent, respectively.

“An exception in the Technology sector was Terrapay’s $95 million loan package aimed at expanding its African operations,” it said.

The African-focused data platform highlighted that the financing, sourced from OP Finnfund Global Impact Fund I, Belgian BIO ($30 million), International Finance Corporation ($30 million), impact investor ILX ($15 million), and the UK’s BII, reflects the growing interest in supporting digital infrastructure across the continent.

However, for debt financing, agriculture and energy top the sectors with the most investment, which together accounted for 79 per cent of recorded debt deals—more than double their contribution to all private capital transactions (33 per cent).

A further breakdown of the report revealed that equity-focused deals were particularly dominant in North and Southern Africa.

“North Africa led with the highest share of deals featuring an equity component at 86 percent, while Southern Africa recorded the largest proportion of equity-only transactions at 79 percent,” it said.