Goldman Sachs has predicted oil price going up to $100 again, citing lower production output from the Organisation of Petroleum Exporting Countries(OPEC) combined with higher demand, which taken together, “more than offset significantly higher U.S. supply.”

The average gas price in the U.S. on September 20 was $3.875, slightly lower than a day earlier but $0.20 higher than a year ago.

Even with higher gas prices, EV purchases have slowed down instead of rising.

In Europe, the deindustrialization of Germany is no longer news, the car industry is bracing for a Chinese EV rush, and Brussels is trying to build an energy transition supply chain from scratch.

Meanwhile, offshore wind developers are cancelling projects in both Europe and the U.S., solar developers in the EU are complaining about cheap Chinese panels.

Also, oil and gas companies keep reporting meaty profits and investors are rediscovering their love of hydrocarbons.

At the recent World Petroleum Congress (WPC), in Calgary, oil executives and government officials both warned against the continued push to discourage investment in new hydrocarbon production.

“There seems to be wishful thinking that we’re going to flip a switch from where we’re at today to where it will be tomorrow,” Exxon’s chief executive said, during the event.

“No matter where demand gets to, if we don’t maintain some level of investment industry, you end up running shorter supply which leads to higher prices,” Darren Woods also said.

“This is exactly what we are currently witnessing in Europe and the United States. Because of the transition push, oil producers are being extra cautious with production growth.

“Also, they are prioritising shareholder returns to keep shareholders on, so it pays for them to be cautious.

In Europe, the supermajors are being squeezed by windfall profit taxes, activist pressure, and increasingly restrictive legislation, so they are turning elsewhere.

Shell is tapping billions of potential barrels in Namibia, and Total is considering a $9-billion commitment to oil exploration in Suriname.

Meanwhile, drivers across Europe are struggling with higher fuel costs and higher electricity bills as the EU becomes increasingly dependent on intermittent wind and solar that need backup from hydrocarbon-fueled power plants.

These plants are taxed heavily for their carbon emissions, which has pushed the cost of their output and electricity bills higher.

All of this is only going to get worse before it gets better. Because despite a growing number of signs that the transition is not going according to plan, those in the driver’s seat are doubling down on every single commitment.

The offshore wind energy industry is essentially on its deathbed, yet there has been no change of attitude from governments. The most likely thing they would do about its problems will probably be even more subsidies instead of a reconsideration of the role offshore wind would play in the transition.

In EVs, dealers are struggling with rising inventories in the U.S., and Ford said recently it was going to book a $4.5 billion loss on its EV business.

In Europe, sales are up strongly, but carmakers are fretting about Chinese EVs, which are just as good as theirs but cheaper.

Solar energy is doing great in the U.S., set for record growth of 32 GW this year, “helped by investment incentives under the Inflation Reduction Act,” Reuters reported recently.

It appears nobody really cares what happens when the sun goes down over all those gigawatts. Battery storage is far behind solar in terms of capacity.

Solar is doing great in the EU, too, also thanks to heavy subsidies, only there is a shortage of qualified installers, and local panel producers are grumbling against Chinese imports that are, according to the industry, killing them.

So the EU recently essentially declared a selective trade war on China through the mouth of EC president Ursula von der Leyen. China warned there would be consequences at a time when the country has become a major exporter of fuels to Europe thanks to the Russian fuel embargo.

The price of energy is going to continue higher in both Europe and the U.S. All because of an ill-conceived transition away from hydrocarbons.

Meanwhile, Nigeria’s oil output could increase to 2.1 million barrels per day by December 2024 after the country secured $13.5 billion in investment pledges over the next twelve months from oil majors.

The companies agreed to invest a total of $55.2 billion by 2030 – including the $13.5 billion over the next twelve months – to lift crude production, according to a statement from the president’s office.

Nigeria’s oil output stood at 1.18 million bpd in August 2023, according to the Organisation of Petroleum Exporting Countries (OPEC), meaning production would nearly double by the end of next year.

Nigeria is the top oil producer in Africa but large scale oil theft has over the years cost the country billions of dollars, while dwindling investment in the sector has also curtailed output.

The losses from theft and a lack of new projects have reduced oil exports sharply, eroding foreign currency earnings in Africa’s biggest economy.

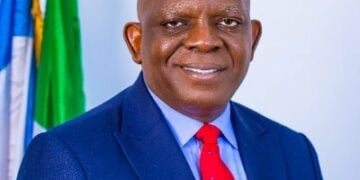

President Bola Tinubu has previously pledged to raise the country’s oil production to 2.6 million bpd by 2027, and the investment commitments could help deliver his promise.

The proposed investments are also expected to lead to a 100 per cent increase in gas production by 2027, exceeding Tinubu’s campaign pledge of 20 per cent growth in that time, the statement said.

Tinubu’s special adviser on energy, Olu Verheijen and the Nigerian Upstream Petroleum Regulatory Commission, held meetings with fifteen foreign and domestic oil and gas companies operating in Nigeria to secure the investments.

Chevron, Total, Shell, Exxon Mobil, Seplat, Heirs Holdings, Waltersmith, First E&P, were among the oil companies that took part in the meetings, the statement said.

“We are faced with a revenue crisis which is impacting all Nigerians,” Verheijen said in the statement.

“Tinubu is actively seeking ways to grow revenue and forex to stabilise our economy and currency; and the oil and gas sector remains critical to our ability to do so despite current production levels falling significantly short of our potential.”

We’ve got the edge. Get real-time reports, breaking scoops, and exclusive angles delivered straight to your phone. Don’t settle for stale news. Join LEADERSHIP NEWS on WhatsApp for 24/7 updates →

Join Our WhatsApp Channel