As rising inflation continues to ravage Nigerians, the poor, who constitute the majority, are settling for cheaper products and services as they try to deal with declining purchasing power.

Inflation is the rate of increase in prices over a given period of time. It can also be described as a rise in prices, which can be translated to the decline of purchasing power over time.

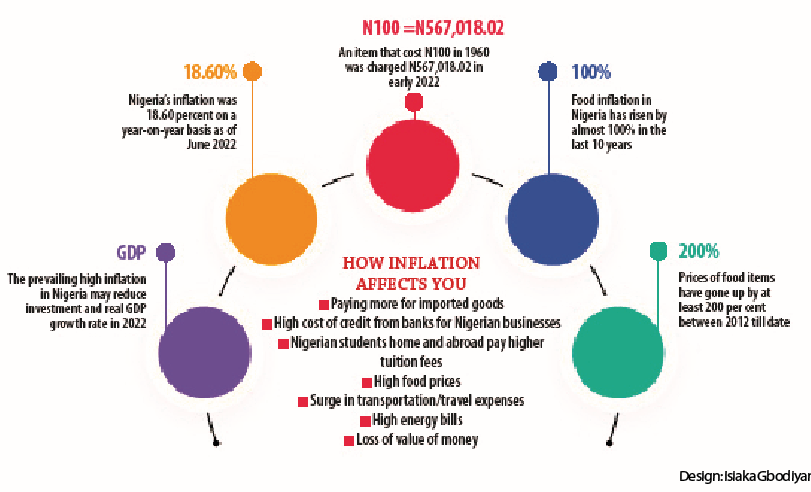

The National Bureau of Statistics (NBS) says Nigeria’s headline inflation rate increased to 18.60 per cent on a year-on-year basis as of June 2022.

The percentage change is the highest in the last five years, according to the records.

Findings by LEADERSHIP Data Mining Department revealed that the cost of purchasing products and services required to maintain a given quality of life continues to be a major worry for many families and individuals in the country.

Nigerians are finding unique ways to cope with the rising cost of goods and services that have eroded their purchasing power. According to experts, people are adjusting to the situation by switching from more expensive products and services to less expensive alternatives when prices rise or income declines.

A business consultant, Joseph Liadi, said when the consumers do not have enough money in their pockets, they will be making choices not based on what they prefer but according to the deepness of their pockets.

Corroborating the view above on the harsh impact of the economy on consumer’s disposable income, a civil servant, Abigail Michael-Paul, said because of the overall rise in the prices of goods and services generally, she has learned to cut his cloth according to his material by obeying the law of scale of preference.

‘‘There is now a conscious effort to manage things like hair cream, perfumes, and skin care products so they can last a very long time.

“The current inflation has practically forced me to be very frugal with money. I use public transport, and do Uber occasionally, I walk distances where I would probably take a bike on a regular day. Because of the drop in currency value as a result of inflation, if there is a need to change my mobile phone or gadgets, I now buy the U.K.-used one. I now have to compare different data plans to see the one that offers more internet data and bonuses at a relatively cheap cost.”

Another consumer in Abuja, Malik Abdullahi, said, “Due to the rising inflation, I have reduced the quantities of the things we buy at home and go for the cheaper alternatives even if the quality is low.

“Inflation rate is affecting everything in Nigeria. Data prices, transportation fares, school fees and stationeries for children – everything has gone up. Recently, I had to change school for my children to the one I can afford,’’ he said.

He also said that food prices, in particular, have risen.

“The price of a bag of rice went from N12,000 to N28,000, a carton of chicken soared from N12,000 to N20,000, a bag of pepper rose from N15,000 to N22,000. The varying pricing of items allows us to choose other goods that are less expensive,’’ he added.

Also, a builder, Joshua Gata, said the cost of building items was the most impacted by inflation.

According to him, ‘‘A bag of cement we were buying for N2,600 climbed to N3,900 in just two years.”

A factory supervisor, Samuel Udoh, said he is now more prudent and buys only what he needs, to avoid waste. Mrs Abiola Ojo, a housewife based in Mokola, Ibadan, Oyo State, said since the inflationary rate became unbearable, she, in agreement with the other family members, have now re-strategised the modus of shopping, as former necessities have become luxury. Also, Aliyu Musa, a driver, shared the same sentiment. “I can’t kill myself. I buy what I can buy,” he said.

A finance expert, Ebuka Chukwu, said that during high food prices, one of the ways to cope is to eat at home.

He said, “Dining out is an expensive proposition. Many of the meals that you pay for in a formal restaurant can be made at home for a fraction of the price. Anyone who has been to the shops lately, whether to buy groceries or other things, will attest that prices of goods have risen sharply and there is no corresponding increase in salaries and income.

“Bread, which is the most common food in Nigeria, is now so expensive that it is almost beyond the reach of regular folks. Cost of road transportation has also risen. Air travel is now almost beyond reach of many. Airlines are charging over N100,000 for one-way tickets to most destinations within Nigeria. Road travel which should be the next option comes with its own risks – bad roads and threat of kidnap.’’

A lady, who craved anonymity, said she had sent her two children to go and stay with her mother in-law, knowing that the mother in-law will never allow them to starve.

According to Timi Olubiyi (Ph.D.), the Coronavirus (COVID-19) pandemic, as well as the economic turbulence has had significant impacts on businesses, manufacturers and households, including individual lifestyles and well-being in recent times.

‘‘The direct consequence of these impacts has been a very large increase in inflation numbers in the country, and it is currently having serious implications. Nigeria is one of the countries where inflation has grown the fastest, and it has been a concern for many businesses and the government due to its severe impact post-COVID-19.

‘‘So, in a time of high inflation and low consumer spending, cheaper substitutes and second-hand (used) items) are the alternatives that are available. The high inflation rate in the country is one of the major reasons why Naira is losing value. Therefore, the government should make a deliberate effort to tackle the key issues in the country: insecurity, incessant power issues, continued exchange rate instability, and non-availability of forex to genuine business operators and exporting companies. Inflation could remain an issue unless these issues are given prime attention.”

Research shows that the inflation rate for consumer prices in Nigeria moved over the past 61 years between -3.7% and 72.8%. For 2021, an inflation rate of 17.0% was calculated. During the observation period from 1960 to 2021, the average inflation rate was 16.1% per year.

Overall, the price increase was 566,918.02 %. An item that cost N100 in 1960 went for N567,018.02 in the beginning of 2022.

LEADERSHIP reports that globally, no country is immune to inflation. Around the world, inflationary pressure has been experienced in the USA, the UK, and many other developed and developing nations. But in Nigeria, experts said the peculiarity is that inflation has been getting higher steadily for the last two years. The experts said inflation growth has been the macro-economic problem in Nigeria that seems to be intractable over the years.

Nigeria’s inflation rate spiked to an 11-month record high in May

2022, hitting 17.71% and representing its fourth consecutive monthly rise in the year, with energy and food prices rising to record levels.

The world is currently battling with unprecedented levels of high inflation rates, triggered by the Russia-Ukraine crisis, which has caused a significant hike in energy prices and, by consequence, a spike in the price of food and services. The United Kingdom is currently dealing with a 40-year inflation rate of 9.1%, Germany’s inflation rate soared to 7.9% in May 2022, Ghana’s rate peaked to an 18-year high of 27%, all as a result of the global trend caused by rising crude oil prices, and sanctions on Russia’s trade, amongst others.

An economist, Femi Alayande, told LEADERSHIP that while Nigeria’s inflationary pressure cannot be isolated from the global energy crisis, food supply shocks and global inflationary uptrend, the country seems to be bearing the brunt of the rise in commodity prices.

He said that high inflation basically erodes the purchasing power of the citizens and affects all areas of spending. He urged Nigerians to cut down on unnecessary expenses, get smart with budgeting and invest in equities for long-term goals.

He said, ‘‘The prevailing high inflation in Nigeria is eroding the value of money, which is likely to reduce investment and the real GDP growth rate in 2022. Many Nigerians are passing through acute pain as they can no longer eat twice daily due to high commodity prices. Many Nigerians now buy lesser quantities of consumables due to the prevailing high prices in the market.

“High inflation is killing the economy, and Nigerians need to be saved from the imminent collapse of the economy. Annual inflation rate in Nigeria accelerated for a fifth straight month to 18.6% in June of 2022, the highest rate since January of 2017, and compared to 17.7% in May.

‘‘Food inflation in Nigeria has risen by almost 100% in the last 10 years, moving from 11.1% in December 2012 to 20.6% in June 2022.

Prices of food items such as rice, beans, bread, yam, vegetables, fruits and eggs have grown exponentially due to the rising rate of food inflation which have all gone up by at least 200 per cent between 2012 till date.’’

How does inflation affect Nigerians?

According to Alayande, ‘‘Nigerians will be paying more for imported goods as a result of the high exchange rate. Nigerian businesses will get credit from banks at a higher rate because of a hike in interest rates. Nigerian students, home and abroad, are likely to be paying higher tuition fees. There are

already high food prices and a surge in transportation/travel expenses. Energy bills are rising and there is less money value.’’