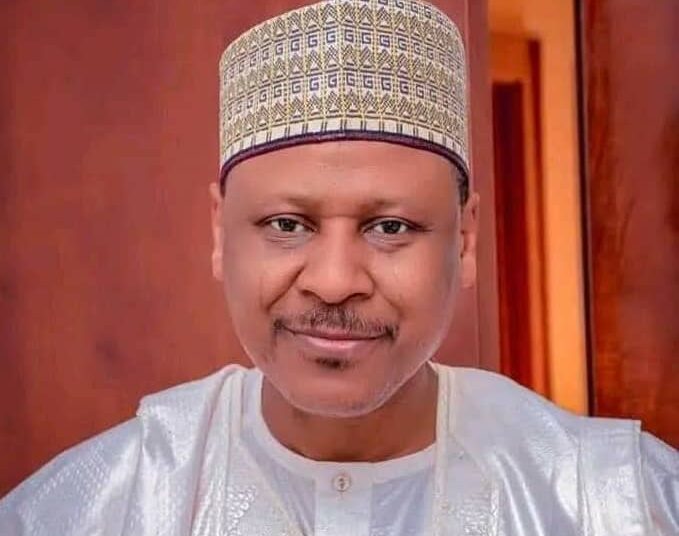

The minister of Information and National Orientation, Mohammed Idris, has said the nation’s tax administration system was long overdue for reforms on account of the general attitude of taxpayers on taxation, among others.

The minister’s remark was sequel to various arguments for and against the proposed tax reform bills before the National Assembly (NASS) for consideration.

He stated this as the chairman of the 2024 Annual Public/AGM and Awards organised by the Kaduna State chapter of the Nigerian Institute of Public Relations (NIPR) themed, “Tax Reform: The Role of Public Relations in Fostering Constructive Dialogue for National Economic Renaissance.”

He said the theme has brought to the fore yet again the place of constructive dialogue as a vital pillar of democracy noting that the ongoing review of the country’s tax laws is timely and crucial, especially as part of a larger set of macroeconomic reforms.

The minister commended the Presidential Committee on Fiscal and Tax Reforms for doing an excellent job in terms of public engagement.

Idris said, “The topic before us today is a sensitive yet important and inescapable one: taxation. It was the American statesman, Benjamin Franklin, who famously said that ‘in this world, nothing is certain except death and taxes.’

“Let me make it clear that, even with our keenness for fundamental reform of Nigeria’s governance and fiscal systems, the Tinubu administration will never do anything to undermine the ideals of participatory democracy. The current mandate and responsibility that we have for governing and reforming Nigeria at this time came by way of democracy, and we will continue to live up to those very high democratic standards and expectations.

“All over the world, effective taxation is important as a source of financial power for governments to provide social services for their citizens. However, there are several reasons to believe and assert that Nigeria’s tax administration system has become long overdue for reforms on account of design and implementation flaws as well as the general attitudes of taxpayers toward taxation.

“In the light of this, the ongoing review of the country’s tax laws and realities is timely and crucial, especially as part of a larger set of macroeconomic reforms aimed at setting the country on an irreversible path of growth and development. The full details of the new tax bills are available in the public domain – one must commend the Presidential Committee on Fiscal and Tax Reforms for an excellent job in this regard, in terms of public engagement – so, I will not attempt to go over these details again here.

“What I will say is that it is very inspiring and heartwarming to see Nigerians from all walks of life coming out to express their views and opinions on these matters of critical national importance and such is the very essence and meaning of democracy. In spite of the challenge of trust deficit that tends to crop up around matters of governance in Nigeria, we have still been able to have what can be adjudged as robust debate on this sensitive issue.”

The minister said taxation is a crucial tool for funding governance and public services but acknowledged persistent challenges in Nigeria’s tax system, including structural flaws and resistance from taxpayers.

He also assured stakeholders that the Tinubu administration was dedicated to addressing public concerns regarding tax reforms.

“We are all in this together. The sacrifices we make collectively will lead to social and economic benefits for all Nigerians,” he added.

On his part, NIPR president, Dr Ike Neliaku, stressed the importance of collaboration in addressing misconceptions about tax policies.

He said, “Unless we all sit down to discuss this matter, people may not understand where the government is going, and the government may not understand the intentions of its citizens. This dialogue platform is a means to ventilate opinions, clarify intentions and chart a mutually beneficial path forward.”

Similarly, the chairman of the NIPR Kaduna Chapter, Haroun Malami, emphasised that tax reform is not just about policy but also about people.

“It’s about creating a narrative that resonates with citizens, businesses and stakeholders. It’s about fostering constructive dialogue that builds trust, promotes understanding and encourages participation,” he said.

Also, the deputy director and head of Treaties and International Tax Policy Division at the Federal Internal Revenue Service (FIRS), Mr Kehinde Victor, shed light on the technical aspects of the bills.

He explained that the proposed legislations seek to repeal certain Acts on taxation, consolidate the legal frameworks related to taxation and enact the Nigerian Tax Act. The Act would govern taxation of income, transactions and instruments.

He also pointed out key features of the bill, including the elimination of minimum tax on loss-making companies. The introduction of a “top-up tax” to ensure a 15 per cent effective tax rate for multinational and large domestic companies.

Also, the lead discussant, Professor Mustapha Muhammad gave insights into the advantages of the reform while the panelists who included Senator Shehu Sani, Prof Cosmos Eze and Prof Hauwa’u Evelyn Yusuf endorsed the proposed tax reform.

Renowned Islamic scholar, Sheikh Ahmad Gumi and former chairman of the Christian Association of Nigeria (CAN), Kaduna State, Rev John Joseph Hayab, both argued that the tax reform was necessary, but called for more awareness creation and sensitisation.