Analysts expect the Nigerian stock market to continue on similar dynamics as in the previous week as investments will be shaped by the ongoing third quarter (Q3) results.

The market extended its bullish run last week, on the back of favourable sentiment and strong liquidity inflows. This positive performance, underpinned by increased investor confidence and active buying interest, highlights an optimistic outlook on the country’s economic fundamentals and key market indicators.

Analysts Optimism

Analysts at Cowry Assets Management Limited pointed that the recent positive quarterly corporate earnings reports have further buoyed market sentiment, particularly in the banking, industrial goods, and consumer goods sectors, delivering strong performances from key players and driving the benchmark index closer to the 100,000-points psychological threshold.

“Notably, we think the current rally is likely to persist, though cautious profit-taking activities may create intermittent dips. Looking ahead, we see the local bourse poised for further gains as investors look forward to the upcoming macroeconomic data releases and corporate earnings reports, which are anticipated to influence short-term trading dynamics,” Cowry stated.

The chief operating officer of InvestData Consulting Limited, Ambrose Omordion said that “we expect positive sentiment and mixed trend to continue on profit taking and positioning, ahead of more Q3 earnings reports. Also, sector rotation and portfolio rebalancing continue in the market, with investors taking advantage of pullbacks to buy into value.”

Last Week’s Trading Activities

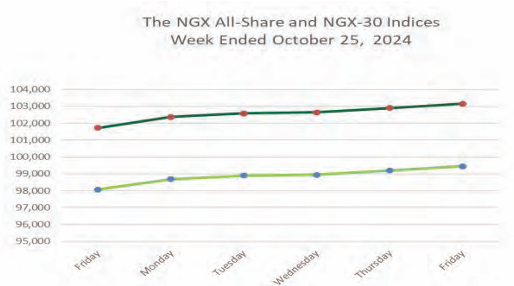

Over the trading week, market participants engaged in strategic investments, boosting the Nigerian Exchange (NGX) All-Share Index by 1.41 per cent to close at 99,448.91 points. Similarly, market capitalisation gained N835 billion to close the week at N60.261 trillion.

Sectoral performance last week was overwhelmingly positive, with gains seen across all major indices except the NGX Consumer Goods index, which declined by 0.84 per cent. In contrast, the NGX Banking Index emerged as the week’s top performer, posting a 7.86 per cent week-on-week increase.

NGX Insurance Index recorded a weekly gain of 4.04 per cent, the NGX Oil & Gas index also recorded 3.95 per cent gain, while NGX Industrial index posted a gain of 0.1 per cent for the week.

The market breadth for the week was positive as 58 equities appreciated in price, 18 equities depreciated in price, while 76 equities remained unchanged. Eunisell Interlinked led the gainers table by 20.69 per cent to close at N3.50, per share. United Bank for Africa (UBA) followed with a gain of 18.50 per cent to close at N30.10, while Unilever Nigeria went up by 18.42 per cent to close to N22.50, per share.

On the other side, Dangote Sugar Refinery led the decliners table by 10.13 per cent to close at N31.50, per share. John Holt followed with a loss of 9.84 per cent to close at N2.75, while Secure Electronic Technology declined by 9.68 per cent to close at 56 kobo, per share.

Overall, a total turnover of 2.142 billion shares worth N85.946 billion in 41,217 deals was traded last week by investors on the floor of the Exchange, in contrast to a total of 1.447 billion shares valued at N73.889 billion that exchanged hands prior week in 39,546 deals.

The Financial Services Industry (measured by volume) led the activity chart with 1.176 billion shares valued at N23.739 billion traded in 19,570 deals; contributing 54.91 per cent and 27.62 per cent to the total equity turnover volume and value respectively. The Consumer Goods Industry followed with 366.923 million shares worth N4.672 billion in 4,004 deals, while the Oil and Gas Industry traded a turnover of 228.439 million shares worth N52.635 billion in 7,547 deals.

Trading in the top three equities; UBA, Champion Breweries and Japaul Gold and Ventures accounted for 828.822 million shares worth N12.319 billion in 5,080 deals, contributing 38.70 per cent and 14.33 per cent to the total equity turnover volume and value respectively.