You’re just seconds away from sending money — the offer sounds perfect, the seller seems trustworthy, and the clock is ticking. But just before you hit send, OPay flashes a critical warning:

“Caution — this account has been linked to suspicious activity.”

In that moment, the rush fades, your instincts kick in, and you realize you were on the brink of falling for a scam. One smart alert, one timely pause — and your hard-earned money stays exactly where it should: safe.

This is the power behind OPay’s multi-layered scam alert system — an AI-driven, real-time defense network designed to detect and stop fraudulent transactions before they happen. At the heart of it is a machine learning engine trained on thousands of scam patterns, user reports, flagged accounts, and unusual transaction behaviors. But OPay’s approach goes far beyond a single alert.

How OPay’s Scam Alert Ecosystem Works:

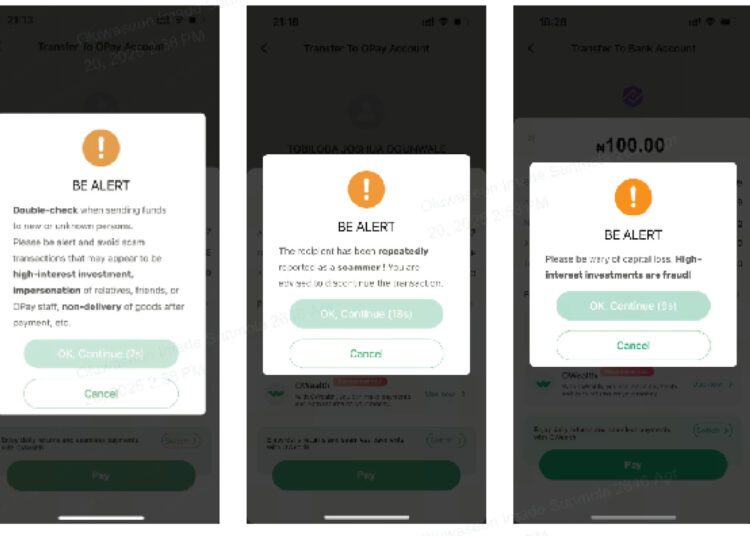

1. Abnormal Transaction Pop-Up Reminders

When suspicious behavior is detected, OPay immediately interrupts the flow with a clear, targeted pop-up message. Every day, over 60,000 users receive these urgent fraud warnings — and thanks to that, 30,000 risky transactions are stopped in their tracks.

2. Intelligent Outbound Call Reminders

For higher-risk transactions, OPay activates a multi-channel response: sending warnings via SMS, email, app notifications, and even escalating to customer service calls. This proactive layer reaches more than 10,000 users daily, discouraging over 8,000 fraudulent transactions.

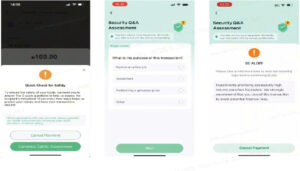

3. Interactive Q&A Verification

In cases where more context is needed, users are engaged with real-time Q&A prompts to understand the purpose of their transaction. If red flags are confirmed, the system presents a tailored warning or ends the transaction flow altogether. This feature alone helps deter over 46,000 scam attempts daily from the 50,000+ users who interact with it.

Together, these layers form a real-time scam detection and prevention engine that evolves with every user interaction. OPay’s system doesn’t just warn — it learns and adapts, constantly improving its accuracy and response time.

Many users don’t even know they’re in danger until OPay steps in. As one X user, @JAHS, shared:

“OPay alerted me that I might be sending money to a scammer when I wanted to patronize an IG vendor. Stopped the transaction ASAP.”

These interventions are happening silently, daily — often before the user even suspects something is wrong.

OPay’s scam alert system is part of a broader philosophy: security is not just about technology — it’s about trust. From scam alerts to Face ID transaction verification, USSD instant account locking, the Large Transaction Shield, and automated callback alerts, every tool is designed to protect users in the moments they can’t predict.

As scams get more sophisticated, the future of financial safety depends on real-time prevention. And OPay isn’t waiting for fraud to happen — it’s stopping it in its tracks. Sometimes, the smartest financial decision you make… is the one OPay helped you avoid.

About OPay

OPay was established in 2018 as a leading financial institution in Nigeria with the mission to make financial services more inclusive through technology. The company offers a wide range of payment services, including money transfer, bill payment, airtime & data purchase, card service, and merchant payments, among others. Renowned for its super-fast experience and reliable network, OPay is licensed by the CBN and insured by the NDIC with the same insurance coverage as commercial banks.