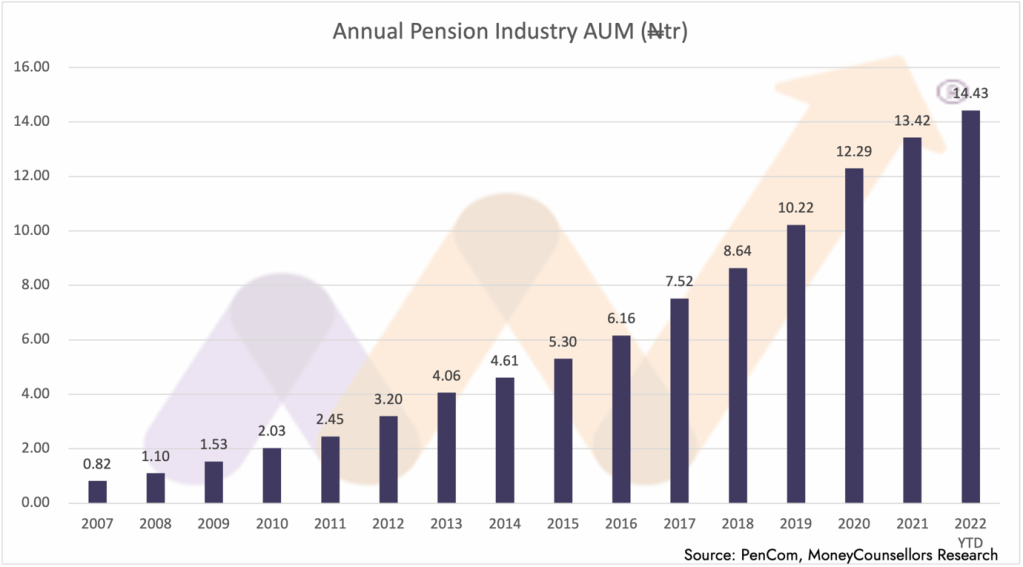

The nation’s pension fund assets rose to N14.99trillion as at December 31st, 2022, thereby, confirming earlier

LEADERSHIP reports.

LEADERSHIP had, last month, reported that the pension assets may rise to N14.8trillion by the end of 2022.

The increase depicted N199.17 billion growth when compared to N14.79 trillion it was in November, 2022.

Investment income, according to LEADERSHIP investigation, was crucial to the expected growth, despite the fact that governments at majorly, State level are not paying the monthly pension contributions of their workers as and when due.

Similarly, the consistent increase, according to findings, was attributed to new pension contributions received, interest from fixed income securities and net realised on equities and mutual fund investments.

Meanwhile, subscribers under the Contributory Pension Scheme(CPS) rose to 9.86million even as the assets, when dollarised at N448.55, translated to $33.42 billion.

Of the pension assets, N9.64 trillion were invested in federal government securities, while State securities gulped N166.14 billion even as Corporate debt securities amounted to N1.66 trillion. Money market instrument attracted N1.98 trillion.

As at the end of November, 2022, the assets stood at N14.79 trillion, having climbed from N14.58trillion in October, 2022.

The managing director/CEO, First Pension Custodian, Mr. Oloruntimilehin George, had predicted, on behalf of pension fund operators, that the fund will hit about N14.8trillion by year end.

According to him then, “ the nation’s pension fund assets is expected to hit N14.8trillion, despite the challenging business environment, not forgotten that the industry also undergone recapitalisation of which all PFAs scaled through. The Shareholders Fund of the industry is N211billion post recapitalisation.”