Analysts maintained that the Nigerian stock market will continue its negative sentiments, as pre-election risks amplifies.

Stock trading and investing depends on the underlying economic situation. However, company performances are also the main drivers of fund flows between different stocks as they buy for future earnings and payout.

The forex market problem today is affecting investments and repatriation of profits by investors, while attracting new investors ahead of 2023 general election uncertainty.

Investors are also reviewing the central bank and government responses to economic conditions faced by businesses and investors, which also impacts their investment decision at any time. Experts said, it is time for monetary and fiscal authorities to shake hands, and address this issue to save the economy from a looming recession.

Analysts Optimism

Going into the new week, while profit-taking activities continue, Cowry Assets Management Limited anticipated cautious trading to keep market muted as investors seek opportunity to hedge against the bear market and the inflationary environment in their search for value.

“However, we continue to advise investors to trade on companies’ stocks with sound fundamentals and a positive outlook amid the macro-dynamics which remains a headwind,” Cowry Assets said.

Afrinvest Limited also noted that “in the coming week, we anticipate the bearish sentiment would linger as investors position in the fixed income space given the spurring yield environment, especially after the bond auction on Monday.”

Analysts at Cordros Securities Limited stated that “with the significant moderation in the prices of bellwether stocks this week, we expect savvy investors to take advantage of this and make a re-entry into stocks with sound fundamentals and attractive dividend yields.

“However, we do not rule out the possibility of continued profit-taking activities. As a result, we envisage a choppy trading pattern. Nonetheless, we advise investors to take positions in only fundamentally justified stocks as the unimpressive macro story remains a significant headwind for corporate earnings.”

Last Week’s Trading Activities

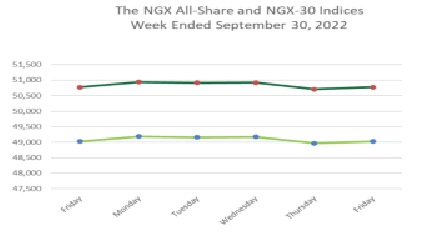

Momentum in the domestic equities market last week was downbeat as investors seeking alpha resort to bargain hunting as profit taking activities drove negative sentiments with the benchmark index moving downhill by 6.67 per cent week on week (W-o-W) below the 45,000 psychological mark for the first time since January 2022.

This comes as investors take into sectoral rotation as year-end seasonalities draw closer. As a result, the All-Share Index declined by 3,172.31 points or 6.67 per cent W-o-W to close at 44,396.73 points. Similarly, market capitalisation decreased by N1.728 trillion to close the week at N24.182 trillion.

Meanwhile, selloffs of top telecommunication player, Airtel Africa Plc underpinned the market’s performance. Sectoral performance was mixed as the NGX Industrial Goods index recorded a weekly gain of 3.2 per cent, while NGX Banking index grew by 1.2 per cent W-o-W. on the other side, the NGX Insurance index down by 3.7 per cent W-o-W. NGX Oil & Gas index down by 1.5 per cent, while NGX Consumer Goods index depreciated by 0.9 per cent W-o-W.

The market breadth for the week was positive as 33 equities appreciated in price, 29 equities depreciated in price, while 95 equities remained unchanged. Academy Press led the gainers table by 11.45 per cent to close at N1.46, per share. Fidelity Bank followed with a gain of 10.14 per cent to close at N3.80, while United Capital went up by 10.13 per cent to close to N10.25, per share.