Sterling Financial Holdings Company (Sterling Holdco) Plc, has opened a public offer of N87.067 billion.

The company is offering 12.581 billion ordinary shares of 50 kobo each at N7 per share. The subscription offer opened on September 17 and is scheduled to close on September 30.

The public offer is a strategic initiative aimed at strengthening the capital adequacy of Sterling Bank Limited, capitalising SterlingFi Wealth Management, and supporting the Group’s strategic expansion opportunities.

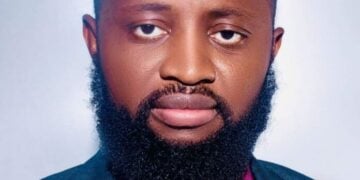

Speaking on the offer, Sterling Financial Holdings Company’s Yemi Adeola said, “Further to our shareholders’ approval at the 2024 annual general meeting, I am pleased to report that we have completed two rounds of capital raise. In 2024, we completed an N75 billion private placement and N28.79 billion right issue, which our shareholders significantly oversubscribed.”

He added that, following receipt of the relevant regulatory approvals and the distribution of the proceeds from the capital raise to our banking subsidiaries, Alternative Bank has fully complied with its minimum regulatory capital requirement. At the same time, Sterling Bank only requires an additional N43 billion to retain its current license.

The company has also completed an N10.29 billion special placement which is currently undergoing the necessary approval processes for recognition as capital.

Adeola added that “the net proceeds from the offer will be applied towards the full recapitalization of Sterling Bank Limited, with a focus on expanding digital banking channels, strengthening and upgrading our technology infrastructure, and driving business growth across the Retail & SME, Commercial, and Corporate segments. A portion of the funds will also be allocated to the capitalisation of our new asset management subsidiary, SterlingFI Wealth Management, to support its business expansion.

At the same time, the remaining will be deployed towards better positioning the Holdco to pursue further strategic expansion and revenue diversification.”

He noted that “while the Nigerian economy continues to present challenges and opportunities, we are confident in our ability to navigate volatility while capturing growth given our proven board and management capability, diversified business model, and disciplined risk culture.

“Our strategy remains focused on deepening market share in key segments, enhancing customer experience through technology and service excellence, and maintaining prudent capital and liquidity buffers.”

He pointed out that “this public offer is an invitation to both our existing shareholders and new investors to participate in the next chapter of our growth story. Our strong financial performance in 2024, which was further strengthened in the first half of 2025 has demonstrated our ability to deliver exceptional results in difficult conditions, and with your continued support, we will build on this momentum to create even greater value.”