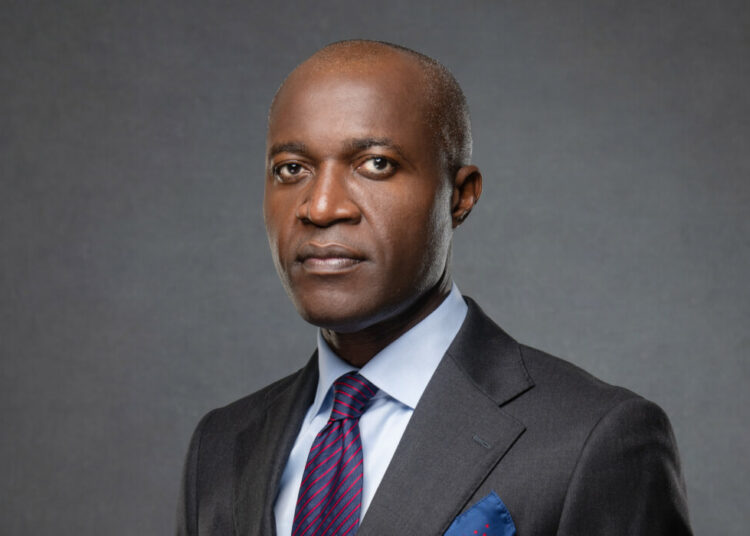

With 50 per cent of deposits sterilised with the Central Bank of Nigeria (CBN) and the obligation to the Assets Management Corporation (AMCON), bigger banks have continued to bear the larger brunt of regulatory constraints, the managing director and chief executive of Access Bank, Roosevelt Ogbonna, has said.

This is as he said the bank is further expanding with new branches to be set up in Hong Kong and the United States of America by the end of next year with plans to do business in all 55 countries on the African continent.

Speaking with journalists on Monday on the plans of the bank as it enters the consolidation phase next year, Ogbonna noted that while big banks suffer the most under regulatory constraints, they are able to expand more when the constraints are removed.

Shareholders of banks have consistently raised concerns over the burden of the AMCON levy which took N453.71 billion from the books of six banks in the first six months of this year. However, Ogbonna noted that Access Bank is focused on winning irrespective of the regulatory constraints.

“When there are regulatory constraints or structural constraints, large banks suffer the most. When those constraints are resolved and removed, large banks are the greatest beneficiaries. AMCON is here for another five years, Cash Reserve will not always be 50 per cent.

“So the question you have to ask yourself is, should we wait until the structures are removed? Or do we say, invest now, take that market share, control it, knowing that these structural limitations cannot exist forever, and when they come off, be prepared for the benefits that you get. Our mindset is: take the latter. Invest now, rule the market share, prepare yourself for tomorrow.”

Speaking on the expansion plans, he said the bank is focused on leading cross border trade in Africa whilst establishing presence across the world. He stated that Access Bank “will be in global markets, and we will have global conversations dealing with different counterparties who operate across the world. When we started this journey, one of the things that was clear to us is that if we have to be the bank that catalyses trade and payments in the continent, we need skill. So we started something we refer to as our aggregator strategy. There’s no point being a Pan African bank where you have zero impact.

“It was very clear that in every market, we have to compete locally, and we have to be a dominant bank in the local market.

Of our 19 markets that will be in the continent by 2027, eight of those markets will be a top three bank. In 15 of those markets we will be a top 10 bank. In 11 of them we will be in the top five.

“We want to be a local bank first, employ local talent, impact the local economy, and work with the local governments on the offerings in those markets to make an impact in the market. I think, importantly, it means that we then have the skill and the size to be able to then force cross border trade to happen.

“From a trade perspective, the most dominant trade banks in the continent have been the international banks, but they are leaving the continent, the banks who will get the benefits of that exit, are banks who have built the scale in those local markets. We’re very deliberate in terms of the markets.”

On funding, he said the bank is looking to raise a dollar instrument noting that “the form and the contours that you take are still work in progress. Our view is that there will be two tranches of that capital instrument.”