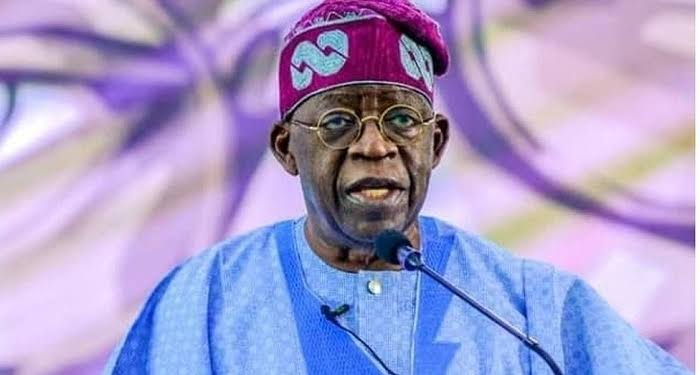

When Tuesday, October 30, 2023, President Bola Ahmed Tinubu wrote to the Senate to seek approval for N2.18trillion Supplementary Budget, he did not mince words in pointing at the urgency of the matter at issue.

Urging the Senate to “speedily” approve the budget, it was obvious, even to the law makers that the matter at hand requires expeditious attention.

And at the heart of that request, requiring speedy attention is the implementation of the 15-point Memorandum of Understanding (MoU), signed by the government and Labour Unions Leaders on October 3, 2023 in Abuja.

The agreement includes the Federal Government approval of a wage award of N35,000 to all Federal Government workers beginning from the month of September pending when a new national minimum wage is expected to have been signed into law, suspension of collection of Value Added Tax (VAT) on Diesel for six months beginning from October, 2023.

Federal Government also agreed to vote N100 billion for the provision of high capacity CNG buses for mass transit in Nigeria. The Federal Government also agreed to pay N25,000 per month for three months starting from October, 2023 to 15 million vulnerable households, including pensioners, commitment on the part of the federal government to the provision of funds as announced by the President on the 1st of August broadcast to the Nation for Micro and Small Scale Enterprises. The MSMEs beneficiaries should commit to the principle of decent jobs.

The situation today is that the federal government, in a bid to stave off disruptive labour unrest, has commenced the implementation of the MOU.

The Supplementary Budget which the President sent to the Senate on Tuesday requiring speedy treatment was in a bid to appropriate the needed funds for the implementation of critical aspects of the MOU.

In that N2.18 trillion Supplementary Appropriation is the sum of N210 billion for the agreed wage award and another N400 billion for Cash Transfer to vulnerable households, while another N200 billion is for Seed and Agricultural Inputs and Equipment

Just last week Friday, seven CNG Conversion Centers were inaugurated with more coming up across the country, according to Zach Adedeji, Chairman of the CNG Conversion Committee, while two CNG buses were handed over to Olusesan Adebiyi, the State House Permanent Secretary, at the presidential villa, Abuja.

Provisions are also being made for initial 55,000 CNG conversion kits to kick start an Auto Gas Conversion Programme.

On Refineries, the Presidential Committee had visited the Refineries, ascertained their rehabilitation status and assured the nation that Warri Refinery and Petrochemicals would resume pumping of fuel before the end of the year.

In listening to the yearnings of the Academic Staff Union of Universities (ASUU), the President , Bola Ahmed Tinubu, last week approved a partial waiver of the “No Work, No Pay” order on members who participated in the last 8 months long strike and ordered the release of four months of their withheld salaries.

In a similar vein, in commemoration of the 2023 International Day for the Eradication of Poverty last week, President Tinubu launched the disbursement of N25,000 to 15 million households for three months as a social safety net.

To complement the efforts of the Federal Government and avert a face off with Labour is the commendable moves by some private sector players as exemplified by the Depot and Petroleum Products Marketers Association of Nigeria, DAPPMAN, an Association that threw its weight behind the government’s decision to end the subsidy regime and to deregulate the downstream sector of the oil industry. DAPPMAN, leading other oil marketers, are now ready to donate a number of CNG buses to the federal government to help mitigate the effects of petrol subsidy removal.

According to DAPPMAN chairman, Dame Winifred Akpani, the donation is to support the federal government’s post-subsidy palliative measures.

She said: “We collectively agreed that we’re going to work at providing real mass transit buses that work. The ones that run on CNG, which is a compressed natural gas and diesel interchangeably,” the DAPPMAN Chair said.

For this marketers’ association, it is walking the talk. DAPPMAN had been in the forefront of the calls for the removal of fuel subsidy affirming repeatedly that it will put an end to fuel scarcity, eliminate unnecessary hardship on Nigerians seeking to buy fuel, reduce waste and stimulate responsible consumption of this petrol .

Now that the federal government has yielded to the calls and abolished the subsidy, DAPPMAN has also taken the lead in support of government’s bold and creative actions towards cushioning the harsh effects of the subsidy termination.

Another good news is that of the planned injection of fresh $10 billion into the Nigerian economy in the coming weeks. This, the Minister of Finance and Coordinating Minister of the Economy, Mr Wale Edun says would provide the much-needed relief to a liquidity squeeze that has been adversely affecting the Naira.

He emphasized that the substantial inflow is expected to play a significant role in bolstering Nigeria’s economic stability and alleviating the pressures on the national currency.

It is also anticipated that the fresh inflow will help to open the official forex window to oil marketers to accelerate their quick return to business and begin fuel importation to help stabilise fuel supply and distribution.

Other experts have added that government should look into streamlining the cost of importation of fuel by charging the taxes in local currency. This, they insist, will reduce the cost of fuel import and further help to reduce the price of fuel for Nigerians thus complementing government’s much needed efforts in this direction.

Other efforts by the government to boost forex inflow is the $3bn emergency loan the Nigerian National Petroleum Company Limited (NNPCL) secured from Afreximbank.

An analyst said: “Goldman Sachs is an external asset manager to the CBN, so using NNPC’s account that CBN manages with Goldman as an unsecured credit line to tap $10bn for the purposes of clearing outstanding forwards and stabilizing the exchange rate back to the N800 range is plausible,” he said.

“This means that Goldman Sachs will net off gas revenues from WAGPCO and NLNG over an extended period to repay back.”

This approach, which involves an upfront cash loan against proceeds from a limited amount of future crude oil production, was used by the NNPCL to secure the $3 billion emergency loan from Afreximbank.

With all these proactive measures aimed at meeting the agreements reached with labour and to reignite the economy with the ultimate objective of engendering economic growth and alleviating poverty, the contention out there is that the labour/government face off is about to be resolved for the benefits of all Nigerians.

Said Olusesan Ige, an Abuja based Media Content Creator: “The fact on ground today is that the federal government has shown good faith, good intentions, it is obvious, even for the Labour also to see. The issue of ultimatum no longer holds. I think labour will sheath the sword now that all their requests are being swiftly attended to.”

It is difficult to fault Ige’s submission.

* Okoh wrote in from Abuja