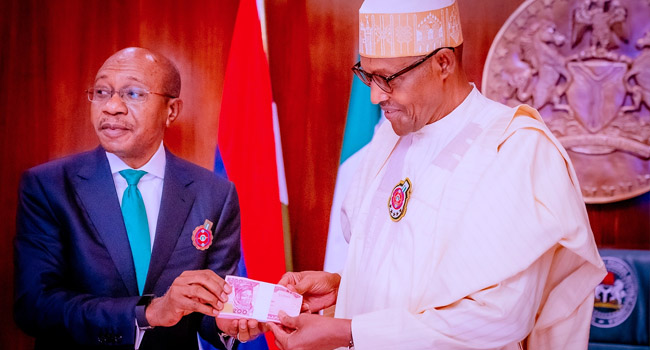

In the build-up to the party primaries towards the 2023 General elections, Mr. Godwin Emefiele, the current Governor of the Central Bank of Nigeria (CBN), stepped forward and acted clearly towards succeeding President Buhari through the ballot box. In a serious and more responsible country, that singular act, would have seen him impeached immediately. Failure to do that put the CBN in an uncomfortable position as to the independence granted it in section 1 (3) of the CBN Act 2007.

So, when the CBN claimed to be acting under its powers in sections 18 & 20 of the extant Act to change the N1,000, N500 and N200 notes, a good number of Nigerians had reason to doubt the honest intent of the action. The CBN gave plausible reasons as to why the currency notes being changed will no longer be legal tenders by January 31st, 2023. Emefiele stated that “N3.23 trillion is in circulation and out of that N2.72 trillion is outside the bank vault”. 80% of money in circulation not under the CBN’s control, including through the commercial banks is bad for monetary policy. As at 29th of January, Emefiele said the CBN has collected N1.9trn old notes, with some N500bn more to go. The change of currency, for the CBN, will halt money laundering and other crimes as well as aid the evolution of a cashless economy. In addition, he stated that the changing of the currency would deter counterfeiting that the CBN claimed is rife since additional security measures are being put in place.

Yes, periodic currency swaps are legitimately the duty of responsible agencies of governments the world all over. The United Kingdom carried out some changes to some notes over a long period of time and ceased to be legal tender in September last year. My daughter was holding about 75 pounds of such and handed them to me to find out if I could redeem them as I was passing through London in October. I asked and was politely told that I should take them to the Bank of England. I decided to do that on another visit since I did not have much time. Very recently, following the death of Queen Elizabeth II, the United Kingdom has “silently”, devoid of needless drama and brouhaha made policy moves for appropriate changes to the face of its currency, to reflect her current political reality. A change that is to be rolled out smoothly over a period of time comfortable enough for the people. The United States dollar have gone through several changes, especially the 100 dollars bills and all old ones have remained valid even though the “Aboki Forex” dealers put premium on newest versions. But the same value is for all bills in the USA.

The CBN, as a result of its Governor stepping into the political fray, in spite of his being pressured to withdraw, has become politically polluted. So, it was easy for politicians and Nigerians to interpret the currency swap action of the politicised CBN Governor as a partisan move to halt the chances of some politicians who had clamoured for the stopping of the CBN Governor from joining the political race. Some even argued that the policy was to create artificial scarcity, including on fuel availability to ensure chaos, presidential election postponement and an installation of an interim government. President Buhari did not help the CBN when he added that the exercise would ensure free and fair elections by ensuring that votes could not be purchased. Similarly, the major competitors for the topmost job of the country have also jumped into the fray distilling political arguments, each seeming to be wanting to appear as sympathisers for the sufferings of the people.

Ahmed Halilu, reportedly President Buhari’s brother-in-law is leading the national printing and minting company that was given the task of changing the inks on the naira denominations being swapped. Again, if we agree that at least one-third of the currencies being withdrawn would be needed as we allow cashless efforts through our epileptic internet order to assist and ameliorate the impact of our cash dependent culture we are being weaned from, Buhari’s brother-in-law-led outfit’s installed capacity will reportedly, require one year to print about N1 trillion naira.

The unavailability of new notes after a huge chunk of old notes has been returned to the CBN has resulted in chaos in some places as some banks started hoarding new currency notes and failed to allow their Automated Teller Machines (ATM), to serve their customers. Point of Sale (POS) operators started trading with the naira notes at varying redemption rates. If you want N20,000 in cash you pay N2,000 as commission. Even while citizens stay on queue for petrol, when it is their turn, some gas attendants insist on payment in cash and direct fuel buyers to a side POS operation service to acquire cash that is being recycled between the petrol point and the POS.

In reaction to the no cash, no fuel, not to talk of other hardships, Nigerians started to react, at least in the southern part of the country. Lives have been reportedly lost and properties destroyed. The government of Nigeria did not just start to fail in guaranteeing the protections of lives and properties as envisaged in the dubious 1999 Constitution which has been forced down our throats. Of course, the security forces are busy chasing Bank Managers said to be hoarding the under-printed new notes as well as arresting POS operators keen on making quick bucks. Meanwhile Godwin Emefiele who lacked the integrity to make it clear to President Buhari or resign on the ground that there is no capacity to implement a 1984 style of currency swap continues to gallivant and pontificate around as a free man.

So, why the rush to phase out the old currency? I honestly do not know but I’m ready to hazard a guess that the reason is political. The current chaos flowing from President Buhari as Petroleum Minister as well as the principal on currency swaps as clearly stated in Sec. 20(3) of the CBN act puts the buck on the President’s table. Godwin Emefiele is only a willing tool who may also be acting in his self-interest. However, President Buhari has been smart by half as he is not considering the fact that there were only 84 million Nigerians in April 1984 when he tried the same rash policy. Today, we have over 200 million Nigerians clamouring against leadership failure ruining their economic lives. Quite a large population that can be mobilised for political actions. Furthermore, unlike 1984, we have politicians occupying alternative posts of power as Speaker and Governors as opposed to the centralised command we used to have under Major General Muhammadu Buhari as Head of State and the Commander-in-Chief in 1984.

Aside from the vociferous position of the stormy petrel of Kaduna state who could very well be playing several games, the National Assembly clearly pointed out that under the CBN Act, money will never expire as Sections 20(3) and 22 of the CBN Act make it clear that all perfect/unmutilated old notes presented to the CBN shall be redeemed at the face value. This fact took the wind out of the sail of our politicised CBN Governor even before the Supreme Court granted an injunction to three states that approached it on behalf of millions of Nigerians.

It was within the powers of the Supreme Court to grant an interim injunction until Wednesday February 15, 2023, when it would hear all interested parties on the substantive issues, including whether it has jurisdiction. It is the Supreme Court that will decide if it has jurisdiction or not and not the Attorney-General not to talk of CBN lawyers. However, following some of the recent outings of the supreme court, many Nigerians may have cause to be doubtful of the “supremacy” of the supreme court, whose integrity should not be toiled with as a policy court.

Some lawyers have been suggesting that joining the CBN is necessary before a Supreme Court decision can be binding on the CBN, after all, the CBN is independent under Section 1 of its Act. But such argument losses focus of the fact that the CBN under Sec 20 (3) of the CBN Act 2007 has to be directed by the President on the need for currency swaps. Hence the Bank is an Agent of the Federal Government of Nigeria. Service of the Supreme Court order on the Attorney-General of the Federation binds the CBN’s politicised Governor. Of course, he can disobey as he has been doing. I cannot say he will face consequences but normally, he should be put in jail for contempt.

We have a problem from having a highly politicised CBN Governor who wanted to transit to being the President of Nigeria while still holding the post of the apex bank. . Unfortunately, leadership failure made it impossible to sanction him for such greed.

By error of commission and/or omission, President Buhari through the CBN Governor has set our country on its current slippery slope of disorder and insanity. The Commercial Banks and POS operatives are just following the slippery slope the Governor of the CBN, as Agent of President Buhari, puts us into.

Alternative leaders to the current leadership, including some on campaign for posts in the next dispensation have a mobilised population to use for various purposes. It is easy to direct that the old currencies said to be in hiding if indeed there are, be brought out and used concurrently with the new notes. There is nothing a rapidly deinstitutionalizing CBN can do. As a state Governor has already given a similar instruction in continuation of the disorder being brewed. Others can follow through. If the market women in Lagos resolve to continue trading with the old notes, there’s nothing the court system can do and the security forces would be overwhelmed after arresting a few. At least, it would still be pleasing that it is the old naira currency and not Oduduwa or Biafra currencies that are being used.

We are on a slippery slope towards the abyss that President Buhari and Godwin Emefiele should have thought through deeply and dispassionately before starting.

*Babafemi A. Badejo, author of a best-seller on a dual biography: (Kenya and Raila Odinga), rolled into one among other books, is a former Deputy Special Representative of the UN Secretary-General for Somalia, and currently a Legal Practitioner as well as Professor of Political Science and International Relations at Chrisland University, Abeokuta, NIGERIA.