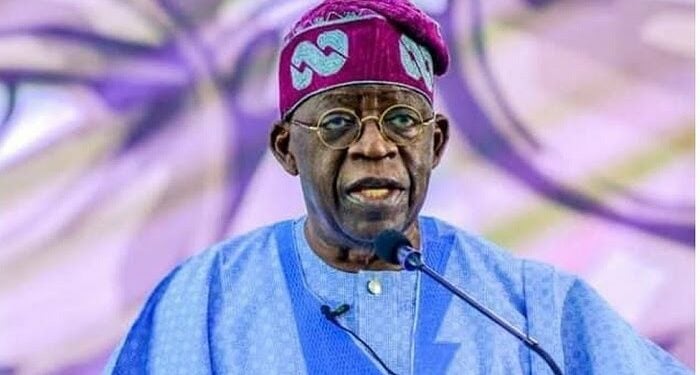

President Bola Ahmed Tinubu is leading a wave of reforms aimed at revitalising Nigeria’s economy, attracting foreign investment, and improving the quality of life for everyday Nigerians.

The Renewed Hope Agenda, which promises a fair, simplified, and business-friendly tax system, is at the heart of these efforts.

According to Arabinrin Aderonke Atoyebi, Technical Assistant on Broadcast Media to the Federal Inland Revenue Service (FIRS) executive chairman, Tinubu inherited a struggling economy when he assumed office in 2023. Rather than sustaining ineffective policies, he opted for bold restructuring to recalibrate Nigeria’s financial trajectory.

She said one of his standout initiatives was the introduction of the Tax Reform Bills, which are designed to simplify the tax system, reduce burdens on workers, and create a more equitable economic framework.

She noted that a major highlight was the exemption of minimum-wage earners from personal income tax, providing significant relief to low-income Nigerians.

Additionally, the VAT rate, initially proposed to rise to 12.5%, has been retained at 7.5%, curbing inflationary pressures on households.

She added that small businesses are also poised to benefit, as the exemption threshold for small enterprises has been raised from ₦25 million to ₦50 million in annual turnover, giving more businesses the breathing space to grow.

Furthermore, corporate income tax for large companies has been reduced from 30% to 25%, a move designed to stimulate investment and job creation.

“These reforms show the Renewed Hope Agenda’s commitment to a tax system that is fair, simple, and good for business,” she said.

Despite the widely anticipated benefits, the Nigeria Labour Congress (NLC) president, Joe Ajaero, has called for the withdrawal of the Tax Reform Bill, citing concerns over its implications.

However, some analysts argue that Ajaero’s opposition may stem from misconceptions, noting that the reforms are designed to ease financial pressures on workers and make essential goods more affordable via VAT exemptions.

“Has there been adequate consultation with unions, economic experts, and workers who stand to gain the most?” Aderonke queried while stressing the bill’s alignment with the interests of low- and middle-income earners.

Another notable reform is the revamped VAT revenue-sharing formula, which will allocate 60% of VAT proceeds to the states where goods and services are consumed. This is expected to strengthen state economies and enable greater infrastructure, education, and healthcare investments.

Additionally, the creation of the Office of Tax Ombud will ensure that businesses are protected from arbitrary tax assessments and that disputes are resolved more efficiently.

She stated,” Supporters believe President Tinubu’s reforms will boost investor confidence, accelerate job creation, and drive national development through a more transparent and business-friendly tax system.”

“President Tinubu is building the foundation for a stronger and more prosperous Nigeria,” Aderonke noted. “His leadership is focused on economic stability, innovation, and fairness for all.”

“As Nigerians await Senate approval of the Tax Reform Bills, there is growing optimism that these measures could usher in a new era of economic stability and shared prosperity,” she asserted.

Arabinrin Aderonke Atoyebi an technical assistant to the Executive Chairman of the Federal Inland Revenue Service