In Nasarawa State, a groundbreaking initiative called the “Youths Revolving Fund Scheme” is transforming the lives of young entrepreneurs and reshaping the landscape of small and medium-scale enterprises (SMEs). At the forefront of this remarkable change is Ahmed Dauda Guto, the chief promoter of Darab Agro Allied and General Services, and one of the beneficiaries of this life-changing programme.

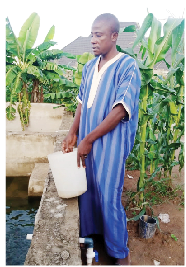

Nestled in the Up Oversea area along Zakun Bello Road in Nasarawa town, Guto’s residence doubles as a thriving fish farm. Here, he and his fellow young entrepreneurs tend to the ponds, nurturing the aquatic life that is an essential part of their business. As Guto explains, this serene sight of fish swimming in harmony serves as a soothing balm, relieving the stress of entrepreneurial challenges.

The Youths Revolving Fund Scheme, initiated by the Nasarawa State Government, was designed with the vision of providing critical financial support to SMEs, ensuring their sustainability and growth. By offering accessible loans and financial aid, the program empowers young individuals to pursue their dreams, break free from unemployment, and contribute to the state’s economic development.

Under this scheme, Guto’s fish farm has not only flourished but also inspired countless others to join the ranks of successful entrepreneurs. The once daunting task of accessing capital has been alleviated, allowing these determined youth to make their mark in the world of business.

With beaming smiles, Guto and his peers exemplify the spirit of resilience and determination that has come to define Nasarawa’s enterprising youth. Their success stories have become a testament to the impact of governmental support in fostering an environment of innovation and growth.

Guto’s fish farm, no doubt, is one of the emerging success stories of a scheme many young entrepreneurs were initially reluctant to embrace, but are now queuing up to key into.

His farm had undergone some measure of expansion and transformation since March, 2023, when he accessed the loan. The number of ponds had increased to three from one, each with a capacity of 5,000 fishes, a number which he noted was huge. Cumulatively all the ponds would give him about 15,000 fishes per harvest within a space of a few weeks.

The loan enabled him to have his own water source; a motorised borehole on the farm, explaining that, “I don’t need to draw water from a neighbour’s farm as had been the case in the past.”

The initiative also solved the problematic challenge of power within the facility when he acquired his own generating set and also enabled him to hire more hands to assist on the farm thereby reducing the pressing unemployment challenge that had become a thorn in the flesh of the state government.

Guto has been “thinking big” since the gains of the loan facility began to manifest in the number of fishes in the ponds: “With my experience, since I put the loan to use, what has been in my head is more expansion,” he said.

How to dispose off the impending harvests is the least of his worries. “There is a ready market awaiting the harvests. In fact, buyers have been coming and indicating interest.”

Guto has his “big dream” from the onset when the opportunity for the facility presents itself. He applied for N20m, an amount the initiators said was outrageously huge for one person in the first phase of a scheme which targeted many beneficiaries.

Nevertheless, he was still one of the beneficiaries with the highest take home of N3m with a caveat that he could go back for more when the money is well utilised for the purpose it is meant and the loan repaid within the designated timeline.

However, as things stand, Guto’s “big dream” has to tarry before it materialises because his six-month moratorium before he commences repayment of the loan has not elapsed.

“I would have wanted the repayment plan shortened if there was any way to do so because I’m sure I can pay up the sum and the interest within a year. But as it is, the procedure has to be followed to the latter; so I have to wait,” he stated.

Guto veered off his lane as a computer scientist into fish farming; “A route I never in my wildest dreams thought I would ever contemplate taking,” he said.

But almost all applicants who have benefited from the youth scheme branched off from their chosen professions to embrace different vocations at some point in their life journey.

In seeking alternative livelihood means, only a few delved into their dream passion away from their course of studies. One of such is Mrs Rukaiya Suleiman, a makeup artist who is changing the narrative through her dogma that “people can look elegant and beautiful while still maintaining their natural looks.”

Rukaiya, whose business name is Omemi Strokes, “want to help people look better and wear makeup properly”. She abhors excessive makeup which “totally transforms someone into an entirely different person”, and the use of fake products to maximize profit.

She told our correspondent in her shop opposite Polaris Bank, Lafia penultimate Friday that it was the fake outlook that made her father skeptical when she broke the news of her intention to go into the vocation to him eight years ago and that he even refused to support with the initial capital.

Disappointed but undeterred, Rukaiya emptied her savings and plugged into the trade with only her passion and academic training as a business administration graduate as the insurance.

She made a difference in the industry through her simplistic approach to the art, and operating in a community that appreciates modesty over excessiveness, she became an instant celebrity.

And basking in the euphoria of her success story, Rukaiya, like Guto, became hungry for expansion, but her “big dream” was haunted by lack of resources and all hope seemed lost until she got wind of the Youths Revolving Fund Scheme through social media.

Even with the news, there was that initial skepticism and reluctance from her because of the fear that the scheme was another “usual government abracadabra” which never materialized. She said her close friends also tried to discourage her, singing the same song and telling her not to waste her precious time by applying.

“After some time, I decided that there’s no harm in trying,” she said.

An invitation for a pitch presentation of her business idea came a few days later. She got selected from a list of about 60 participants who scaled the presentation hurdle with the number narrowing down to 10.

She got a cheque of N2m a few weeks later at a ceremony where she and other beneficiaries were introduced to officials of the Bank of Industry (BoI), which is the implementing partner.

“I thought I was in dreamland. I couldn’t celebrate until I got the alert after lodging the cheque with my bank,” she said.

She said her workforce had increased to five from two since accessing the facility and that she had also become one of the major dealers in cosmetics and boasted of an impressive customer base.

There were over 25 apprentices learning how to become makeup artists when our correspondent visited her facility.

She explained that the apprentices were part of her empowerment programme aimed at giving young women the opportunity to earn a living and also become employers of labour.

She said her target was to train at least 100 apprentices drawn from across the state as part of her own way of giving back to society in reciprocation to the state government’s gesture, but that what was holding her back was the space to carry out the training programme as her shop was too small to accommodate the target number.

Like Darab Agro Allied and General Services and Omemi Strokes, other businesses belonging to young entrepreneurs in the field of Information and Communication Technology (ICT), electronics, fashion and design, beads and chain making, fruit juice processing, among others, have benefited from the first phase of the loan scheme.

The director general (DG) and focal person of the Nasarawa State Human Capital Development Agency (NHCDA), Hajiya Habiba Balarabe Suleiman, whose office is overseeing the scheme, said the Phase B of the initiative had since kick-started with about 109 applicants participating.

She said the scheme’s benchmark was 500 million, adding that the state government had since released N250m to BoI, part of which was being disbursed to the beneficiaries.

She explained that the process for accessing the facility was stringent and transparent; a situation which Guto and Rukaiyat noted stood the scheme out from others before it and erased any fear of failure midway.