With the take off of a fully cashless economy along with the naira redesign, analysts have said, it is expected to help the government increase revenue generation through tax administration.

Speaking at the bi-monthly forum of the Finance Correspondents Association of Nigeira (FICAN) in Lagos last week, Head, Global Markets at Parthian partners, Ronke Akinyemi, noted that, it will be a way to boost the government revenue.

Speaking on revenue generation by the government, she noted that, “we expect that there will be increased remittances from government owned enterprises, we expect to see improved tax administration.”

According to her, the naira redesign coupled with the cashless policy of the Central Bank of Nigeria(CBN) is expected to see more naira move from private hands into the banking vaults.

“We expect that if we eventually transition to a cashless economy, more money is in the bank, the banks would have an idea of who owns what and it will be easier for the tax guys to go after who has not been paying tax on who has been evading tax because you cannot collect tax from the person that is putting money under his bed. So once all the money is in one place, it creates a clearer view for them. So, in that respect we expect that there will be improved tax administration and increased oil outputs, hopefully.”

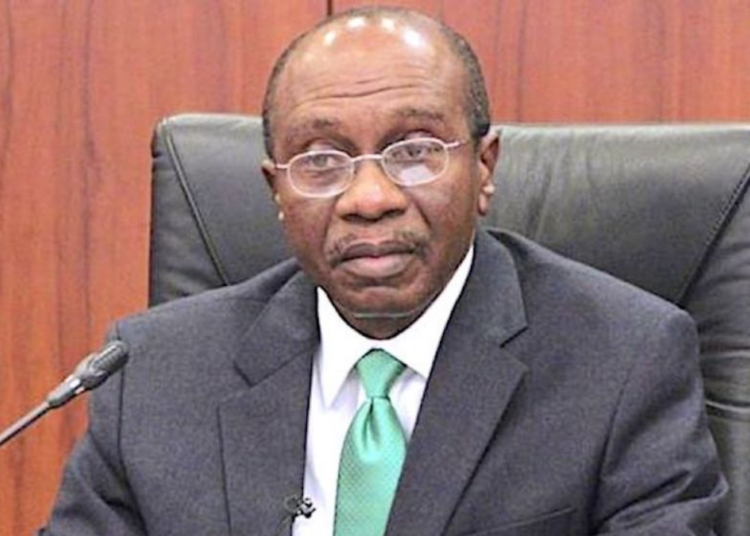

According to the governor of the CBN, Godwin Emefiele, the macroeconomic impacts of currency redesign are multidimensional and could seem uncertain, especially, at this early stage when its inconvenience is widespread.

‘‘By spurring more people to use bank accounts, this policy will further increase bank account ownership and increase the use of accounts by enhancing people’s saving behavior. It could encourage some hitherto informal business operators to formalise the pattern of transactions and adopt more formal settlement channels.

“In addition, the short-term decline in cash holding and the increased formalization of business activities as the cashless policy forces more economic agents to open bank accounts, will also boost fiscal policy. With more transactions going through e-channels and bank accounts, more agents come within view of the government’s tax net.

“This enlarges the base of taxable activities and increases the possibility of more tax receipts by various tiers of government. In the long-term, the policy improves the sophistication of tax collection and would no doubt reduce tax evasion and tax avoidance. As experiences from other jurisdictions have shown, effective currency redesign can support regulatory reform, increase legislative reach and coordinated fiscal and structural policies.”

On his part, Head of financial institutions ratings at Agusto&Co, Ayokunle Olubunmi, who noted that the cashless policy is a good one, said, it will help the economy in the long run, creates a dislocation in the country’s economy in the short run as people strive to adjust to the new policy.

To him, the policy will enable CBN track the flow of funds against what has been happening in the country where its monetary policies do not have control over cash in circulation.

He also noted that, the policy, in the long run, will be good for the credit system as banks will be able to give out loans based on Bank Verification Number(BVN). Asides this, he said, it will boost government revenue as small and micro businesses in the informal sector will now be brought into the formal system, thus, allowing the tax authorities to track and tax them accordingly.

Meanwhile, Ronke Akinyemi called for a gradual removal of the subsidy, saying, a sudden withdrawal would increase the level of hardship currently faced by Nigerians. The federal government had proposed to end fuel subsidy removal last year but had decided at the last minute to shift it to June this year.

Noting that, while the removal of fuel subsidy would lead to an improvement in foreign reserves of the country and reduce the burden on the fiscal side, she said, it will also lead to an increased cost of living in the country.

To her,“the impact of subsidy removal will be an increased cost of living because at the moment we are buying fuel expensive. We know how this has affected food prices, how this has affected transportation costs. So, we expect that these things will happen. If subsidy is removed, there is likely going to be increased social unrest. We haven’t even seen anything and we already seen unrest in little bits and pieces. But on the flip side, if subsidy removal is done, we expect our reserves would improve.

“However, we have a recommendation we recommend that even if the subsidy is removed or when subsidy is removed, it should be staggered as opposed to removing it 100 per cent. So, let’s say 25 per cent, wait a few months see how that pans out, take out more so that the effect is not fully felt by the most vulnerable even though it will be fully felt. Because it is staggered, it sort of prepares them for what is ahead.

“We also expect that there will be some sort of safety net. I think they announced that last year that government was going to give N5000 transport allowance. We expect something of that sort to happen, so that it helps the most vulnerable people of the society. The outlook for Nigeria for 2023 is very scary, but we are here we just have to keep hoping for the best.”