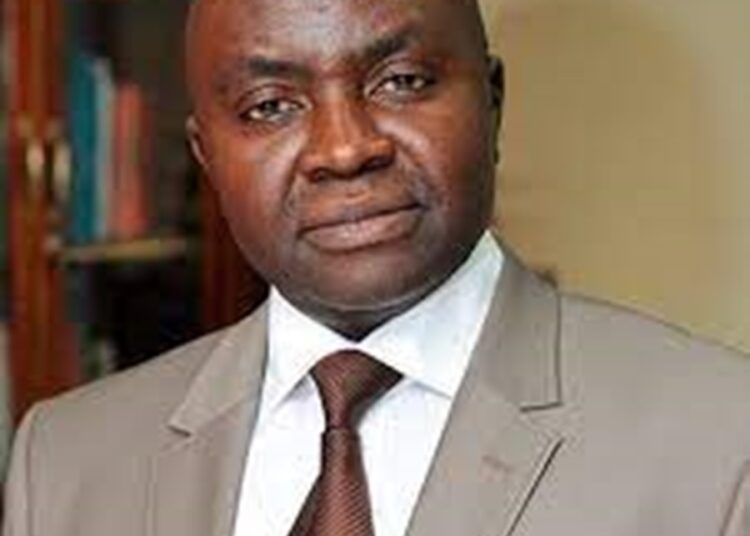

The chief executive officer of Centre for the Promotion of Private Enterprise (CPPE), Dr Muda Yusuf has said the frequent changes in the customs duty exchange rate have become a huge burden on the business community.

He stated this in a release sent to LEADERSHIP, saying “this has led to high volatility in cargo clearing costs, worsening inflationary pressures and aggravating investment risk , especially in the real sector of the economy.

“These frequent changes are profoundly detrimental to production, planning and other real sector activities in the Nigerian economy.”

He noted that “in the first quarter of this year, there were changes in the customs duty exchange rate twenty-eight times. In April , the frequency of changes would be close to ten times or even more. As at May 1, 2024, the rate has jumped to N1373.65 per dollar ($). It was less than N1200 per $ few days before.

“It is extremely difficult for investors to plan under these unstable circumstances. The situation has introduced an unprecedented level of uncertainty and unpredictability to the international trade dynamics. Investment risk has become elevated, planning has become difficult, risk management has become challenging and investors’ confidence is being weakened.”

He pointed out that it is double whammy for investors to grapple with volatility in the foreign exchange market and contend, concurrently, with high level of unpredictability in the international trade ecosystem, saying “this is not consistent with our growth aspirations at this time.”

CPPE appealed to the Central Bank of Nigeria (CBN) to adopt a framework to minimize volatility in the customs duty exchange rate in line with the commitment of the present administration to bolster investors’ confidence and drive economic growth.

According to Yusuf, such framework should adopt a quarterly customs duty exchange rate, after due consultation with the fiscal authorities. We propose a commencement rate of N1000 per $ customs duty exchange rate.

“Consultation with the fiscal authorities is imperative because of the trade policy implications of such decisions. It is also consistent with the commitment of the present administration to effective coordination between fiscal and monetary authorities.”