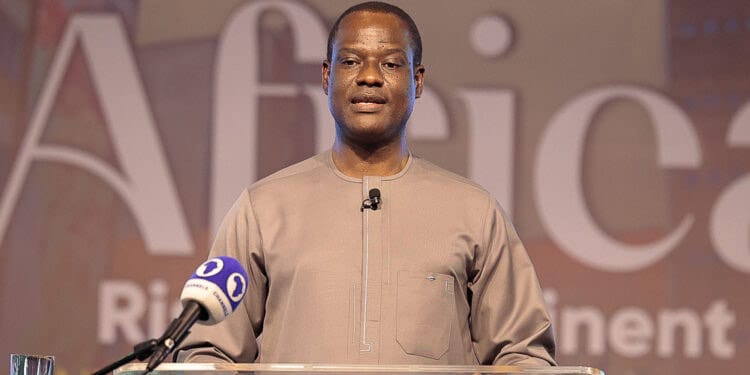

The Presidential Fiscal Policy and Tax Reforms Committee, chaired by Taiwo Oyedele, has announced plans to propose a law to the National Assembly that would increase the Value Added Tax (VAT) rate from the current 7.5 per cent to 10 per cent.

Oyedele revealed that the committee was also working on consolidating the multiple taxes in Nigeria to streamline the tax system and ultimately reduce the tax burden on citizens and businesses.

Presidential C’ttee Proposes Tax Removal On Food, Housing, Transport

According to Oyedele, the draft of the proposed tax law will be submitted to the National Assembly soon. He explained, “The law we are proposing to the National Assembly includes an increase in the VAT rate from 7.5 percent to 10 percent, starting from 2025. However, we are uncertain about how quickly the law will be passed. The proposal also outlines subsequent increases and the specific years they will take effect.”

Speaking on Channels TV’s Politics Today on Monday night monitored by our correspondent, Oyedele highlighted the significant challenges facing Nigeria’s tax revenue system. “We are facing major issues in our revenue system, both tax and non-tax. The entire fiscal system is in a state of crisis,” he said.

He further explained the broad mandates given to the committee upon its establishment: “The first mandate is to examine governance, including the country’s finances, borrowing practices, and coordination within the federal government and across sub-national entities. The second mandate focuses on revenue transformation. The country’s revenue profile is abysmally low; even if we dedicated our entire revenue to infrastructure, such as road construction, it would still be insufficient. The third mandate involves the management of government assets.”

Oyedele also mentioned that the proposed tax reforms include a corresponding reduction in the personal income tax rate. He noted that if the law is passed, individuals earning N1.5 million per month or less would see a reduction in their personal income tax. Additionally, corporate income tax rates are expected to decrease from 30 per cent to 25 per cent over the next two years. “This represents a significant reduction,” he added.

Nigeria currently has multiple types of taxes, including an IT levy and an education tax. Oyedele stated, “We are consolidating all these into a single tax. Initially, the consolidated tax will be set at 4 percent, and it will decrease to 2 percent over the next few years.”

The committee’s proposals, if implemented, could bring significant changes to Nigeria’s tax landscape, with implications for both individuals and businesses across the country.