Nigeria’s new tax reforms, recently introduced through a series of legislative amendments and fiscal policy pronouncements, have been touted by the government as transformative, designed to widen the tax net, improve revenue generation, and reduce the nation’s dependence on oil. Will these reforms finally benefit millions who earn a living through honest labour, entrepreneurship, and micro-enterprise and bridge the inequality gap?

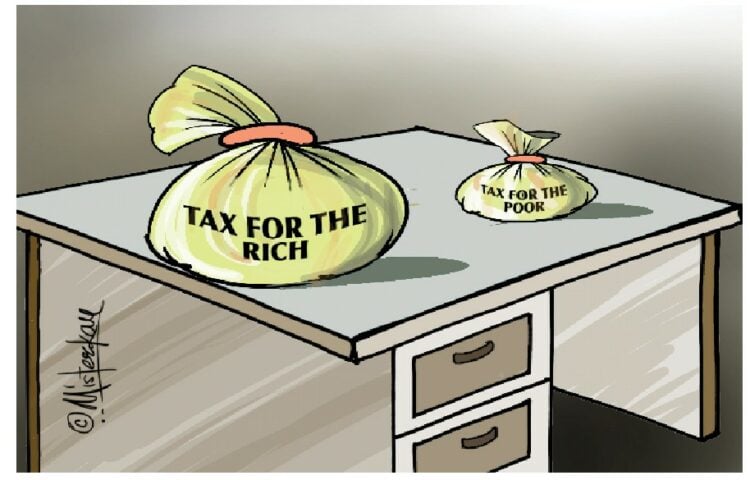

Nigeria’s tax system relies heavily on indirect taxes like VAT and levies, which hit the poor and working class hardest. While formal sector workers pay PAYE, wealthy individuals and big corporations often exploit loopholes or secure generous exemptions and incentives. A 2023 FIRS report found that 70% of potential tax revenue remains uncollected.

In response, the Presidential Fiscal Policy and Tax Reforms Committee, chaired by Taiwo Oyedele, has introduced a suite of measures aimed at improving tax fairness, compliance, and efficiency. Key highlights include proposed adjustments to the VAT threshold, streamlining of multiple taxes into a single platform, and reforms to tax waivers and incentives. There’s also a renewed emphasis on digital tax collection and a gradual shift away from oil-revenue dependency.

While these initiatives reflect a welcome pivot particularly for those at the margins of society, their real impact will depend on how they are implemented, who bears the burden, and whether the generated revenue translates into tangible improvements in the lives of ordinary Nigerians.

Will Nigeria’s Tax Reform Finally Benefit The Working Class?

The Nigerian working class is diverse, with low-wage earners in the public and private sectors, market traders, artisans, gig economy workers, junior civil servants, and small business owners. They pay taxes, often involuntarily, through VAT on basic goods, tolls, levies, and other informal charges. Many also face double taxation from state and local governments that collect fees with little transparency or accountability.

Unlike big corporations, working-class Nigerians and small business owners can’t fight back when overcharged by tax agents. For them, compliance is a survival tactic, yet they receive little in return — poor services, costly healthcare, unreliable power, and failing schools. The social contract feels broken.

So, when government officials claim that the new tax reforms will ease the burden on the working class, scepticism is warranted. At the heart of the new tax policy direction is the goal of increasing Nigeria’s tax-to-GDP ratio from 10.8% to at least 18%, in line with global best practices.

The committee recommended several changes, including reducing the number of taxes from over 60 to fewer than 10 to eliminate duplication and ease compliance and the other is reining in tax waivers and incentives, especially those benefiting wealthy corporations without contributing to job creation or industrial growth.

The committee also recommends raising the VAT registration threshold to exempt micro and small enterprises from tax obligations they cannot afford and a single, unified tax payment platform, making it easier for businesses and individuals to pay taxes without being caught in bureaucratic red tape or subjected to harassment.

On paper, these are commendable steps. But glaring gaps remain.

The reform documents say little about progressive taxation that ensures the wealthy pay more in real terms, or how the revenue will improve services like education, healthcare, and transport. Without clear plans for social reinvestment, the reforms risk being viewed as mere revenue grabs.

Lessons from the Past: Who Pays and Who Benefits?

The 2019 Finance Act raised VAT from 5% to 7.5%, leading to higher prices of goods and services. That move was justified to increase public spending, yet many working-class families saw no improvement in their quality of life.

Government revenue did increase marginally, but it was not accompanied by a commensurate boost in infrastructure or social safety nets. Public trust eroded further. The question is not just whether people should pay taxes; they should. The real issue is whether the taxes paid lead to collective progress.

One of the most frustrating aspects of Nigeria’s tax system is the uncoordinated and aggressive revenue collection by state and local governments. For instance, market women in Lagos, truck drivers in Kano, or barbers in Benin are often hounded by multiple agencies claiming to collect taxes, dues, and levies. Many of these are unofficial and end up in private pockets.

The reform debate is too federal-centric, but without overhauling state and local tax systems for fairness and accountability, the working class will still suffer. Broader reforms must include sub-national harmonisation, local capacity building, and stronger oversight.

Tax systems are not neutral; they have implications for different groups. Women who are mostly engaged in low-margin businesses make up a large proportion of the informal economy and bear the burden of indirect taxation. Yet, they are seldom consulted in tax policy design or implementation.

Persons living with disabilities, too, face structural challenges, limited income opportunities, discriminatory practices, and poor access to public infrastructure. A socially inclusive tax reform would consider waivers, targeted subsidies, and representation in fiscal governance structures.

To its credit, the committee has acknowledged these gaps and promised a gender, disability and social inclusion approach. But this commitment must be embedded in legislation and practice, not just public relations statements.

Is Technology and Compliance A Double-Edged Sword?

One of the proposed pillars of the reform is digitisation. Platforms like the TaxPro Max by FIRS are expected to reduce human contact, promote transparency, and eliminate rent-seeking. However, many Nigerians, especially in rural areas, lack digital literacy or access to reliable internet. Without bridging this digital divide, automation may end up excluding the very people it is meant to help.

While digital systems can improve compliance, they can also become surveillance tools if not properly regulated. Citizens need assurance that their data will be protected and not used for political or commercial exploitation.

Perhaps the greatest obstacle to tax justice in Nigeria is not technical, but political. The country’s political elite, many of whom benefit from tax exemptions, asset secrecy, and rentier privileges, are not incentivised to support truly progressive reforms. Real change will require political courage: ending sweetheart tax deals, prosecuting evaders, publishing tax records of public officials, and linking revenue with development outcomes.

Civil society, labour unions, professional associations, and the media must play their part in demanding accountability. Citizens must ask not just what they are taxed, but why, how, and to what end.

What Would a Working-Class-Friendly Tax Reform Look Like?

A serious pro-poor tax reform will ensure transparent reporting of how tax revenue is spent, with dashboards and citizen audits. It will exempt basic goods and services such as food staples, sanitary pads, medicines, and school supplies from VAT and ensure progressive income and wealth taxation, including capital gains and luxury property taxes.

There must be clear social protection guarantees tied to tax revenue: universal health coverage, child benefits, or transport subsidies for low-income earners and inclusive policymaking, with workers, women, informal sector representatives, and persons with disabilities at the table.

Taxation is not just a fiscal tool; it is a moral contract, a way to build a shared future. Nigeria’s new tax reforms offer a moment of possibility. But for that moment to become a movement, one that genuinely uplifts the working class, much more needs to be done than shifting numbers on a ledger.

Until every artisan sees better roads, every teacher sees a decent wage, every market woman sees her daughter in school, and every family sees affordable healthcare, we must keep asking: Whose reform is it anyway?