The Nigerian stock market experienced a massive sell-off yesterday as investors shed shares amid concerns over the proposed 30 per cent capital gains tax, resulting in a N4.64 trillion loss in market value in just one day.

The market capitalisation tumbled by N4.641 trillion to settle at N89.885 trillion, while the All-Share Index plunged by 7,454.6 points, or 5.01 per cent, closing at 141,327.30 points.

The N4.64 trillion one-day loss recorded yesterday is unprecedented in Nigerian stock market history, analysts have said.

The NGX All-Share Index fell by five per cent on Tuesday, the steepest decline since March 19, 2010. The drop marked the seventh consecutive session of losses and the longest losing streak since Aug. 1, 2024, according to data compiled by Bloomberg.

This marks the first time the Nigerian equities market has recorded a loss of this magnitude in a single day in its history. The previous decline, which almost rivalled this one, was in 2010, when Nigeria’s benchmark stock index fell the most in 11 weeks as investors sold bank shares before a September 1, 2010 deadline to meet new central bank rules that curbed lending to speculators who would use the funds to buy shares.

“It’s the whole capital-gains-tax issue, a bit more clarity is needed on it,” co-managing partner at Aztran Global Investments, Victor Aluyi, told Bloomberg.

Also, the vice-chairman of Highcap Securities Limited, David Adonri, described the market as currently in bear territory, with losses pervasive across all sectors and very few stocks showing gains. He attributed the steep decline primarily to investor concerns about the impending 30 per cent capital gains tax, alongside international factors such as President Trump’s intervention statements and disappointing third-quarter earnings in the banking sector. Adonri further suggested seasonal market lulls may play a role but expressed cautious optimism for a possible rebound as the quarter ends.

An investment banker and stockbroker, Tajudeen Olayinka, stated that the N4.6 trillion drop in market capitalisation occurred against the backdrop of Trump’s threat and the Federal Government’s introduction of CGT by 2026.

“The combination of these two factors has played a significant role in investors’ profit-taking in highly capitalised stocks on the NGX.

“The likes of Dangote Cement, among others that dropped when the market closed, have strong forces to pull down the market. The overall negative news around the market has played a significant role,” he said.

Also, the Imperial Asset Managers Limited said, “we anticipate sentiment will remain highly cautious as the market continues to reprice positions following the steep sell-off and prevailing volatility.

“This heightened risk aversion will sustain downside pressure and drive portfolio realignments ahead of year-end. Nonetheless, selective bargain-hunting in oversold, fundamentally sound stocks may offer brief support. However, overall market tone remains risk-off, with the index likely to probe lower support levels in the near term.”

They predicted that heightened risk aversion would maintain selling pressure, prompting portfolio adjustments into year-end. However, bargain opportunities in fundamentally strong, oversold stocks might provide temporary support amid the risk-off environment.

The market’s negative performance was driven by price depreciation in large and medium capitalised stocks which are; Aradel Holdings, Dangote Cement, MTN Nigeria Communications (MTNN), Beta Glass and BUA Cement.

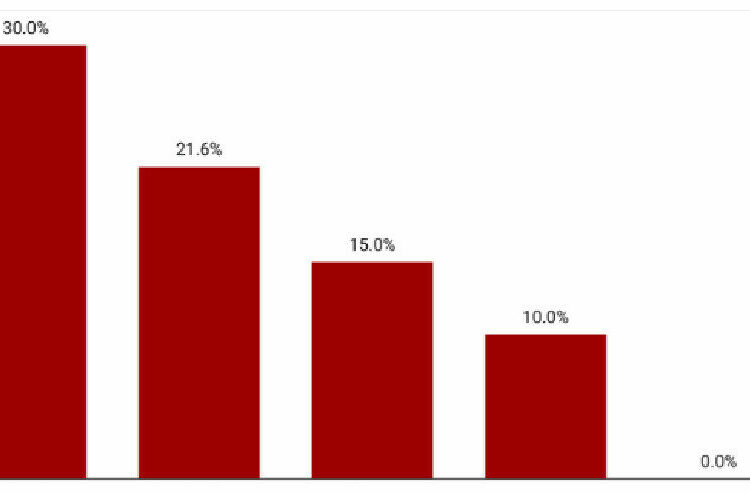

Market breadth was overwhelmingly negative, with 62 decliners against four advancers. NCR Nigeria recorded the highest price gain of 9.82 per cent to close at N21.25, while Berger Paints Nigeria followed with a gain of 2.56 per cent to close at N36.00, per share.

FCMB Group appreciated by 0.96 per cent to close at N10.50, while AXA Mansard Insurance rose by 0.25 per cent to close at N12.10, per share.

On the other hand, Academy Press, Custodian Investment, Dangote Cement, Deap Capital Management & Trust, Oando, Transnational Corporation (Transcorp), Veritas Kapital Assurance, MTNN and BUA Cement led the losers’ chart by 10 per cent each to close at N6.75, N34.20, N594.00, N1.71, N36.00, N39.60, N1.53, N429.30 and N162.00 respectively, per share.

Cadbury Nigeria followed with a decline of 9.99 per cent to close at N56.30, while Stanbic IBTC Holdings declined by 9.97 per cent to close at N101.15, per share.

Meanwhile, the total volume of trade increased by 80.03 per cent to 655.953 million units, valued at N29.390 billion, and exchanged in 29,558 deals. Transactions in the shares of First Holdco topped the activity chart with 68.270 million shares valued at N2.113 billion. Access Holdings followed with 56.282 million shares worth N1.184 billion, while Zenith Bank traded 41.917 million shares valued at N2.322 billion.

Fidelity Bank traded 38.483 million shares valued at N693.734 million, while Stanbic IBTC Holdings transacted 31.551 million shares worth N3.193 billion.