Capital market analysts are anticipating cautious trading in the domestic stock market this week due to the absence of significant positive catalysts to boost sentiments.

In the just-concluded week, the market took a sharp decline as investors’ sentiment remained subdued, leading to significant sell-offs across key sectors, particularly, in Industrial, Insurance, and Consumer Goods. This decline reflects cautious trading behaviour amid ongoing portfolio rebalancing, with investors grappling with economic uncertainties and the latest macroeconomic data releases.

Analysts Optimism

Analysts at Cowry Assets Management Limited said, “the ASI’s decline underscores continued caution among investors, many of whom are taking a risk-off stance amidst fluctuating economic indicators, uncertain earnings outlooks, and ongoing corporate actions.

“Persistent liquidity concerns and inflationary pressures appear to have dampened investor enthusiasm, with many awaiting clearer signals on monetary policy and potential fiscal measures before making fresh commitments.”

Looking ahead, Afrinvest stated that, “The market is likely to remain volatile in the near term considering the cautious sentiments of investors. However, positive developments, such as improved corporate earnings or stabilising macroeconomic conditions, could help bolster investor confidence and drive a recovery.”

The chief operating officer of InvestData Consulting Limited, Ambrose Omordion said, “the Nigerian equities market last week recorded a highly volatile sessions amid the rekindled buying interests at the peak of earnings reporting season. Already, many companies had reported better than expected Q3 numbers that reveal value with upside potentials as market players continue reacting to these earnings and rebalancing their portfolios.”

Omordion expected mixed sentiment to continue on reaction earnings reports, profit taking and positioning, ahead of more Q3 earnings reports, saying, ‘also, sector rotation and portfolio rebalancing continues in the market, with investors taking advantage of pullbacks to buy into value.’

Last Week’s Trading Activities

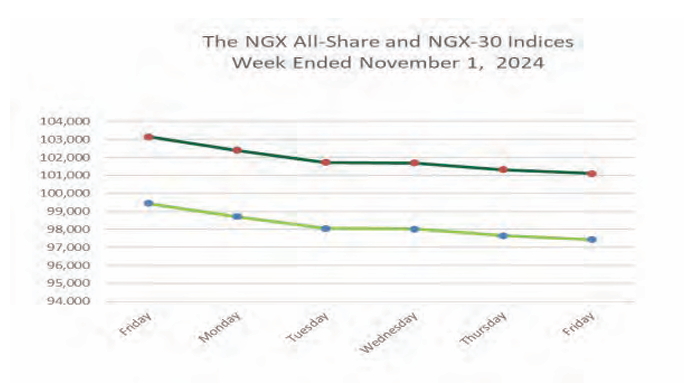

Notably, the All-Share index dipped by 2.03 per cent week-on-week (W-o-W) to close at 97,432.02 points. Similarly, market capitalisation shed N1.222 trillion W-o-W to close at N59.039 trillion.

Sectoral performance over the week reflected widespread losses. The NGX Industrial Goods index was notably impacted, declining by 3.70 per cent week-on-week. NGX Insurance index recorded a weekly decline of 0.40 per cent, while NGX Consumer Goods index dropped by 0.22 per cent for the week.

In contrast, the NGX Oil & Gas sector posted a weekly gain of 1.15 per cent week-on-week, while the NGX Banking index achieved 0.19 per cent gain week-on-week.

Also, market breadth for the week was negative as 39 equities appreciated in price, 45 equities depreciated in price, while 68 equities remained unchanged. Transnational Corporation (Transcorp) led the gainers table by 314.03 per cent to close at N45.75, per share. Eunisell Interlinked followed with a gain of 60.57 per cent to close at N5.62, while John Holt up by 20.00 per cent to close to N3.30, per share.

On the other side, Aradel Holdings led the decliners table by 25.75 per cent to close at N445.60, per share. Caverton Offshore Support Group followed with a loss of 20.00 per cent to close at N2.00, while Ellah Lakes declined by 12.59 per cent to close at N3.54, per share.

Overall, a total turnover of 2.717 billion shares worth N54.632 billion in 46,848 deals was traded last week by investors on the floor of the Exchange, in contrast to a total of 2.142 billion shares valued at N85.946 billion that exchanged hands previous week in 41,217 deals.

The Financial Services Industry (measured by volume) led the activity chart with 1.821 billion shares valued at N28.958 billion traded in 20,173 deals; contributing 67.01 per cent and 53.01 per cent to the total equity turnover volume and value respectively. The ICT Industry followed with 389.848 million shares worth N6.560 billion in 2,515 deals, while the Conglomerates Industry traded a turnover of 160.993 million shares worth N4.746 billion in 3,623 deals.

Trading in the top three equities; Fidelity Bank, Chams Holding Company and United Bank for Africa (UBA) accounted for 1.225 billion shares worth

N17.721 billion in 4,912 deals, contributing 45.10 per cent and 32.44 per cent to the total equity turnover volume and value respectively.