Shelter is one of man’s priorities after food and clothing. Among many things that underscore the importance of housing is that the sector plays a pivotal role in a nation’s economic fortune.

While the housing sector contributes about 16 per cent to the Gross Domestic Product (GDP) in some countries that prioritise it, its contribution to the Nigerian economy is abysmal. For instance, according to the National Bureau of Statistics (NBS), in 2024, housing contributed a paltry six per cent to the GDP.

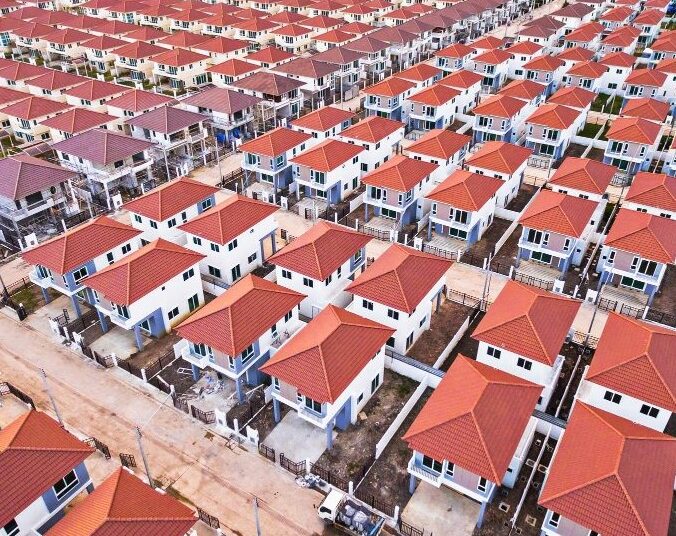

But what does the nation expect when it is trapped in a 28-million housing deficit that requires about N21 trillion to address? Sadly, the government has not done enough to suggest that the nation is on its way to addressing this alarming statistic.

Due to the massive housing deficits, Nigerians of middle- and low-income levels, including those fortunate enough to be gainfully employed, are having to contend with the burden of rental accommodation since most of the workforce cannot afford a house.

It is estimated that only about five million out of 69.54 million gainfully employed people can afford to own a house. Most of this workforce resort to renting, with all its challenges – and there are many of them. In most Nigerian cities, securing and retaining rental accommodation is like a tug-of-war.

Fundamentally, the burden of rent payment in most Nigerian cities is compounded by the multiplicity of fees a tenant is expected to pay. Often, a tenant must contend with illegal fees such as caution, inspection, and something as ridiculous as finder’s fees.

However, the most outstanding of such challenges is the struggle of low-income earners with large, upfront rental payments. Most landlords in Nigeria have made it a norm to demand upfront fees. Now, the snag in this arrangement is this: How can a worker who earns income at the end of every month afford a year’s rent? This is one question nobody has bothered to ask let alone answer.

The global best practice is that rent is paid monthly, and the reason is simple: the tenant earns income only at the end of the month. It seems property owners in Nigeria don’t believe tenants deserve to be provided with various flexible payment options that align with their income.

Curiously, the authorities look the other way while property owners insist on yearly upfront rental payments. It is so disturbing that some landlords even insist on two years’ rent upfront. The strain this has on most families can only be imagined.

There is no contesting the fact that the yearly rent demands place heavy strain on many families who have to contend with other equally essential needs such as health, school fees and other incidental expenses.

Conscious of this and mindful of the need to reduce the rent burden, the Lagos State government has concluded plans to introduce monthly and quarterly rent payment options.

Fundamentally, the monthly payment envisioned by the Lagos State government will provide some relief, even if momentarily, to the bulk of Nigerians struggling to make a living. The challenge associated with sourcing a lump sum, with some landlords demanding a two-year upfront payment, is herculean.

Yet again, Lagos has proven to be a torchbearer that leads others to follow. As a newspaper, we applaud the Lagos State government’s initiative and urge other state governments and the FCT to emulate the good example.

We are aware that there would be some challenges, such as secure payment tracking. The government should factor in all the challenges and provide adequate safeguards for tenants and property owners.

But even as we expect other states to emulate Lagos in institutionalising monthly rent payment, there is an overarching need to examine the housing sector holistically to close the intolerably wide gap. Nigeria’s over 20 million housing deficit is inexcusable. It must be bridged, and the time to ensure that is now.

To effectively bring this about, the government must partner critical private sector players to confront key impediments like the needlessly high cost of building materials, encumbrances in accessing land, lack of access to good infrastructure, frequent building collapse incidents, lack of affordable mortgage, poor housing finance, and prohibitive mortgage interest rates among other challenges that have continued to dwarf progress in the housing sector and make it impossible for many Nigerians to own homes.