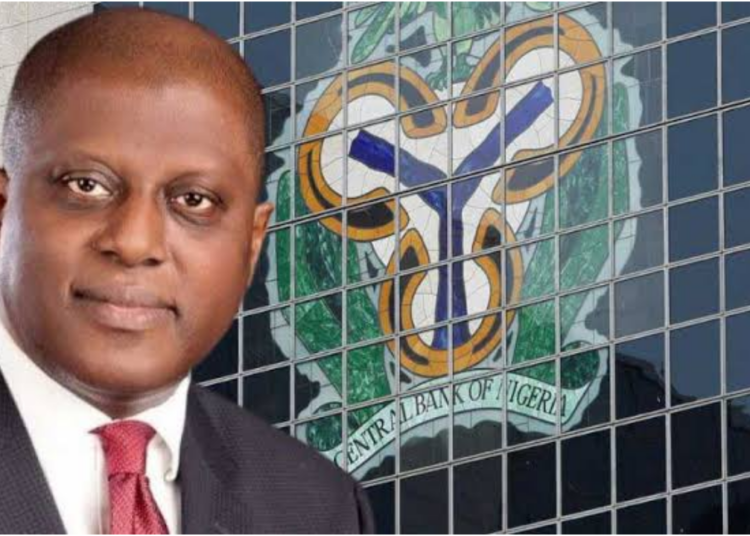

Amidst a growing scarcity of cash and empty ATMs across the country, the Central Bank Of Nigeria (CBN) has suspended the charges on the cashless policy, allowing individuals and corporates to deposit above the stipulated limit without charges.

The CBN also dismissed reports alleging that some licensed commercial banks in the country failed to meet the Capital Adequacy Ratio, (CAR).

The apex bank, in a statement signed by the acting director, Banking Supervision, Adetona Adedeji stated that the two per cent and three percent charged on all cash deposits above the stipulated amount should be suspended.

In December 2019, the CBN had imposed processing charges on cash deposits above N500,000 for Individuals and N3,000,000 for Corporates as contained in the “Guide to Charges by Banks, Other Financial Institutions and NonBank Financial Institutions”.

However in a circular issued to all banks, other financial institutions and non bank financial institutions titled “Re:Processing Fees On Cash Deposits” the apex bank said It “hereby suspends the charging of processing fees of two per cent and three per cent previously charged on all cash deposits above these thresholds with immediate effect. This suspension shall remain in effect until April 30, 2024.

“Consequently, all financial institutions regulated by the CBN should accept all cash deposits from the public without any charges going forward.”

Meanwhile ATMs remained empty with banking agents known as POS operators increasing their charges by over 200 per cent from N100 on N10,000 to N300. This they said was due to scarcity of cash. It would be recalled that a scarcity of cash had rocked the country.

Meanwhile, another statement by the bank’s spokesperson, Sidi Hakama, said that key financial soundness indicators which reflect the stability and resilience of the sector, as detailed in its most recent Economic Report of 2023, remain well within the regulatory thresholds.

The adequacy ratio offers a swift assessment of whether a bank holds sufficient funds to offset potential losses and maintain solvency amid challenging financial conditions.

“We wish to clarify that the Nigerian banking industry remains resilient as key financial soundness indicators were within the regulatory thresholds as captured in the CBN’s most recent Economic Report of 2023,” the CBN said.

The apex bank added that it is actively collaborating with various critical stakeholders to sustain the level of confidence in the Nigerian financial sector.

The CBN reassured Nigerians of the strength and reliability of the banking industry, urging them to rely on official communications from the CBN for accurate information.

We’ve got the edge. Get real-time reports, breaking scoops, and exclusive angles delivered straight to your phone. Don’t settle for stale news. Join LEADERSHIP NEWS on WhatsApp for 24/7 updates →

Join Our WhatsApp Channel