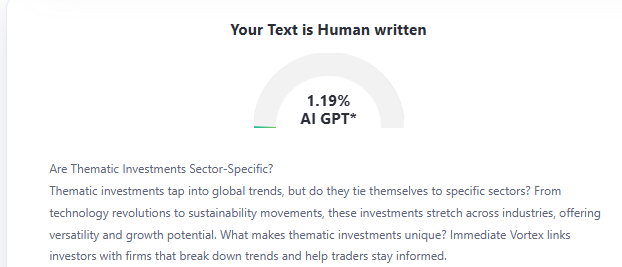

Thematic investments tap into global trends, but do they tie themselves to specific sectors? From technology revolutions to sustainability movements, these investments stretch across industries, offering versatility and growth potential. What makes thematic investments unique? GPT Definity Ai links investors with firms that break down trends and help traders stay informed.

Dissecting Sector vs. Theme: Where Does One End and the Other Begin?

(Sector-Focused Paradigm — Cross-Sector Synergy)

A classic sector-focused approach often feels like sorting books by color. It looks tidy. It’s easy to grab one section and call it home base. Yet labeling a business “technology” or “healthcare” can be misleading. Some ventures straddle multiple arenas. A manufacturer might produce medical devices while dabbling in cloud-based solutions. Traditional labels can miss those fascinating crossover stories.

Certain market watchers recall events from 2008, when banks, insurance groups, and even tech giants found themselves tangled by common factors. That period showed how lines between sectors can fade fast. A strict sector lens may highlight big players in one category. But a thematic lens can reveal unexpected connections. It may pinpoint companies that ride a broader idea, such as environmental consciousness or expanded digital lifestyles.

A friend once joked, “Is a grocery store with online delivery still just a grocery store?” The wise response: sometimes that’s like calling a spaceship a car with fancy headlights. Themes capture these blurred edges. Many folks enjoy the convenience of thinking in tidy boxes. However, markets rarely follow neat patterns. Consider the shift toward clean power. It touches utilities, transportation, and even real estate. Themed investing can mix them all.

Curious minds might wonder if this approach adds complexity. It can. Yet seeking professional input helps untangle any confusion. Talking with a knowledgeable person can avert costly surprises. A balanced perspective promotes better planning. Isn’t that what investors crave? Something that melds different ideas while remaining clear enough to guide decisions.

Mapping Thematic Investments Onto Real-World Sectors

(Case Study 1: Sustainable Energy & Climate Tech — Case Study 2: Digital Revolution & AI — Case Study 3: Demographics & Evolving Consumer Lifestyles)

Blending themes with classic sectors sometimes sparks a lively debate. Real examples show how concepts cut across categories. A single trend might unite electric cars, farm tools, and fancy new gadgets. Some folks marvel at how these areas align under broader visions, especially when big changes unfold year after year.

● Sustainable Energy & Climate Tech

Solar panels, wind turbines, and electric vehicles often share a broader outlook. One person might picture giant wind farms humming along a coastline. Another might think of farmland adopting greener methods. Both point to a collective push toward better energy choices. In 2022, major automotive brands announced plans to increase electric car production by double-digit percentages. That figure wasn’t limited to the auto sector alone. Suppliers, software firms, and even battery recyclers thrived as part of that same theme.

● Digital Revolution & AI

Chips for computers, algorithms for hospitals, and next-generation phone apps all fit here. A healthcare startup may use cutting-edge systems to process patient data. An e-commerce platform might rely on the same technology to power product recommendations. AI soared in 2021, with record funding reported for machine-learning companies. Each player came from a different place, yet they joined this revolution.

● Demographics & Evolving Consumer Lifestyles

Aging populations need advanced home care tools, while younger groups embrace online education. Both shape new niches. Retirement communities adopt fresh tech solutions. Entertainment giants chase streaming trends. It’s a vibrant blend that touches real estate, software, and beyond.

Staying curious about these areas leads to inspired actions. A specialist can guide decisions on how to handle interlocking trends.

Strategic Considerations: Balancing Thematic Concentration and Diversification

(Risk Exposure in Cross-Sector Themes — Time Horizon & Volatility)

Combining multiple trends can feel like juggling flaming torches. It looks cool, but a slight misstep might cause trouble. Certain themes rise and fall without warning. In 2021, renewable assets soared, then dipped sharply. A cross-sector portfolio might cushion that shock by spreading money among different industries. But too much concentration in a single idea risks heavier swings.

A short holding period may not capture the full promise of a broader theme. Some breakthroughs need time. Patience often pays off, especially if the trend expands over several years. Around 2015, wearable technology seemed like a passing fad. By 2020, shipments of smartwatches had surged, boosting fitness app firms and biotech device makers. That lengthy timeline rewarded those who took a longer view.

Markets can surprise even the most cautious individuals. Back in 2000, tech mania reached high peaks. Then came a sharp decline. A balanced thematic stance might have absorbed fewer bumps by mixing stable areas with emerging ones. Overconfidence in a single wave can lead to painful lessons. Yet running away from innovation means missing the boat.

Does that spark questions about how to proceed? Speaking with a professional is handy. An industry pro can pinpoint how different themes might fit personal goals. There’s no magic formula. Different folks have different aims. Some prefer slow and steady. Others enjoy bigger risks for bigger rewards. An experienced guide can help clarify those goals. After all, money decisions deserve thoughtful attention, especially when multiple themes collide.

Conclusion

Thematic investments aren’t confined to single sectors; they capture the essence of global megatrends. By crossing industry boundaries, they offer dynamic opportunities for investors to align with the future while maintaining diversified portfolios.

We’ve got the edge. Get real-time reports, breaking scoops, and exclusive angles delivered straight to your phone. Don’t settle for stale news. Join LEADERSHIP NEWS on WhatsApp for 24/7 updates →

Join Our WhatsApp Channel