For the second time in the history of the country, the president, last weekend suspended the governor of the Central Bank of Nigeria (CBN).

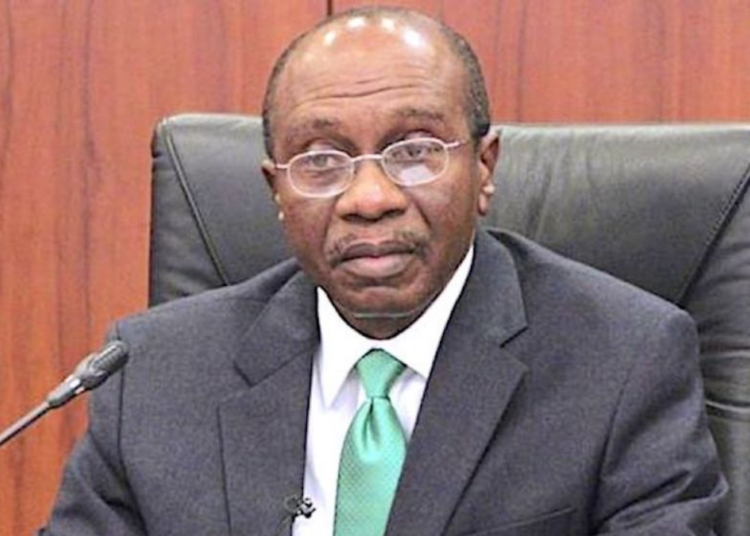

In 2014, Sanusi Lamido Sanusi was suspended and eventually removed from his post, a situation that was replicated last Friday when President Bola Ahmed Tinubu announced the suspension of Godwin Emefiele from the top job at the apex bank.

This, analysts believe, could send signal to investors that the president is willing to take the steps towards reforms in the monetary policy. The president had, in his inaugural speech on May 29, stated that, “monetary policy needs thorough housecleaning. The Central Bank must work towards a unified exchange rate.

“This will direct funds away from arbitrage into meaningful investment in the plant, equipment and jobs that power the real economy. Interest rates need to be reduced to increase investment and consumer purchasing in ways that sustain the economy at a higher level.”

These are contrary to the stance of the CBN under Emefiele as the Monetary Policy Committee had, at its last meeting, raised benchmark interest rate to 18.5 per cent, maintaining its stance that it will continue to tighten monetary policy as inflation rises. The CBN has also defended its decision to continue to defend the naira leading to the spread of over N230 between the official and parallel market rates.

In its latest report titled ‘Macro Thematic Report on President Tinubu’s Policy Imperatives: Likely Economic Impact and Investment Opportunities,’ Afrinvest noted that, Tinubu’s inaugural speech on May 29, 2023, had also raised the hope of market participants.

According to analysts at Afrinvest (West Africa) Limited, President Tinubu’s foreign exchange unification policy would rebuild confidence in foreign direct investments (FDIs), enhances the development of capital market, and promotes inclusive economic growth.

Reacting to the removal of Emefiele, the head, Financial Institutions Ratings at Agusto & Co, Ayokunle Olubunmi said, it signals the willingness of the new administration to follow through with the policy direction in the inaugural speech of the president.

Olubunmi noted that, “some investors will be neutral until a replacement is announced. In Nigeria at times, we feel something is bad, but will move to a worse position. Some will see it as positive with the expectation that the President will appoint someone that can implement his plan. Recall that the President said all the right things about monetary policy in his inauguration speech.

“We can only hope for the best. I doubt if it will give any negative vibe to investors. Recall that he was also suspended and not sacked. The court has also established that the President has the power to suspend the CBN governor.”

On unifying the multiple exchange rate windows, Afinvest noted that, policy imperative would eliminate arbitrage opportunities and round-tripping, support currency stability and halt the trend of galloping inflation and restore foreign investors’ confidence in the sanctity of the market.

On the policy’s expected impact on the broader economy, It states that: “Enhance foreign investment and diaspora inflows, support exchange rate stability, deepen the capital market and promote business sustainability and broader economic growth.

Furthermore, on the president’s stance on holistically addressing issues of multiple taxations, anti-investment inhibitions including high-interest rate, and capital control measures, it added that, the policy direction would increase job creation capacity of entrepreneurs and halt the trend of business collapse.

On the potential goals, it states that: “Increase the number of taxable businesses in the short to medium-term and attract foreign investment flows especially Foreign Direct (FDI) and Foreign Portfolio (FPI) Investments and expected impact on the broader economy would lower the unemployment rate and accelerate the growth of the national economy and reduce the poverty rate.

Furthermore, on attendant opportunities in the domestic equities market, it states: “Following the announcement of several pro- market policies by the President, the domestic equities market responded by posting gains of 5.2 per cent on Tuesday 30 May 2023 the highest daily gain since November 11, 2020 causing the NGX to trigger its market-wide 30-minute circuit breaker clause. In our view, we believe that a properly implemented FX unification and the clearing of backlogs would drive traction on the local bourse in the short-to-medium term, especially for foreign participants.

“For context, since 2015, the share of foreign investors’ participation in the domestic equity market has constantly declined, falling from 53.8 per cent to 10.4 per cent in February 2023. We estimate that improved liquidity in the FX market and market reflective pricing could drive foreign participation up to 20.0 per cent by year-end.”

“Accordingly, the increased foreign investors’ transactions amid sustained participation by domestic investors would be crucial to driving equity prices of undervalued fundamentally sound stocks closer to their intrinsic value.”