The National Bureau of Statistics (NBS) recently released the first quarter (Q1) 2024 telecoms data which include Foreign Direct Investments (FDIs), active voice, internet, porting and tariff information.

NBS data indicates that in the first quarter of this year, foreign direct investments (FDIs) totaling $191.5 million were made in Nigeria‘s telecoms sector.

For the telecom industry, which has suffered a steady drop in investments over the previous few years, this suggests a promising start.

In fact, the Q1 2024 amount exceeded the sector‘s total FDI in 2023, which was $134.75, based on NBS statistics.

Year on year, capital importation received by the sector in Q1 2024 represents a 769 per cent increase compared with $22.05 million received in Q1 2023.

Similarly, compared with the $22.84 million received in the preceding quarter, Q4, 2023, this also represents a 738 per cent growth in investments.

Voice Subscription

The NBS report disclosed that the total number of active voice subscribers in Q1 2024 was 219,304,281 from the 226,161,713 reported in Q1 2023, indicating a growth rate of –3.03 per cent. On a quarter-on-quarter basis, active voice subscribers fell by 2.41 per cent.

Also, in Q1 2024, the total number of active internet subscribers stood at 164,368,292 from 157,551,104 reported in Q1 2023, showing an increase of 4.33 per cent. On a quarter-on-quarter basis, this grew by 0.32 per cent.

On state profile analysis, Lagos state had the highest number of active voice subscribers in Q1 2024 with 25,956,074, followed by Ogun with 12,672,990 and Kano with 11,931,128.

On the other hand, Bayelsa recorded the least with 1,608,473, followed by Ebonyi and Ekiti with 1,885,657 and 1,969,568 respectively. In addition, Lagos state had the highest number of active internet subscribers in Q1 2024 with 18,841,943, followed by Ogun with 9,528,795 and Kano with 9,067,983. On the other hand, Bayelsa recorded the least with 1,201,601, followed by Ebonyi and Ekiti with 1,401,626 and 1,545,729 respectively.

On active voice subscription by zone, NBS data revealed that South-west zone had the highest with 61,923,126 voice subscribers, followed by North Central with 43,782,750 subscribers; North West with 39,820,499 subscribers; South-South, with 32,260,532 subscribers; North East with 21,203,233 subscribers and South East with 20,314,141 subscribers.

On active internet subscription per zone, NBS data showed that South West leads with 45,734,074 active internet subscribers, followed by North Central with 32,757,695 subscribers; North West with 30,248,869 subscribers; South-South with 23,763,645 subscribers; North East with 16,798,523 subscribers and South East with 14,851,610.

However, MTN had the highest share of subscriptions in Q1 2024. According to NBS data, MTN had 81,799,666 active voice subscribers with 69,386,959 active internet subscribers. This is followed by Airtel with 63,357,061 active voice subscribers and 46,819,616 internet subscribers.

Next is Glo, with 62,191,448 voice subscribers and 44,380,117 active internet subscribers. 9mobile had 11,657,703 voice subscribers and 3,308,493 active internet subscribers during the period under review.

On porting activities, MTN had the highest port-in with 1,296, followed by Airtel, 343; Glo, 210 and 9mobile, 62. On the other hand, 9mobile had the highest port-out with 1,333, followed by Glo, with 269; Airtel, 173 and MTN with 136.

The Information and Telecommunication services’ contribution to the Gross Domestic Product (GDP) was 14.58 per cent in the period under review.

Deepening Broadband Penetration

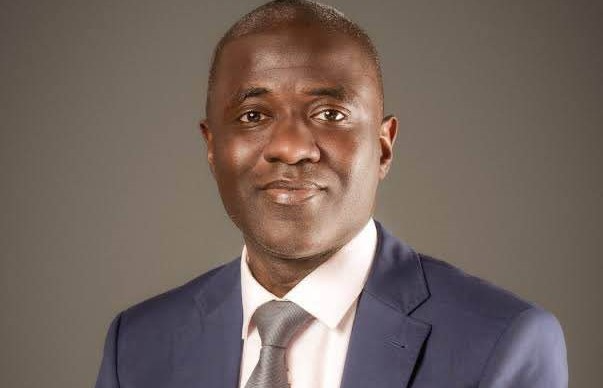

Meanwhile, the executive vice chairman of the Nigerian Communications Commission (NCC) Dr. Aminu Maida, has said the Commission and the Ministry of Communications, Innovation, and Digital Economy are working on the appropriate policies to encourage the telecom sector‘s contribution to reach 25 per cent.

Maida, who disclosed this recently in Lagos, during a reception held in his honour by the Association of Telecommunications Companies of Nigeria (ATCON), averred that, the sector has done well with its current 14.58 per cent contribution but it could do better if current challenges confronting the sector are addressed.

“I know that there are challenges in the industry. I also want to assure you that we are taking them seriously. Myself and the Minister of Communications, Innovation, and Digital Economy, are working very closely looking at the right policies to ensure sustainability for an industry that has done so well for the country with 14 per cent GDP contribution. We believe we can do 25 percent and above and work is going on in that regard with the Ministry,” Maida told the telecom operators.

Deepening Broadband Penetration

The NCC boss also noted that the Commission and the stakeholders have work to do to boost connectivity in the country. According to him, although Nigeria has close to 200 million connected lines, more than half of them are still on 2G.

Data from the Commission’s website shows that out of the 219 million active subscriptions recorded in March this year, 56.97 percent of them were on 2G, while only 32.74 percent were on 4G.

“There is a lot of work to be done, especially in addressing challenges faced by Mobile Network Operators (MNOs) and Original Equipment Manufacturers (OEMs) for long-term sustainability. I think even the president realizes the importance of the digital infrastructure to the future of Nigeria for this great nation,” he said.

Apparently referring to the recent requests by the telecom operators for the Commission to approve tariff increase, which the regulator has declined, Maida said, “Please have my assurances that we have your best interest at heart, but also as a regulator, we have two sides, the industry, and the consumer, so it’s about getting the balance right so that everybody gets a fair deal.”

The increase in capital importation to the telecom sector may have come as a boost to the country’s ambition to connect at least 70 per cent of its population to broadband by 2025.

Amid the ongoing implementation of the Nigeria National Broadband Plan (NBP 2020-2025) for which the country is relying on more foreign investments, the sector has been recording a consistent decline in foreign investments.

Meanwhile, according to industry experts, the Nigerian telecom industry would require, at least, $3.4 billion in investments in fibre infrastructure to meet the 70 per cent broadband target.

Government’s SPV

In achieving this target, the federal government has established a Special Purpose Vehicle (SPV) for the delivery of an extra 90,000km of fiber optic cable to supplement existing connection for universal internet access throughout Nigeria.

Working with partners and stakeholders from the public and private sectors, the SPV would construct the additional fiber optic coverage necessary to increase Nigeria‘s connectivity backbone from its current coverage of roughly 35,000km to a minimum of 125,000km, the minister of Communications, Innovation, and Digital Economy, to Dr. Bosun Tijani, said.

“Building on our existing work with the Broadband Alliance, this increased connectivity will help plug the current non-consumption gap by connecting over 200,000 educational, healthcare and social institutions across Nigeria, ensuring that a larger section of our society can be included in the benefits of internet connectivity,” the Minister said.

He added that that project would also help to increase internet penetration in Nigeria to over 70 per cent and reduce the cost of access to the internet by over 60 per cent.

Through the project, Tijani said Nigeria would achieve the inclusion of at least 50 per cent of the 33 million Nigerians currently excluded from access to the internet. It is also expected to deliver up to 1.5 per cent of GDP growth per capita raising GDP from $472.6 billion (2022) to $502 billion over the next four years.