As Malaysia accelerates its digital economy agenda, one homegrown fintech player is emerging as a key enabler of the nation’s cashless adoption. Paydibs, a company registered with Bank Negara Malaysia and a long-standing Cashless Payment Services Enabler, is building an inclusive digital payments ecosystem. Paydibs empowers businesses of all sizes, from local hawker stalls and SMEs to large corporates, to adopt modern, secure, and accessible cashless solutions.

At the heart of its mission, “Payment Inclusion, Beyond Transactions”, lies a simple idea: digital transformation should be available to everyone, not just the tech-savvy or urban elite.

Lowering Barriers to Digital Adoption

Malaysia’s 13th Malaysia Plan places SME digitalisation at the centre of the country’s economic priorities. Yet for many small businesses, the shift from cash to digital payments has been slowed by cost, complexity, and lack of awareness.

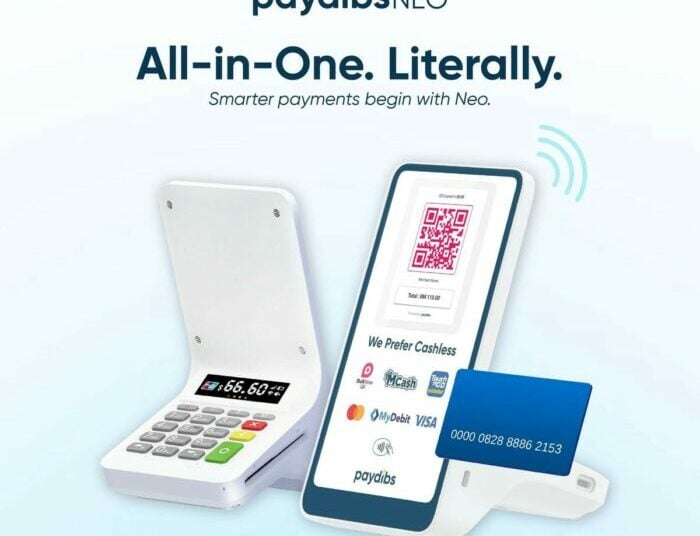

Paydibs is tackling this challenge with solutions designed to be simple and affordable. Its first of its kind device, the Paydibs NEO smart terminal, combines card payments, QR codes, Buy Now Pay Later (BNPL) options, and even soundbox features into one compact, user-friendly device. Priced at just RM189, it provides an accessible entry point for small merchants to embrace cashless transactions without heavy upfront investment.

“Financial inclusion goes beyond enabling transactions. Our mission at Paydibs is simple and straightforward: to empower businesses of all sizes with comprehensive, affordable, and well-rounded solutions, enabling them to thrive in a digital-first economy. Paydibs Neo is the perfect example of this commitment in action,” says Tee Kean Kang, Chief Commercial Officer at Paydibs.

Strengthening Malaysia’s Payment Infrastructure

Beyond in-the-store merchants, Paydibs is enhancing Malaysia’s broader payment ecosystem through its role as an FPX direct acquirer for online transactions. This allows merchants using Paydibs as their Payment Gateway provider to access real-time online payments and strengthening the nation’s digital payment infrastructure.

Partnerships with regional payment giants such as Alipay+ further open doors for local enterprises. Malaysian businesses can now accept payments from leading e-wallets across Asia, including Alipay, GCash, and Kakao Pay, creating cross-border opportunities for even the smallest SMEs.

Looking Towards a More Inclusive Digital Future

As Malaysia works towards a more connected, cashless economy, Paydibs sees itself not just as a payment provider but as a partner for businesses navigating digital transformation.

Its long-term goal is to ensure no business, regardless of size or sector, is left behind in the shift to digital commerce. With more integrations and merchant-friendly solutions on the horizon, Paydibs is positioning itself as a catalyst for inclusive growth in Malaysia’s evolving fintech landscape.

For more information, visit Paydibs.

Media Contact

Ms. Natasha

Marketing Manager, Paydibs Sdn Bhd

Email: [email protected] | Tel: +6017-533 3801