Global payment solutions provider, BPC, is doubling down on its commitment to Nigeria’s digital economy with a major strategic expansion.

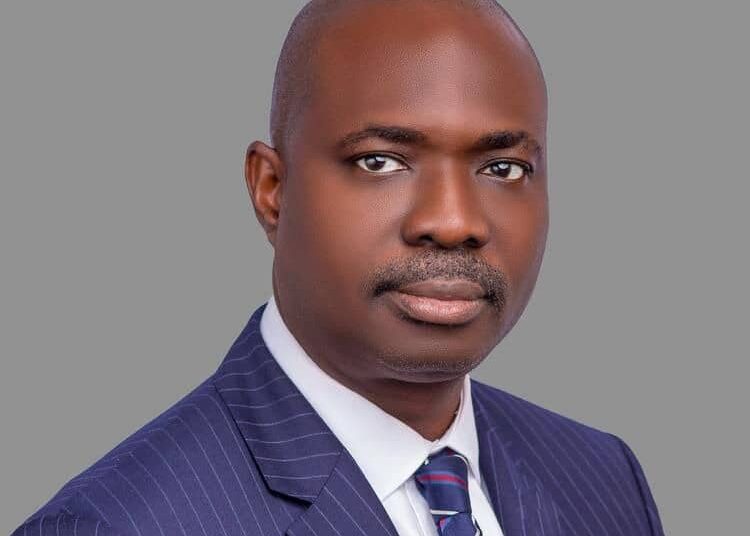

At the heart of this renewed focus is the appointment of seasoned banking and payments expert Dapo Adeosun as managing director, Nigeria, a leadership decision poised to accelerate digital innovation and deepen financial inclusion in Africa’s largest economy.

The expansion comes as Nigeria experiences a dramatic transformation in its payment ecosystem. Between 2023 and 2024, the value of digital transactions surged by 80 per cent, leaping from N600 trillion to an unprecedented N1.08 quadrillion. Point-of-sale (POS) adoption has skyrocketed, now accounting for 92.8 per cent of combined POS and ATM transactions, a reversal from 2016 figures.

However, alongside this progress lies persistent challenges: legacy banking systems, an underbanked population, and a sharp rise in digital fraud, which jumped fivefold to N52 billion in early 2024.

Recognising both the potential and the pain points of the Nigerian market, BPC is positioning itself as a key player in modernising digital payments through its flagship platform, SmartVista. The platform provides flexible, scalable, end-to-end solutions that include card and merchant management, e-wallets, mobile and agent banking, and SoftPOS, technologies critical for today’s mobile-first economy.

Adeosun, in a press statement, said at NIBSS, he witnessed firsthand the challenges that are in front of Nigeria’s financial sector, which ranges from ensuring secure, efficient services to finding future-proof, easily scalable solutions to bridge the financial inclusion gap.

“BPC brings globally certified tools and AI-driven fraud prevention mechanisms that can drastically reduce transaction failures, enhance security, and optimise financial operations for banks and payment providers,” he added.

On Legacy systems, Adeosun said, “Legacy systems have long hindered banks from reaching their full potential, often preventing them from serving unbanked communities with modern financial solutions. With BPC’s SmartVista, we are changing that landscape, offering banks the flexibility, security, and scalability needed to thrive in today’s digital economy.”

As Nigeria advances its digital agenda, BPC remains dedicated to equipping financial institutions, payment providers, and government agencies with technology that drives efficiency, security, and financial inclusion. The technology modular architecture and holistic approach allows financial institutions to centralise diverse third-party services, smoothing operational discrepancies and speeding time-to-market for new offerings.

“Our goal is to provide cutting-edge solutions that support Nigeria’s financial ecosystem from powering complete digital financial ecosystems to enhancing non-financial sectors through enablement of marketplaces and digitalisation of government services. With SmartVista, we are not just offering payment solutions, our goal is to advance Nigeria’s nationwide digital agenda and we are building a future-ready digital economy,” Adeosun stated.